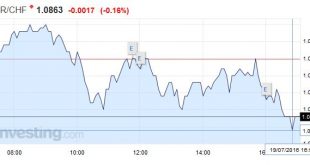

Swiss Franc Click to enlarge. FX Rates The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event....

Read More »Dollar Bull Case Intact: It is All About the Perspective

Summary: Our bullish dollar outlook was based on divergence and we judge it to still be intact. The Dollar Index has been trading broadly sideways since March 2015, but never did more than a minimum retacement of its earlier rally. The Dollar index is at it highest level since March today. Our underlying constructive outlook for the US dollar remains intact. It is broadly based on the divergence between the...

Read More »European Court of Justice Ruling Weighs on Italian Banks

Summary: ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event. The European Court of Justice upheld the principle of making creditors bear the burden for investment in banks that sour before government funds can be used. Italian banks are particularly...

Read More »Givaudan profit beats estimates on U.S. fragrance demand

Investec Switzerland. Givaudan SA, the world’s largest flavors and fragrance company, reported first-half profit that beat analyst estimates on increased demand for perfumes. © Ragsac19 | Dreamstime.com Earnings before interest, taxes, depreciation and amortization rose 13 percent to 638 million francs ($649 million), the Vernier, Switzerland-based company said in a statement on Monday. Analysts...

Read More »Novartis says profit may drop

Investec Switzerland. Novartis AG said profit may fall this year as the Swiss drugmaker increases spending on the heart medicine Entresto and faces declining sales of its best-selling cancer treatment Gleevec. © Lucaderoma | Dreamstime.com Core operating income will either be about the same as 2015 or decline by a percentage in the low single digits at constant exchange rates, Novartis said Tuesday...

Read More »Hans-Hermann Hoppe: “Put Your Hope In Radical Decentralization”

Via The Mises Institute, [An interview with Hans-Herman Hoppe in the Polish weekly Najwy?szy Czas!] What is your assessment of contemporary Western Europe, and in particular the EU? All major political parties in Western Europe, regardless of their different names and party programs, are nowadays committed to the same fundamental idea of democratic socialism. They use democratic elections to legitimize the taxing...

Read More »The dying art of professional mourning

In parts of India, trained mourners are called in at funerals to create an atmosphere of grief and bereavement. One such mourner was invited to Switzerland as part of an artistic performance. (Anand Chandrasekhar & Michele Andina, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or...

Read More »FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

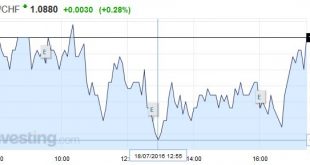

Swiss Franc Continuing risk appetite is positive for the euro (and certainly sterling).At this levels we do not see much SNB intervention. Click to enlarge. FX Rates The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign...

Read More »Bank of Japan: Destination Mars

Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this is now standard operating procedure. For example, in Japan this explicit intervention into the...

Read More »Squaring the Circle: Can Article 7 be Used to Force Article 50?

Summary: Article 7 would suspend the UK’s EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what “is” means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not. Due to an unlikely string of events, the UK had sorted out its government more than two months...

Read More » SNB & CHF

SNB & CHF