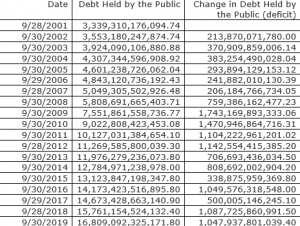

Recently, the Treasury Department reported a 26% increase in the federal budget deficit with a 2019 deficit of $984 billion. The reported data on the budget can be misleading. You might think that a budget deficit is the amount of spending that exceeds budget revenue, in other words, the amount of borrowing needed to make up for this shortfall. However, in the world of Washington D.C., not all spending is counted as spending and it’s possible for the government to borrow money from itself. Let’s look at the actual Treasury Department budget numbers.

The Treasury reports the Total Public Debt Outstanding of almost $23 trillion, which is the sum of the Intragovernmental Holdings and the Debt Held by the Public.

There is roughly $6 trillion of Intragovernmental

Read More »