Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting billion in block trades and billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the disaster.“Do you think it’s possible that this could produce a very fundamental reset in how your IRB credit risk models work?” wondered Stefan Stalmann of Autonomous Research. “I mean you have only CHF20 billion to CHF25 billion of counterparty credit risk-weighted assets on literally hundreds of billions of equity swaps

Topics:

Tyler Durden considers the following as important: 1.) Zerohedge on SNB, 1) SNB and CHF, 3.) Swiss Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Authored by Nick Dunbar of Risky Finance

When the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the disaster.

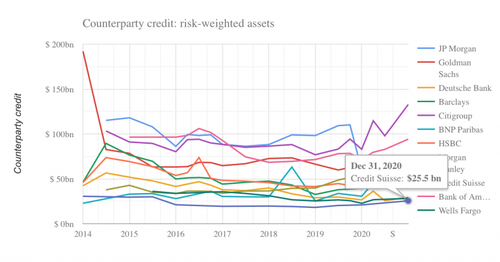

“Do you think it’s possible that this could produce a very fundamental reset in how your IRB credit risk models work?” wondered Stefan Stalmann of Autonomous Research. “I mean you have only CHF20 billion to CHF25 billion of counterparty credit risk-weighted assets on literally hundreds of billions of equity swaps and repos”.

Risky Finance shares Stalmann’s bewilderment. Expressed as a capital requirement, Credit Suisse was able to satisfy regulators with just $2 billion of capital for counterparty credit losses – the lowest among the G-SIFI banks tracked by Risky Finance. Months later it reported a loss of $4.7 billion.

It should serve as a warning. 14 years ago, obscure corners of banking businesses became hotbeds of regulatory arbitrage, speculation and leverage. The contagion of US subprime brought the financial system to its knees. Now, after years of low or negative interest rates, equity finance may have become a similar hotbed.

The business is much larger than published estimates – Risky Finance believes there are more than $3 trillion of exposures. And the pressure to grow equity finance is leading banks to exploit loopholes in Basel rules. As in 2007, this is masked by the complexity of the models that Credit Suisse and other banks used to allocate capital to their prime brokerage business.

In following articles we will try to unpick the way Archegos was so damaging, and we will give a broad brush picture of how the risk models are supposed to work. And we will showcase some new data that reveals why this business is bigger and riskier than many imagined. Lastly we will identify a list of fixes for regulators to work on.

Tags: Featured,newsletter