USD/CHF recovers from four weeks’ low. 50% Fibonacci retracement level, October bottom restrict further downside. 200-DMA breakout will again highlight 1.0000 psychological magnet. USD/CHF seesaws around 0.9873 while heading into the European session on Wednesday. The quote dropped to the lowest since early November on Tuesday but pulls back off-late. The pair’s refrain to drop further below the latest bottom seems to prepare for a confrontation to 38.2% Fibonacci...

Read More »Crunchtime: When Events Outrun Plan B

Not only will events outrun Plan B, they’ll also outrun Plans C and D. We all know what Plan B is: our pre-planned response to the emergence of risk. Plan B is for risks that can be anticipated, regular but unpredictable events such tornadoes, earthquakes, hurricanes, etc. In the human sphere, risks that can be anticipated include temporary loss of a job, stock market down turns, recession, disruption of energy supplies, etc. Hidden in most Plan B’s are a host of...

Read More »Verpflichtungen der Anlagefonds sinken erstmals seit 2008

Zwei Faktoren prägten 2018 die finanziellen Forderungen der privaten Haushalte: Einerseits führten sinkende Aktienkurse zu hohen Kapitalverlusten, andererseits erhöhten die privaten Haushalte ihr Finanzvermögen durch Transaktionen. Sie bauten ihre Ansprüche gegenüber Versicherungen und Pensionskassen aus, sie stockten ihre Einlagen bei Banken auf, und sie investierten in Wertschriften. Insgesamt gingen die finanziellen Forderungen der privaten Haushalte geringfügig...

Read More »China No Longer Needs US Parts In Its Phones

Authored by Mike Shedlock via MishTalk, China was once very dependent on US chips for its phones. The latest Chinese phones have no US parts. The Wall Street Journal reports Huawei Manages to Make Smartphones Without American Chips. American tech companies are getting the go-ahead to resume business with Chinese smartphone giant Huawei Technologies Co., but it may be too late: It is now building smartphones without U.S. chips. Huawei’s latest phone, which it...

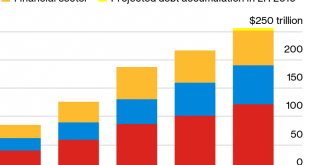

Read More »$255 Trillion Global Debt Bubble May Burst In 2020 – Prepare Now

Source: Bloomberg ◆ Global debt has risen to another record at $255 trillion due to cheap borrowing costs. ◆ A decade of easy money has left the world with a record $250 trillion of government, corporate and household debt. ◆ This is almost three times global economic output and equates to about $32,500 for every man, woman and child on earth. ◆ “With central bank rates at their lowest levels and U.S. Treasuries at their richest valuations in 100 years, we appear to...

Read More »Exports: Currency Devaluation Won’t Grow the Economy

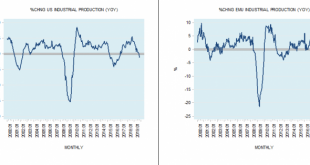

A visible weakness in economic activity in major world economies raises concern among various commentators that world economies have difficulties recovering despite very aggressive loose monetary policies. The yearly growth rate of US industrial production stood at minus 1.1 % in October, against minus 0.1% in September, and 4.1% in October last year. In the euro zone, the yearly growth rate of production stood at minus 1.7% in September versus minus 2.8% in the...

Read More »Dollar Soft on Weak Data and the Return of Tariff Man

The dollar has taken a hit from the weaker than expected data Monday Tariff man is back The US economy remains solid in Q4 but there are some worrying signs for the November jobs data Friday The political pressure on Turkey from the US could increase soon; South Africa’s Q3 GDP came in well below expectations at -0.6% q/q and 0.1% y/y Japan JGB auction went poorly on supply concerns ahead of planned fiscal stimulus; RBA kept rates steady at 0.75% but the outlook was...

Read More »FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Swiss Franc The Euro has fallen by 0.29% to 1.0946 EUR/CHF and USD/CHF, December 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asia Pacific equities mostly declined in sympathy with yesterday’s large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia’s 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the...

Read More »USD/CHF hammered down to sub-0.9900 levels, 2-week lows

USD/CHF lost some additional ground for the second straight session on Tuesday. A subdued USD demand, stability in equity markets did little to provide any respite. Trump’s latest remarks opened the room for a further intraday depreciating move. The USD/CHF pair witnessed some follow-through selling on Tuesday and dropped to near two-week lows, below the 0.9900 handle in the last hour. Having repeatedly failed to find acceptance above the parity mark, the pair came...

Read More »Swiss Consumer Price Index in Novemeber 2019: -0.1 percent YoY, -0.1 percent MoM

03.12.2019 – The consumer price index (CPI) fell by 0.1% in November 2019 compared with the previous month, reaching 101.7 points (December 2015 = 100). Inflation was –0.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The decrease of 0.1% compared with the previous month can be explained by several factors including falling prices for international package holidays and hotel accommodation. The prices...

Read More » SNB & CHF

SNB & CHF