See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Before it collapsed, the city of Rome had a population greater than 1,000,000 people. That was an extraordinary accomplishment in the ancient world, made possible by many innovative technologies and the organization of the greatest civilization that the world had ever seen. Such an incredible urban population depended on...

Read More »FX Daily, July 09: Possibility of a Soft Brexit Excites Sterling (too Early?)

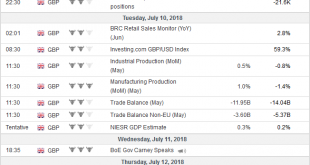

Swiss Franc The Euro has risen by 0.17% to 1.164 CHF. EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and...

Read More »FX Weekly Preview: Macro Considerations for the Capital Markets

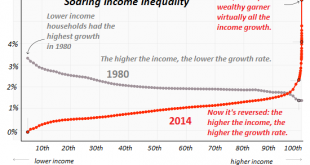

The triumphalism that followed the fall of the Berlin Wall nearly three decades ago has evaporated. The Great Financial Crisis and inexorable widening of income and wealth inequalities within countries undermined claims of moral and economic superiority. Liberal democracies are fighting a rearguard action and the rise of illiberal regimes. The president of the country with the strongest military might and largest...

Read More »Germany alleged to have spied on Swiss firms in Austria

Novartis’ Sandoz unit is one of the dozen Swiss firms alleged to have been targeted in the long-running German spying operation in Austria A dozen branches of Swiss firms in Austria were targeted by German spies between 1999 and 2006, according to the SonntagsBlick newspaper which has seen documents belonging to Germany’s federal intelligence service BND. Part of the data was allegedly handed to the United States. The...

Read More »The USA Is Now a 3rd World Nation

I know it hurts, but the reality is painfully obvious: the USA is now a 3rd World nation. Dividing the Earth’s nations into 1st, 2nd and 3rd world has fallen out of favor;apparently it offended sensibilities. It has been replaced by the politically correct developed and developing nations, a terminology which suggests all developing nations are on the pathway to developed-nation status. What’s been lost in jettisoning...

Read More »Gold $10,000 In Currency Reset as Russia, China Gold Demand To Overwhelm Futures Manipulation (GOLDCORE VIDEO)

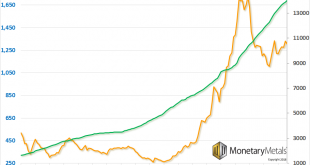

Is the currency reset or global monetary reset (GMR) upon us? Russia dumped half their US Treasuries in April ($47.4 billion out of the $96.1 billion it had held) and bought 600k ozs of gold worth less than $800 million in May Has the IMF “pegged” gold to SDRs at 900 SDR per ounce? China stops buying US Treasuries and quietly accumulates gold China has over $3 trillion in fx reserves and Russia has $461 billion...

Read More »Euro area: a slight rebound

Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit...

Read More »TV Recording could be under threat in Switzerland

With TV recording there’s no need to miss programmes just because they’re on at the wrong time. And, when it’s time to watch them, it’s easy to fast forward through the adverts, something that can’t be done when watching live. ©-Sebastian-L-_-Dreamstime.com_ - Click to enlarge In Switzerland, television recording is offered by big distributers, such as Swisscom, Sunrise and UPC. Broadcasters don’t provide it. While...

Read More »Credit Suisse: “Our Risk Appetite Index Is Near Panic”

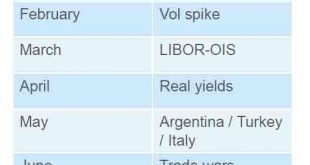

Sure, it’s been a bad year for investors, with the S&P posting the smallest of gains in the first half (all of which thanks to tech stocks) after several hair-raising, monthly incidents including February’s vol-spike, April’s real yield scare, May’s Emerging Market massacre and June’s trade war fears as shown in the following Citi chart… … but it’s hardly been apocalyptic: in fact, most of the shocks that took...

Read More »‘Hidden’ transport costs on the rise

Traffic jam in Geneva: bad for the environment, bad for the nation's wallet. (Keystone) - Click to enlarge A government study has found that the so-called ‘external costs’ of various modes of transport collectively increased by almost CHF1 billion during the period 2010-2015. For walkers and cyclists, however, benefits outweigh the costs. The study, published on Thursdayexternal link by the Federal Office for Spatial...

Read More » SNB & CHF

SNB & CHF