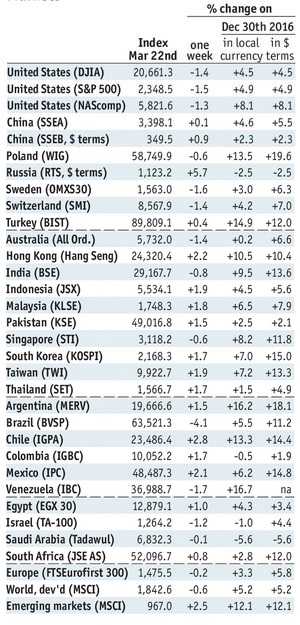

Stock Markets EM FX ended the week on a firm note. Indeed, virtually all of EM was up against the dollar last week, led by ZAR and MXN. BRL and PHP were the laggards. It remains to be seen how markets react to the failure to pass the health care reform in the US. Will Trump move on the tax reform? Can the Republicans proceed with its agenda in light of the fissures within the party? Stock Markets Emerging Markets, March 25 Source: economist.com - Click to enlarge Mexico Mexico reports February trade and January GDP proxy Monday. Banco de Mexico meets Thursday and is expected to hike rates 25 bp to 6.5%. Mid-March CPI rose 5.29% y/y, a cycle high and further above the 3% target. We think Banxico will have to hike several more times this year to head off inflationary pressures. Hungary Hungary central bank meets Tuesday and is expected to keep policy unchanged. However, there is a chance that it makes a small symbolic cut to the deposit cap. CPI rose 2.9% y/y in February, the highest since January 2013 but just below the 3% target. While easing is nearing an end, we do not see tightening until next year. Thailand Bank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 1.4% y/y, down from the cycle high of 1.6% y/y in January and still well within the 1-4% target range.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended the week on a firm note. Indeed, virtually all of EM was up against the dollar last week, led by ZAR and MXN. BRL and PHP were the laggards. It remains to be seen how markets react to the failure to pass the health care reform in the US. Will Trump move on the tax reform? Can the Republicans proceed with its agenda in light of the fissures within the party? |

Stock Markets Emerging Markets, March 25 Source: economist.com - Click to enlarge |

MexicoMexico reports February trade and January GDP proxy Monday. Banco de Mexico meets Thursday and is expected to hike rates 25 bp to 6.5%. Mid-March CPI rose 5.29% y/y, a cycle high and further above the 3% target. We think Banxico will have to hike several more times this year to head off inflationary pressures. HungaryHungary central bank meets Tuesday and is expected to keep policy unchanged. However, there is a chance that it makes a small symbolic cut to the deposit cap. CPI rose 2.9% y/y in February, the highest since January 2013 but just below the 3% target. While easing is nearing an end, we do not see tightening until next year. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 1.4% y/y, down from the cycle high of 1.6% y/y in January and still well within the 1-4% target range. We think base effects will push inflation higher this year, and should cause the BOT to tilt more hawkish. Czech RepublicCzech central bank meets Thursday and is expected to keep policy unchanged. The debate continues over when the bank will actually exit the koruna cap. This meeting seems too soon, but May 4 and June 29 should be seen as very “live.” BrazilBrazil central bank releases its quarterly inflation report Thursday. Mid-March IPCA inflation rose 4.73% y/y, the lowest since September 2010. Markets are looking for a 100 bp cut to 11.25% when COPOM meets April 12. Brazil also reports January retail sales that day, which are expected at -4.3% y/y vs. -4.9% in December. It also reports central government budget data Thursday, to be followed by consolidated budget data Friday. South AfricaSouth African Reserve Bank meets Thursday and is expected to keep rates steady at 7.0%. Earlier that day, South Africa reports February PPI and money and loan data. February trade will be reported Friday. The economy remains weak, but inflation is still above the 3-6% target range and so the central bank cannot ease yet. KoreaKorea reports February IP Friday, which is expected to rise 8.0% y/y vs. 1.7% in January. On Saturday, it reports March trade. Real sector data remain fairly firm. With inflation likely to pick up, we think the BOK will tilt more hawkish this year. Next policy meeting is April 13, no change in rates is likely then. ChinaChina reports official March PMI Friday, which is expected to tick up to 51.7. The economic data out of China recently points to stabilization. Taken along with rising price pressures, we think the PBOC may move to a more hawkish stance this year. The recent snugging of the OMO and MLF rates are likely a precursor for a hike in the policy rates. TurkeyTurkey reports February trade and Q4 GDP Friday. GDP growth is expected to rebound to 1.9% y/y from -1.8% in Q3, which was depressed by the attempted coup in July. The central bank recently hiked the Late Liquidity Window rate but left the benchmark rate unchanged due to concerns about the sluggish economy. |

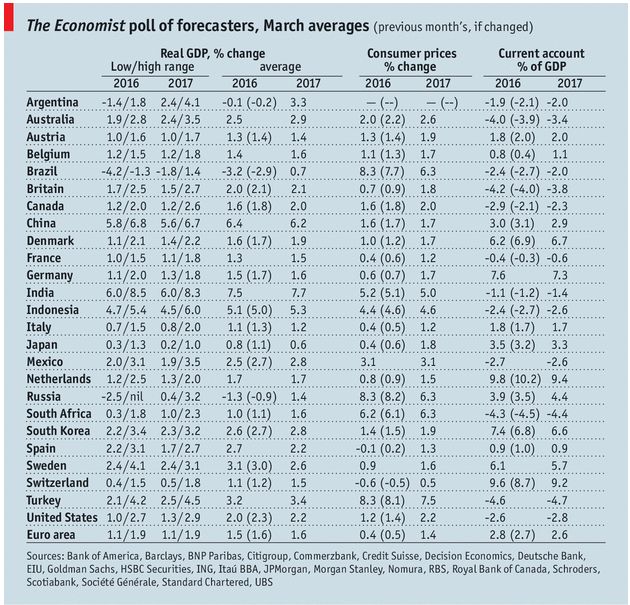

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, March 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter