We critized GDP growth that in many Western economies (e.g. Greece) has become mostly an indicator of consumption and activity. We emphasized that GDP growth in the form of consumption-driven (hyper-) activity (aka Bawerk’s “GDC” Gross Domestic Consumption) must finally lead to a depreciating currency, inflation, falling government bond prices and wealth in real terms. Instead, GDP should be driven by investment and...

Read More »Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. Swiss Franc Speculators reduced their long Swiss Franc position from 6.7K contracts to 4.7K contracts (against USD). The 2K was certainly smaller than the increase of 15K shorts in the euro (against USD) Euro The euro bears added to their gross short position for the fourth consecutive week and for...

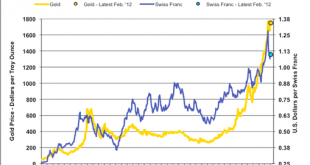

Read More »The relationship between CHF and gold

Gold versus Swiss Franc Many people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels. However the strong gold-CHF relationship broke from 1985 to 2007. Between 1985 and 2001: the reasons...

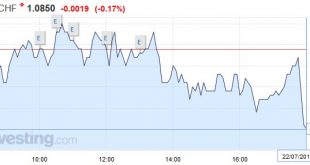

Read More »FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

Swiss Franc The EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy Click to enlarge. FX Rates As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US...

Read More »More Signs the End is Nigh

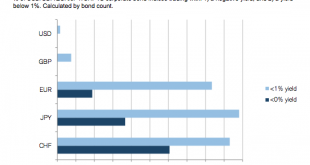

Hyperventilating Minds “What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be. As far as our studies have shown, negative interest rates are a brave new...

Read More »Emerging Markets: What has Changed

The New York Times reported that the US is preparing to seize $1 bln in assets tied to 1MDB S&P downgraded Turkey a notch to BB with a negative outlook, citing political uncertainty Turkish President Erdogan declared a three-month state of emergency The Nigerian Naira weakened above 300 per dollar for the first time Brazil’s central bank signaled a longer wait until it cuts rates In the EM equity space as...

Read More »Swiss markets fluctuate on earnings data

Investec Switzerland SMI last Week The Swiss Market Index is set to finish the week slightly higher as investors digest second quarter earnings reports and central bank policy announcements. Click to enlarge. Bonds Global financial markets showed resilience this week following the failed coup attempt in Turkey over the weekend. Second quarter earnings proved to be the main drive of sentiment with...

Read More »It’s a negative yielding world, we just get to scramble in it

Here’s a rough piece of calculation based on the last few years of news: When x happens, yields fall. An example of this post-GFC rule-of-thumb was Brexit and its fallout. The potential lesson from said rule is that yield hunting isn’t fun anymore, say Credit Suisse’s William Porter and team, with our emphasis: Negative (or very low) 10-year Bund yields have not been a boon for European credit markets, based on our...

Read More »Roche CEO worried about U.K. drug research following Brexit

Investec Switzerland. The U.K.’s decision to leave the European Union poses a threat to research and development in the pharmaceutical industry, Roche Holding AG Chief Executive Officer Severin Schwan said. © Lucaderoma | Dreamstime.com A departure would mean the country would have to set up its own system for approving drugs for sale, a job now done for bloc members by the European Medicines...

Read More »CHF Price Movements: Correlations between CHF and the German Economy

A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time. Correlations between CHF and the German economy The relationship between CHF and the German economy is very close for the following reasons: A big part of Swiss consumption is imported from Germany. Therefore, Swiss inflation...

Read More » SNB & CHF

SNB & CHF