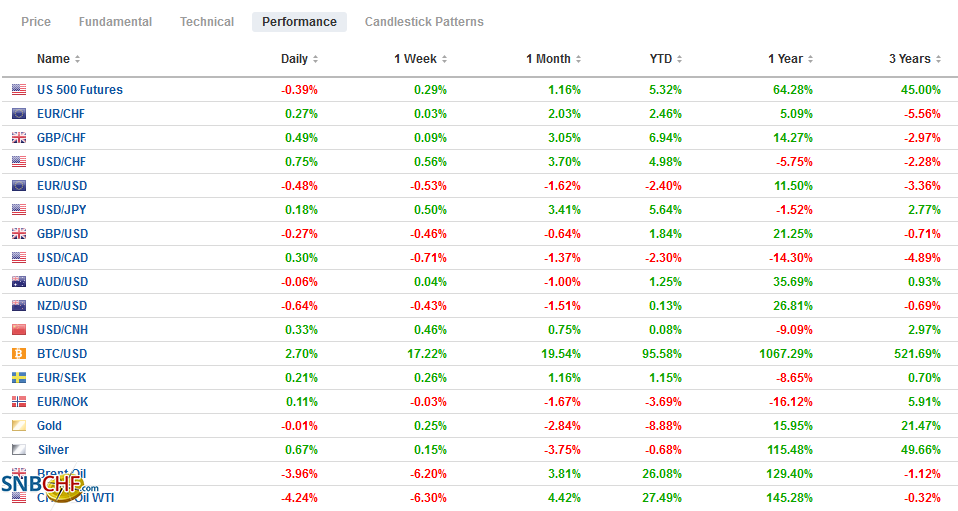

Swiss Franc The Euro has risen by 0.17% to 1.1068 EUR/CHF and USD/CHF, March 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asia Pacific equities mostly advanced after the US benchmarks recovered following the dovish FOMC. Australia, New Zealand, and India did not participate in today’s gains. European bourses edged higher, but US shares are struggling, and the NASDAQ futures are off nearly 1%, threatening to end the three-day rally. Part of the weight is coming from a sharp sell-off in bonds. The US 10-year yield is up seven basis points to 1.72%, while benchmark yields in Europe are mostly 2-4 bp higher. The greenback is mostly firmer, though the Australian and Canadian dollars and sterling are proving

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of England, bonds, Currency Movement, Featured, Federal Reserve, newsletter, Norges Bank, SDR, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.17% to 1.1068 |

