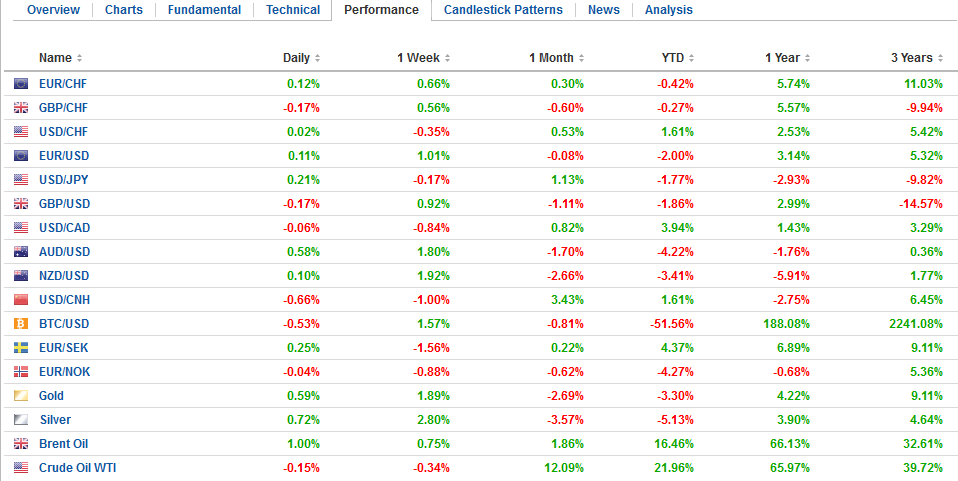

Swiss Franc The Euro has risen by 0.17% to 1.164 CHF. EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and the softer dollar tone puts wind in sterling’s sale. There is a GBP244 mln sterling option at .3375 that expires today. The June highs were set in the .3450-.3470 area. The weaker dollar tone was seen in Asia, and even China’s yuan strengthened. The dollar slipped almost 0.4% against the yuan to a

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR, EUR/CHF, Featured, FX Daily, GBP, JPY, MXN, newslettersent, USD, USD/CHF

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.17% to 1.164 CHF. |

EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesAfter a little wobble, sterling has responded favorably to the resignation of the UK Brexit team led by David Davis. The idea is that a path to a softer Brexit is good for sterling. In fairness, it is a bit early to reach this conclusion, and the softer dollar tone puts wind in sterling’s sale. There is a GBP244 mln sterling option at $1.3375 that expires today. The June highs were set in the $1.3450-$1.3470 area. The weaker dollar tone was seen in Asia, and even China’s yuan strengthened. The dollar slipped almost 0.4% against the yuan to a little below CNY6.62. It has not traded below CNY6.60 since June 27. The offshore yuan (CNH) rose a little more than 0.5%, making it the strongest regional currency today. Chinese equities participated in the rally that lifted the MSCI Asia Pacific Index 1.2%, the first back-to-back gain in nearly a month and the most since June 4. Even though Korea’s Kospi rallied, foreign investors were sellers and here in July through today have sold $168 mln. Foreign investors bought $183 mln of Taiwanese shares today, paring this month’s net sales to a little less than $650 mln. |

