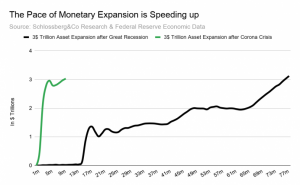

Thanks to central banks’ easy money policies, historically low interest rates and a desperate search for yield have created new danger zones for investors trying to stay out of trouble.

Original Article: “Thanks to Central Banks, the Old Investment Rules Don’t Apply Anymore”

Sixty percent equities, 40 percent bonds. What has been considered the golden rule of portfolio theory for decades is of less and less value to investors today. Because central banks have backstopped almost every market, essentially mimicking the market maker of last and first resort, returns have been low, correlations have increased, and valuations are deprived of their meaning.

To act as the ultimate market maker as such, central banks have been leveraging up their balance sheets. They