EUR/CHF and USD/CHF, March 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

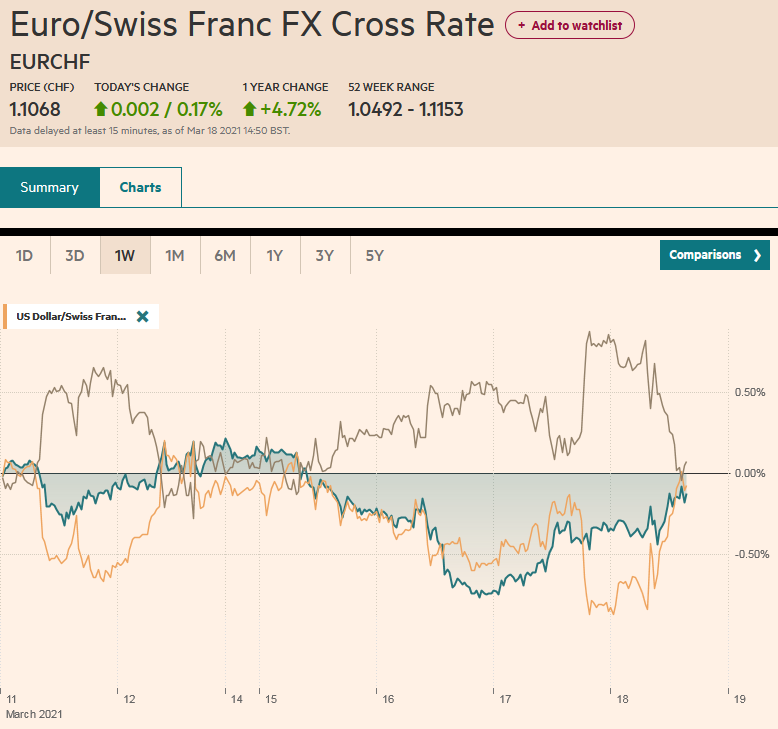

FX RatesOverview: Asia Pacific equities mostly advanced after the US benchmarks recovered following the dovish FOMC. Australia, New Zealand, and India did not participate in today’s gains. European bourses edged higher, but US shares are struggling, and the NASDAQ futures are off nearly 1%, threatening to end the three-day rally. Part of the weight is coming from a sharp sell-off in bonds. The US 10-year yield is up seven basis points to 1.72%, while benchmark yields in Europe are mostly 2-4 bp higher. The greenback is mostly firmer, though the Australian and Canadian dollars and sterling are proving a little resilient. The JP Morgan Emerging Market Currency Index is giving back around half of yesterday’s 0.5% gain. The higher yields appear to be sapping gold’s luster too. The rally fizzled near $1755 in early Asia and has dropped more than $20. It looks set to test the $1725 support area. A rise in US oil inventories and reports of weaker demand in Asia keeps the downward pressure on oil prices, and the May WTI contract is extending its loss for a fifth consecutive session. It finished last week near $65.65 and is now straddling the $64 area. |

FX Performance, March 18 |

Asia Pacific

Australia’s February job report was better than expected. It created nearly three times more jobs than economists expected, and of those 88.7k jobs, a little more than 89k were full-time positions. Part-time posts slipped. While the participation rate was unchanged (66.1%), the unemployment rate fell to 5.8% from a revised 6.3% (initially 6.4%). On the eve of the pandemic, Australian unemployment was hovering around 5.1%-5.3%. Separately, New Zealand surprised by reporting a 1.0% contraction in Q4 after a 13.9% expansion in Q3 (was 14%). Economists anticipated a small expansion.

A Japanese newswire appeared to be the first to leak that the G7 will formally endorse a $650 bln SDR allotment. If true, this is huge. It more than doubles past cumulative issuance. Last year, when the pandemic first struck, an initial push for an SDR issuance ($500 bln suggested) was ultimately rebuffed by the US. The objections were two-fold, and they are still relevant even if not decisive. First, the SDR allotment is based on the IMF quota (subscriptions). That means that the UK, a few other large European countries, and the US will receive half of the SDRs. The poorest countries that are the raison d’etre of the issuance receive a little more than 3%. Second, it was opposed because the funds would likely be used to service debt, and, given that China is the largest bilateral lender, it would bail out Chinese lenders. The report suggests that the G7 will virtually meet ahead. US Treasury Secretary Yellen had previously eluded some conditions or arrangements for the SDR that would minimize these misgivings, but the details are not yet clear.

The dollar initially slipped to new lows for the week against the Japanese yen (~JPY106.65) before rebounding smartly to JPY109.30 before consolidating in the European morning. It stopped just shy of the week’s high (JPY109.35), which is itself the highest since last June. There is talk that the BOJ could widen the band that the 10-year yield moves to+/- 25 bp instead of 20 bp at the conclusion of the policy review meeting tomorrow. The Australian dollar is firm, extending yesterday’s outside up-day advance. It reached nearly $0.7850, and a new high for the month before fading. A move above $0.7860 is needed to signal a run at the $0.8000 seen at the end of February. The dollar briefly traded below CNBY6.49 for the first time this week but quickly recovered back above CNY6.50. It is little changed on the week. The PBOC set the dollar’s reference rate at CNY6.4859, which for the second day running, was nearly spot on with the bank models. After some rhetorical flourishes, the US Secretary of State and National Security Adviser are meeting top Chinese foreign policy officials in Anchorage, Alaska, later today. No joint statement is expected, but it is hoped that sufficient efforts are made to lay the groundwork for a Biden-Xi meeting as early as next month.

EuropeThe outcome of the Bank of England will be known shortly. It is not expected to change policy, and Governor Bailey, like the Fed, will probably push against ideas that conditions are even remotely suitable to remove any monetary accommodation. Norway’s central bank takes a different tact. It signaled it will likely raise rates in the second half of this year. It sees a sooner lift-off, which helped send the krone to a new one-year high against the euro. Previously, Norges Bank had suggested a hike in H1 2022. |

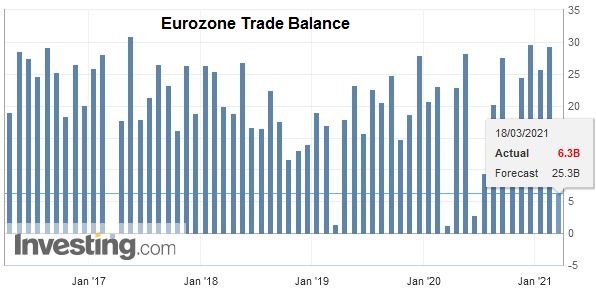

Eurozone Trade Balance, January 2021(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