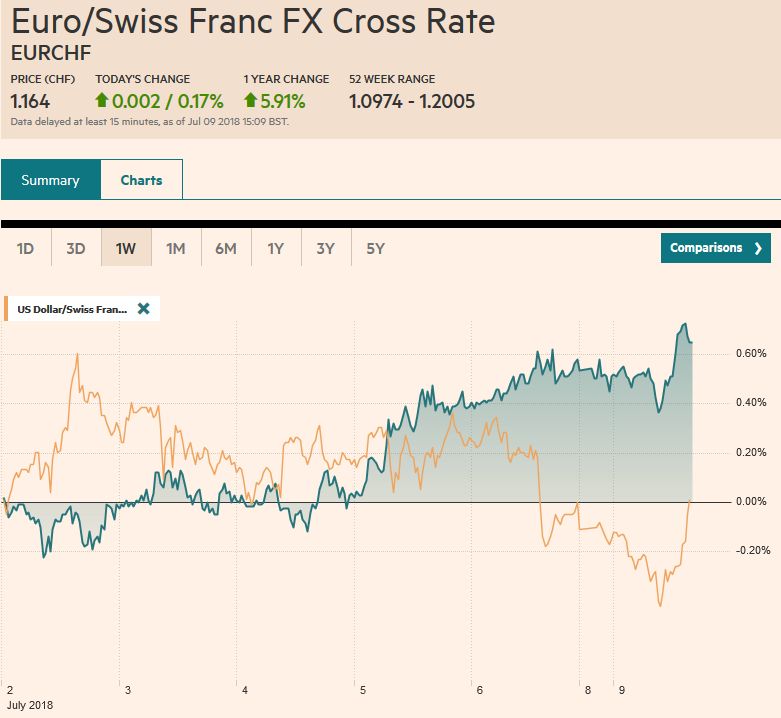

FX Performance, July 09 |

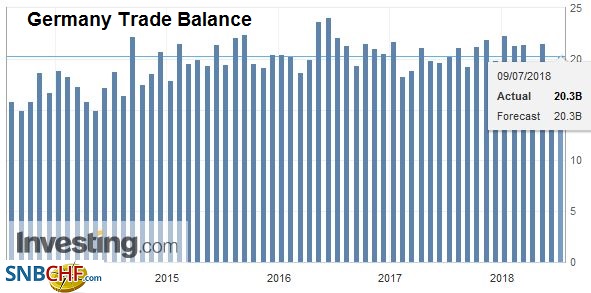

GermanyGerman reported strong export growth of 1.8% in May. It is more than twice the 0.7% rise than the median of the Bloomberg survey forecast. It comes on the heels of strong industrial output and orders data. The trade surplus of 19.7 bln euros was a touch smaller than expected. Imports rose 0.7% and were expected to have fallen by 0.5%. A big drop in primary income (coupon payments?) to a 7.4 bln euro deficit from a 4 bln euro surplus in April. |

Germany Trade Balance, Aug 2013 - Jul 2018(see more posts on Germany Trade Balance, ) Source: investing.com - Click to enlarge |

United Kingdom

The problem is that UK Prime Minister May has to navigate three separate forces, her own cabinet, Parliament, and the EC. With Davis’ and team’s departure, the cabinet appears to stand with her, though another defection or two might not surprise. However, Rees-Mogg has already threatened to oppose May’s plan, and the battle in Parliament begins. The hard Brexit camp appears to be gearing up for a leadership challenge.

There may be nothing quite like the resignation of the team responsible for the Brexit negotiations to demonstrate to the EC that May is on the ropes. Since her main challenge is from the hard Brexit camp, the EC must realize that if May is replaced it will be most likely be someone from the wing. However, at the same time, the EC cannot be pleased with May’s proposal which in effect wants the benefits of the customs union for goods by not the services or people. Even from far away, it still looks like cherry-picking.

On the data front, tomorrow is a big day for the UK. May trade and industrial output figures are due, and they are expected to be better than April, which will lend credence to ideas that the soft patch seen at the start of the year has ended. Also, the UK will introduce its monthly GDP estimate (May) and a rolling three-month estimate. Note that NIESR will also provide an estimate for June GDP tomorrow. It put May’s growth at 0.2%. Canada also reports a monthly GDP estimate.

China

China reported an unexpected increase, albeit minor, of its reserves. The Bloomberg survey anticipated a small decline. Instead, reserves rose to $3.112 trillion from $3.110 trillion in May. China’s reserves stood at $3.140 trillion at the end of last year. Recall China experienced a current account deficit in Q1.

Japan

Japan reported a larger current account in May. It typically falls in May, and the increase stems from the smaller than expected trade deficit. May’s trade deficit was nearly JPY304 bln and forecasts centered around JPY483 bln. However, as we noted, Japan’s investment income balance drives the current account. The current account surplus stood at JPY1.938 trillion up from JPY1.845 trillion in April.

The yen seemed unimpressed, and the dollar remains within the consolidative range seen most of last week. Support is seen near JPY110.25 and resistance is pegged near JPY110.80

Eurozone

Meanwhile, European shares are moving higher, and the Dow Jones Stoxx 600 is up 0.5% to extend its gains for a fifth consecutive session. Information technology and materials are leading the advance. Telecom and utilities are the only sectors underwater today. The DAX is lagging a bit with less than a 0.2% gain near midday in Frankfurt. European bonds yields are mostly firmer, with the notable exception of Italy, where the 10-year benchmark yield is off two basis points. At 1.30% the UK benchmark yield is up 3.5 bp, and the US 10-year yield is up nearly three basis points to 2.85%.

The euro is extending last week’s gains to test the $1.1780 area in the European morning. We suggested near-term potential toward $1.1850, last month’s highs. There is an 876 mln euro option struck at $1.1750 expiring today that might come back into play.

United States

The week begins off slowly for the US and Canada. The Bank of Canada is widely expected to hike rates on Wednesday, while the US reports CPI, the data highlight of the week, the following day.

Note that both Mexico and Brazil report inflation figures today. Mexico June CPI is expected to have risen by 0.33%, which would lift the year-over-year rate to 4.59% (from 4.51% in May). The bi-weekly reading may tick up to 4.64% from 4.54%. The US dollar fell nearly 4.4% against the peso last week. It was the third weekly fall. The dollar slipped below MXN19 for the first time in two months. Brazil’s June CPI (IGP_DI) is expected to have risen about 1.57% after 1.,64% in May. The year-over-year pace would accelerate to 7.88% from 5.20%. The dollar eased about 0.4% against the Brazilian real last week, breaking a three-week advancing streak.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,EUR/CHF,Featured,FX Daily,MXN,newslettersent,USD/CHF