USD/CHF holds onto recovery gains from a 16-month low. 200-hour SMA will please buyers during a sustained breakout. Bears may aim for September 2018 low following the downside break of the recent bottom. USD/CHF confronts a one-week-old falling trend line resistance while trading around 0.9650 during early Friday. The pair recently ticked up to 0.9654 but failed to extend the rise. Hence, buyers will look for entry above 0.9650/55 area while targeting a 200-hour...

Read More »Swiss National Bank expects annual profit of 49 billion francs

SNB building in Bern According to provisional calculations, the Swiss National Bank (SNB) expects to make a profit of around CHF 49 billion in 2019. Most of this comes from the rising value of the SNB’s foreign currency positions (+CHF 40 billion) and a valuation gain on gold holdings (+CHF 6.9 billion). After adjusting reserves, the SNB will have CHF 88 billion available for distribution. Since the announcement SNB shares have risen 2% to CHF 5,600. The central bank...

Read More »‘Yes to an initiative promoting moderately-priced housing’

The free market in Switzerland has built housing units that remain empty because they are too expensive, or in out-of-the-way places, says Marina Carobbio Guscetti. The Social Democrat senator believes that the initiative “More affordable housing” will fix these problems. It will help the middle class and the less well-off. Apart from health insurance premiums, rent is the biggest item in many family budgets. Since 2005, in spite of lower interest rates and a...

Read More »De-dollarization By Default Is Not What You Might Think

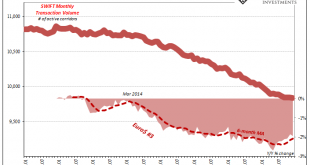

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part. KYC is a particularly...

Read More »WTF: What The Fed?! Mike Maloney, Chris Martenson, Grant Williams & Charles Hugh Smith

Get the bonus video here: https://www.peakprosperity.com/wtf-what-the-fed-insights-from-advisers-sign-up “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you...

Read More »Dollar Soft Ahead of Retail Sales Data

There were no surprises in the US-China Phase One trade deal The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today Bank of England credit survey showed demand for loans fell in Q4 Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5% Japan reported November core machine orders and December PPI; China’s credit numbers for December showed no big change in lending...

Read More »Slice of prime Zurich real estate sold on blockchain

Bahnhofstrasse in Zurich is one of the most upmarket shopping streets in the world. (© Keystone / Gaetan Bally) A building on Zurich’s most exclusive shopping street has been converted into a blockchain-powered investment following its CHF130 million ($134 million) sale. It is the latest attempt to unlock the value of bricks and mortar using digitally-coded tokens. Bahnhofstrasse 52, which houses offices and a Swatch retail outlet, was bought by Zug-based real estate...

Read More »US Debt Makes Us Dependent on Petrodollars — and on Saudi Arabia

The Iranian regime and the Saudi Arabian regime are longtime enemies, with both vying for control of the Persian Gulf region. Part of the conflict stems from religious differences — differences between Shia and Sunni muslim groups. But much of the conflict stems from mundane desires to establish regional dominance. For more than forty years, however, Saudi Arabia has had one important ace in the hole in terms of its battle with Iran: the US’s continued support for...

Read More »WTF: What The Fed?! Mike Maloney, Chris Martenson, Grant Williams & Charles Hugh Smith

Get the bonus video here: https://www.peakprosperity.com/wtf-what-the-fed-insights-from-advisers-sign-up “The plain truth is… we are in the middle of QE4 right now” – Grant Williams during WTF: What the Fed. The Federal Reserve looks to be pumping a healthy patient of full of drugs… Something is not adding up. And Mike Maloney agrees… He recently recorded a free event dedicated exclusively to the topic of the Fed’s recent actions... to help you understand what it’s doing and what it means...

Read More »FX Daily, January 16: Markets Look for New Cues with US-China Trade Pact Signed

Swiss Franc The Euro has risen by 0.04% to 1.0749 EUR/CHF and USD/CHF, January 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are calm today as investors await fresh trading incentives. New record highs in the US equity indices gave Asia Pacific stocks a lift, though China and Taiwan were notable exceptions. Europe’s Dow Jones Stoxx 600 is firm new record highs set last week. US...

Read More » SNB & CHF

SNB & CHF