The Netherlands gave Rutte’s VVD party a victory in yesterday’s election. It will be his fourth term. However, with about 35 seats in the 150-member parliament, it means protracted negotiations will be needed. The pro-European D66 did the best ever, securing second place with 27 seats. Wilders populist party slipped to third place with around 17 seats. The Christian Democrats, which held the finance ministry portfolio, dropped into fourth place. It could lose the ministry to the D66. Recall that after the previous election, it took more than 200 days to forge a coalition. The EU projected the Dutch economy to be the weakest in the region this year with about a 1.8% expansion after a 4.1% contraction last year.

The euro recovered on the back of the dovish Fed, but the demand faded near last week’s high (~$1.1990) and in front of the $1.20-level and the 20-day moving average ($1.2015). This puts the pressure back on the downside. The risk is for a return to the $1.1885 area. Note that several ECB officials are speaking today, and new TLTRO funds will be available. Sterling also tested last week’s high just above $1.40, but it too met sellers. The market is cautious ahead of the BOE meeting outcome. Sterling may have another run at the highs, but the odds favor a continued range-trade affair between $1.38 and $1.40. Lastly, the outcome of Turkey’s meeting is awaited, and most are looking for a 100 bp hike in the one-week repo rate that will take it to 18%. Ahead of it, the lira is trading near its best level in a couple of weeks.

America

The Fed revised up its growth forecast, and the number of officials that see a hike in 2022 and 2023 increased, but the market understood the dovish message. It was dovish in two important respects. First, most officials still do not see a hike until after 2023. Second, Powell underscored that substantial progress toward maximum employment and price stability is not about forecasts but actual data. The Fed Chair was explicit that a transitory increase in prices will not meet the standard for a policy shift. As we have discussed, the base effect from last year’s pandemic-gust of deflation dropping out of the year-over-year comparisons will lift consumer inflation readings starting this month. The Fed will see through this, and monetary policy will remain accommodative. Separately, Powell indicated a decision on the special leverage ratio exemption for Treasury and excess reserves from the calculation will be announced in the coming days.

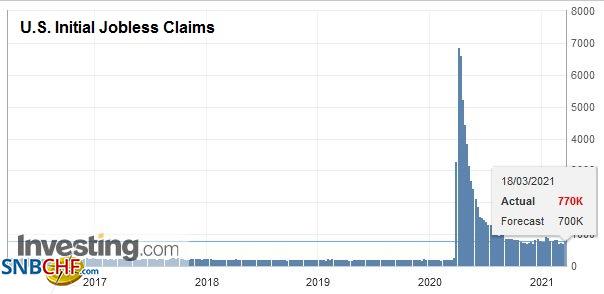

| Today’s US economic diary features weekly initial jobless claims for the week ending March 13. The previous week, they fell by 42k to 712k. They have not been below 700k since the middle of last March. The March Philadelphia Fed manufacturing survey is expected to build on February’s recovery. The February Leading Economic Indicators are not a market-mover. Fed talk resumes next week, with no fewer than seven official presentations, including Powell and Yellen before the Senate Banking Committee on March 24. Canada and Mexico have light calendars today. Tomorrow Canada reports January retail sales, which seems dated, especially after the recent Bank of Canada meeting. Mexico’s central bank meets next week. Lastly, we note that Brazil’s central bank hiked the Selic rate by 75 bp rather than the 50 bp the market expected. The Copom meets next on May 5, and the early call is for another 75 bp hike. |

U.S. Initial Jobless Claims, March 18 2021(see more posts on U.S. Initial Jobless Claims, ) Source: investing.com - Click to enlarge |

The US dollar fell to new multiyear lows against the Canadian dollar near CAD1.2365 but has rebounded in Europe above CAD1.2400. A close above there today would boost the chances of a near-term low being in place and suggest potential back into the CAD1.2500-CAD1.2550 area. The greenback also fell to MXN20.2830 area, its lowest level since February 20, after yesterday’s large outside down-day. However, it has rebounded to MXN20.50 and is consolidating near MXN20.40 in the European morning. A move above the MXN20.50 area could signal a near-term low is in place, and the risk to back toward yesterday’s high near MXN20.80.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of England,Bonds,Currency Movement,Featured,federal-reserve,newsletter,Norges Bank,SDR