For now, Italy has avoided Brussels' Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends from state-owned companies). Furthermore, public spending will be lower than projected this year due to a lower-than-expected take-up of the government’s ‘citizenship income’ and early retirement scheme. The 2019 structural deficit will improve by 0.3pp of GDP (including one-offs), instead of deteriorating by 0.2pp as originally agreed with the

Topics:

Nadia Gharbi considers the following as important: euro area, Italy, italy budget, italy fiscal plans, Macroview

This could be interesting, too:

Marc Chandler writes The Greenback is in Narrow Ranges to Start the Week

Marc Chandler writes Sharp Fall in US Yields ahead of Large Supply

Marc Chandler writes The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Marc Chandler writes Fitch Roils Markets

For now, Italy has avoided Brussels' Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.

In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends from state-owned companies). Furthermore, public spending will be lower than projected this year due to a lower-than-expected take-up of the government’s ‘citizenship income’ and early retirement scheme. The 2019 structural deficit will improve by 0.3pp of GDP (including one-offs), instead of deteriorating by 0.2pp as originally agreed with the European Commission (EC) in December.

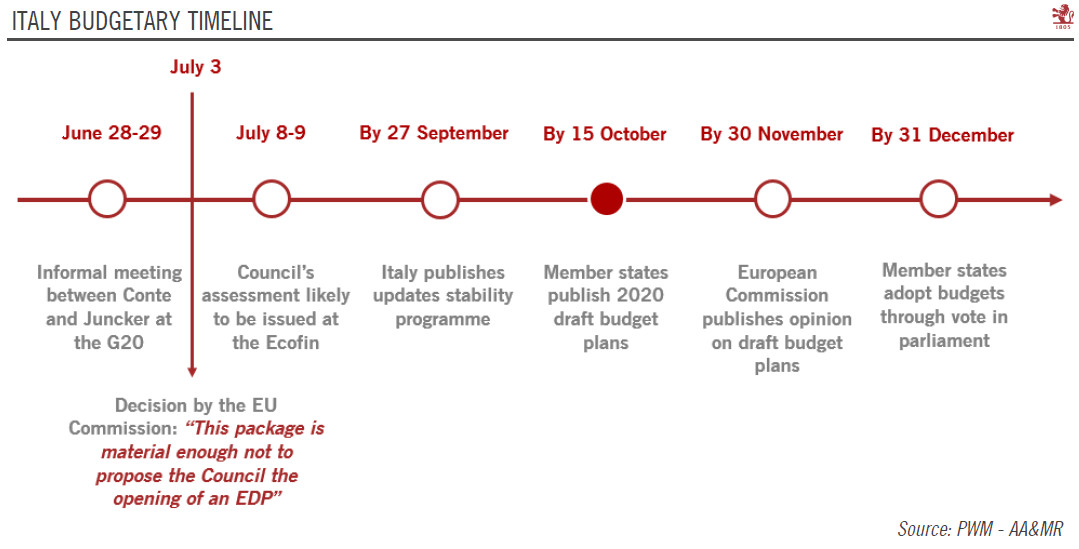

This was enough for the EC not to propose to the Council the opening of an Excessive Deficit Procedure (EDP) for Italy. On 3 July, the EC concluded that launching a debt-based EDP against Italy was not warranted at this stage.

Nevertheless, the threat of an EDP will remain, and the European Commission will closely monitor Italy’s budgetary execution in the second half of this year as well as the2020 draft budget in autumn.

Mario Draghi’s increasingly dovish tone, the prospect of more stimulus from the ECB and Italian officials’ somewhat softening tone have helped to alleviate pressure on BTP yields. All in all, the release of market pressure may alleviate the cost of the Italian government’s confrontational style when its 2020 budget plans come under review in autumn. However, The shaky coalition have insisted that they will not push through VAT hikes slated for 2020. It is hard to see how further tensions with Brussels can be avoided in this case, especially as the League has also been touting tax cuts of at least EUR10bn. Overall, the risk is that Rome uses the current low yield environment to push though significant fiscal stimulus that fails to boost trend economic growth.

Our view regarding the Italian economy remains unchanged. We expect GDP growth of 0.3% in 2019, with risks tilted to the downside.