Changes due to entry into force of FinSA/FinIA andadjustments to minimum reserve requirements The Swiss National Bank is amending the National Bank Ordinance (NBO). Various terms used in the NBO will be revised in connection with the entry into force of the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA) as of 1 January 2020. Moreover, technical adjustments will be made to the statistical surveys in the Annex to the NBO. And finally, two...

Read More »Swiss foreign work permit quotas maintained for 2020

Every year, Switzerland sets quotas for the number of work visas it issues to citizens outside the EU and EFTA. This week the government announced it would maintain the quota of 8,500 permits that was in place in 2018. In addition, it confirmed an earlier deal it struck with the UK to issue up to 3,500 work visas to British citizens in the event of a no-deal Brexit. The 8,500 quota is made up of 4,500 B-permits for stays over one year, and 4,000 short-term L-permits...

Read More »Money and Prices Are a Dynamic System, Report 1 Dec

The basic idea behind the Quantity Theory of Money could be stated as: too much money supply is chasing too little goods supply, so prices rise. We have debunked this from several angles. For example, we can use a technique that every first year student in physics is expected to know. Dimensional analysis looks at the units on both sides of an equation. Money supply is a quantity, a stocks, i.e. dollars or tons in the gold standard. Goods supply is a quantity per...

Read More »FX Daily, December 2: PMIs Provide Latest Fuel for Equity Markets

Swiss Franc The Euro has fallen by 0.10% to 1.0999 EUR/CHF and USD/CHF, December 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Mostly better than expected manufacturing PMI readings for December, including in China, is providing the latest incentive for equity market bulls. Led by the Nikkei, which was aided by a weaker yen major equity markets in Asia Pacific rallied and recouped most of the nearly 1% loss...

Read More »Swiss Retail Sales, October 2019: +0.1 percent Nominal and +0.9 percent Real

02.12.2019 – Turnover adjusted for sales days and holidays rose in the retail sector by 0.1% in nominal terms in October 2019 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.9% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 0.7% in October 2019 compared with the previous year. Real growth takes...

Read More »EM Preview for the Week Ahead

Over the weekend, China reported stronger than expected November PMI readings while Korea reported weaker than expected November trade data. While the China data is welcome, we put more weight on Korea trade numbers, which typically serve as a good bellwether for the entire region. Press reports suggest the Phase One trade deal has stalled due to Hong Kong legislation passed by the US Congress. Until a deal is wrapped up, we remain cautious on EM. AMERICAS Chile...

Read More »Could America Survive a Truth Commission?

A nation that’s no longer capable of naming names and reporting what actually happened richly deserves an economic and political collapse to match its moral collapse. You’ve probably heard of the Truth Commissions held in disastrously corrupt and oppressive regimes after the sociopath/kleptocrat Oligarchs are deposed. The goal is not revenge, as well-deserved as that might be; the goal is national reconciliation via the only possible path to healing: name names and...

Read More »Switzerland’s dark business with Ukrainian coal

A miner in the Lutugina coal mine near the city of Torez in the Donetsk region of Ukraine, August 2019 Pro-Russian separatists are financing their war in Ukraine with coal deliveries to the West. Now the role of Swiss companies in Zug and Geneva is being investigated, according to a reportexternal link in the SonntagsZeitung. Fontus AGexternal link describes itself on its website as a “reliable and responsible supplier of high-grade solid fuels”, selling “coal of...

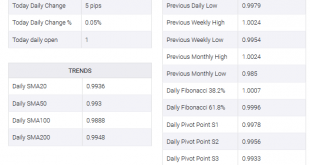

Read More »USD/CHF ignores doubts over phase-one deal, stays around two-month high

USD/CHF focuses more on China’s official PMI-led optimism that the US-China tussle. A few second-tier Swiss data can offer intermediate moves ahead of the US statistics. Trade/political news will continue driving the markets in the case of strong headlines. Technical Analysis October month high near 1.0030 can become immediate resistance ahead of May-end tops surrounding 1.0100. Alternatively, sellers will look for entry below November 08 high near 0.9980....

Read More »Eastern European Nations Buy and Repatriate Gold Due To Growing Risks To Euro and Dollar

◆ Prudent leaders in Eastern European countries are repatriating their national gold reserves and diversifying into gold due to geopolitical risks and monetary risks posed to the dollar, euro and pound ◆ Slovakia has joined China, Russia and a host of countries buying gold or seeking to repatriate their gold from the Bank of England and the New York Federal Reserve ◆ “Brexit and the risk of a global economic crisis put Slovak gold stored in Britain in a dangerous...

Read More » SNB & CHF

SNB & CHF