See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Race to the Bottom Last week the price of gold fell $17, and that of silver $0.30. Why? We can tell you about the fundamentals. We can show charts of the basis. But we can’t get into the heads of the sellers. We can say that in the mainstream view, the dollar is rising. The dollar, in their view, is not measured in gold...

Read More »House View, July 2018

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer. Recent sell-offs have vindicated our cautiousness regarding...

Read More »FX Daily, July 06: Dollar Slips After Tariffs and Before Jobs Data

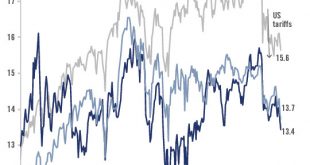

Swiss Franc The Euro has risen by 0.19% to 1.1629 CHF. EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The first set of US tariffs aims specifically at China were implemented, and the retaliatory actions were also launched. The tariffs cover hundreds of goods, though the initial amount of trade covered is relatively small at $34 bln....

Read More »Let there be Bitcoin! And it was Bitcoin!

Bitcoin’s origin can be traced back to September 15, 2008. This is the day the investment bank Lehman Brothers announced its bankruptcy and the financial crisis reached its peak. With the bankruptcy of Lehman Brothers a ripple effect set in, several other banks had to be saved by their patrons, the states. These bail-outs wreaked havoc on the debt of many countries, which is why central banks initiated their massive...

Read More »Thousands of Swiss firms are unregistered

Unlike this company being audited in Zurich, many Swiss firms are falling under the radar. (© KEYSTONE / CHRISTIAN BEUTLER) - Click to enlarge About 13,000 companies are not listed in the commercial register – a serious problem, notes the Swiss Federal Audit Office. Increased cooperation with the tax authorities could be a solution. On Wednesday the office published an evaluationexternal link of how Switzerland has...

Read More »Federal Council appoints Martin Schlegel as new Alternate Member of the SNB Governing Board

Martin Schlegel - Click to enlarge At its meeting of 4 July 2018, the Federal Council appointed Martin Schlegel as the new Alternate Member of the Governing Board of the Swiss National Bank (SNB), following the proposal of the SNB’s Bank Council. He will take up the position of Deputy Head of Department I as of 1 September. Martin Schlegel is currently Head of the SNB’s branch office in Singapore. Having graduated...

Read More »The Gathering Storm

July 4th is an appropriate day to borrow Winston Churchill’s the gathering storm to describe the existential crisis that will envelope America within the next decade. There is no single cause of the gathering storm; in complex systems, dynamics feed back into one another, and the sum of destabilizing disorder is greater than a simple sum of its parts. Causal factors can be roughly broken into two categories: systemic...

Read More »Mythbusting: Why Bitcoin Can Never Go To Zero

Authored by Darryn Pollock via CoinTelegraph.com, Image courtesy of CoinTelegraph - Click to enlarge Bitcoin’s polarizing effect has people on both ends of the scale either proclaiming it is going to the moon or it is going to zero. The volatile, unprecedented, and revolutionary monetary system that is cryptocurrency has a future that not many can accurately predict, but as time has gone on, the idea that Bitcoin is...

Read More »FX Daily, July 05: Dollar is Mixed on Eve of US Jobs and Tariffs

Swss Franc The Euro has risen by 0.38% to 1.161 CHF. EUR/CHF and USD/CHF, July 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is softer against most of the major currencies and mixed against the emerging market currencies. European currencies firmer, with the continued recovery of the Swedish krona on the back of a more hawkish central bank, and the euro poking...

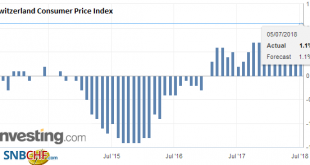

Read More »Swiss Consumer Price Index in June 2018: +1.1 percent YoY, Stable MoM

Neuchâtel, 5 July 2018 (FSO) – The consumer price index (CPI) remained stable in June 2018 compared with the previous month, reaching 102.1 points (December 2015=100). Inflation was 1.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each...

Read More » SNB & CHF

SNB & CHF