In in seven employees of Switzerland’s second-biggest telecoms company is set to lose his or her job. © Keystone/Christian Beutler Switzerland’s second biggest telecoms group, Sunrise UPC, says it will cut 600 jobs by the end of 2022, following UPC’s CHF6.8 billion ($7.4 billion) takeover of Sunrise Communications last year. About 450 redundancies are expected, representing 13.5% of the company’s 3,350 full-time posts, Sunrise UPC said in a statement on Monday. About...

Read More »What’s Yours Is Now Mine: America’s Era of Accelerating Expropriation

The takeaway here is obvious: earn as little money as possible and invest your surplus labor in assets that can’t be expropriated. Expropriation: dispossessing the populace of property and property rights, via the legal and financial over-reach of monetary and political authorities. All expropriations are pernicious, but the most destructive is the expropriation of labor’s value while the excessive gains of unproductive speculation accrue to the elite that owns...

Read More »Thanks to the Fed, the High-Risk, Small-Time Borrower Is Becoming a Thing of the Past

Banks and accounting trickery go together. Last year, as I remember back to my banking days, financial institutions followed the advice once proffered by one of our board members, “If we’re going to the dump, let’s take a full load.” When the pandemic struck, banks dumped plenty in their loan-loss provisions, $60 billion, expecting the worst. The cavalry arrived led by Jerome Powell’s Fed liquidity flood, Steven Mnuchin’s Paycheck Protection Program (PPP) loans,...

Read More »FX Daily, April 27: Markets Mark Time Ahead of Fed

Swiss Franc The Euro is stable at 0.00% to 1.1041 EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Short-covering ahead of the FOMC’s outcome tomorrow appears to be lending the US dollar support today. It has extended yesterday’s gains against the euro, sterling, and yen. Among emerging market currencies, the Turkish lira, along with the South Korean won and Taiwanese dollar, lead...

Read More »56 Fintech Billionaires Worth a Combined US$327B in 2021

There are 56 fintech billionaires around the world who combine a total net worth of US$327.7 billion, data curated by Finextra based on Forbes’ 2021 World’s Billionaires list show. These represent some of the world’s biggest and most successful fintech companies in the world including Ant Group, PayPal, Stripe and Klarna. They are also world renowned fintech investors and the founders of leading firms such as Bloomberg and Thomson Reuters. US leads in fintech...

Read More »Main Swiss farmers’ group alarmed by proposed pesticide ban

Opponents argue that the anti-pesticide initiatives will harm Switzerland’s agriculture sector and undermine the country’s self-sufficiency. Anthony Anex/Keystone The director of the leading Swiss farmers’ organisation is deeply concerned about two initiatives to ban pesticide. Martin Rufer explains what voters’ approval would mean for Switzerland’s agriculture. The two proposals, to come to a nationwide ballot on June 13, are causing heated debates and have not only...

Read More »Switzerland fears impact of minimum corporate tax rate

Switzerland may have to find alternative ways to welcome foreign companies to Switzerland. Keystone / Peter Klaunzer The looming shadow of a global minimum corporate tax rate could threaten Switzerland’s status as a hub for multinational company headquarters. The United States says that no country should tax companies less than 21%, a proposal that has added momentum to talks over a worldwide minimum corporate tax rate. The average corporate tax rate among Swiss...

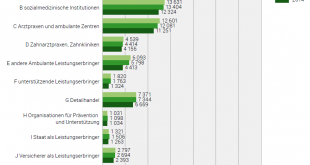

Read More »Total health expenditure in 2019 at CHF 82.1bn

27.04.2021 – In 2019, the total health care expenditure in Switzerland according to international standards was CHF 82.1 billion. At 2.3%, growth in health care expenditure was below the five-year average of 2.8%. In comparison to the previous year, the percentage of gross domestic product (GDP) spent on health care at current prices rose from 11.2% to 11.3%. These are the latest findings of the Federal Statistical Office (FSO) on the costs and financing of the...

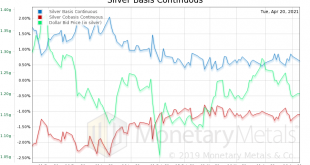

Read More »The Truth about the Silver Squeeze

Some recent videos about the silver market are generating more buzz than we have seen in a while. They make several points, but the main one is that there is a global shortage of silver. This assertion stands in contradiction to the fact that the silver price has dropped. As of the date of the first of these videos, it had dropped around 10% from its level just a month earlier. An 8th grader is a good litmus test for ideas in economics and markets. What would a...

Read More »UBS erwartet 40 Milliarden Franken SNB-Gewinn

Die Frankenschwäche sowie der anhaltende Aufwärtstrend an den Aktienmärkten haben zum voraussichtlichen Gewinn der SNB beigetragen. (Bild: Shutterstock.com/MDart10) Am kommenden Donnerstag wird die Schweizerische Nationalbank (SNB) ihr Finanzergebnis für das erste Quartal 2021 präsentieren. Die UBS erwartet für diesen Zeitraum einen SNB-Gewinn von rund 40 Mrd. CHF, wie einer Mitteilung vom Montag zu entnehmen ist. Wie die UBS-Ökonomen ausführen, haben die...

Read More » SNB & CHF

SNB & CHF