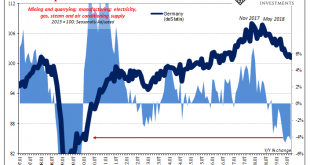

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate. Four percent doesn’t sound like much, but in the context of German IP it is well within recession territory....

Read More »“We don’t have to behead the king if we can just ignore him” – Claudio Grass

“Negative interest rates are unsustainable and once investors decide to stop paying for the privilege of holding government debt, a banking crisis could result, says James Grant.” Returning SBTV guest, Claudio Grass, speaks with us about the unsustainable pensions, crumbling fiat currencies and a looming financial crisis in a world of insane central bank monetary policies. Discussed in this interview: 01:31 A looming global recession ahead? 06:47 Money printing by...

Read More »The Wave of Negative Rates Starts to Recede

Negative yields on long-term European government bonds took financial markets by storm earlier this year but are starting to fade away as investors express renewed optimism about global economic growth. The yield on 10-year bonds issued by the French and Belgian governments turned positive Thursday for the first time since mid-July. Other European countries that experienced negative long-term rates for the first time, including Ireland, Spain and Portugal, have also...

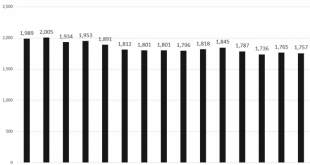

Read More »Ocasio-Cortez is Wrong: We’re Not Working 80-Hour Weeks Now

It has become nearly commonplace for pundits and politicians to claim that Americans are working more than ever before; that they’re working more jobs, and working longer hours — all for a lower income. During the Democratic debates this summer, for instance, Rep. Tim Ryan of Ohio claimed “the economic system now forces us to have two or three jobs just to get by.” Kamala Harris made similar comments. These claims echo statements from Elizabeth Warren in Alexandria...

Read More »Negativzinsen: Für KMU überwiegen weder Kosten noch Nutzen

Schweizer Unternehmen sind wenig abhängig vom Wechselkurs, da nur die wenigsten exportieren. (Bild: Shutterstock.com/guruxox) Auch fünf Jahre nach der Einführung von Negativzinsen zur Schwächung des Frankenwechselkurses durch die Schweizerische Nationalbank (SNB) deutet nichts darauf hin, dass diese Phase der Geldpolitik bald dzu Ende gehen wird. UBS hat deshalb das Thema zum Schwerpunkt ihrer halbjährlich durchgeführten Unternehmensumfrage gemacht und 2’500...

Read More »Swiss payments system aims to link bitcoin and retailers

Spending cryptocurrencies in shops is proving a difficult nut to crack. (© Keystone / Christian Beutler) Prominent European payment infrastructure provider Worldline has teamed up with financial services firm Bitcoin Suisse to allow cryptocurrency enthusiasts to spend their bitcoin in Swiss shops. Worldline last year took over SIX Payment Services, the former arm of the Swiss stock exchange group that provides payment card terminals in 85,000 Swiss retail outlets....

Read More »Demobilising Swiss merchant navy to cost another CHF100 million

The number vessels flying the Swiss flag will reduce from 47 in 2016 to 20. (© Keystone / Gaetan Bally) Switzerland will incur a further CHF100 million ($101 million) loss as it continues to reduce its merchant shipping fleet. The ongoing bill for selling off ships and meeting their debt obligations has now risen to an estimated CHF300 million, the government has admitted. Eight more ships, from the Massmariner company, are to be sold off, bringing the size of the...

Read More »Still Stuck In Between

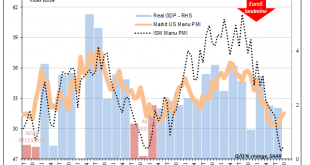

Note: originally published Friday, Nov 1 There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior. Most of that was related to a curious surge in New Export Orders. Having dropped to...

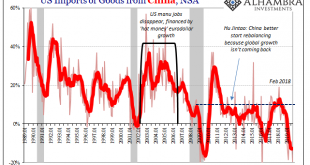

Read More »The Sudden Need For A Trade Deal

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018? I don’t mean to ask what his rationale was, more along the lines of, why 2018? Why...

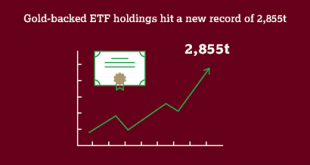

Read More »Gold ETF and Central Bank Gold Buying Supports Gold Demand In Q3

Gold demand grew modestly to 1,107.9 tonnes (t) in Q3 thanks to the largest ETF inflows since Q1 2016 ◆ A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3 ◆ Global central bank buying remained healthy but significantly lower than the record levels of Q3 2018 ◆ Central banks added 156.2t to reserves in Q3. Year to date, central banks have purchased 547.5t on a net basis, 12% higher y-o-y. The -38% monthly...

Read More » SNB & CHF

SNB & CHF