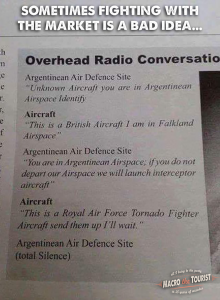

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to stick with me, as the fate of the curve might end up being central to the next financial crisis. Yield curve talk is usually only exciting to propeller twirling bond geeks, yet there well might come a day when the 2-30 year Treasury yield spread is plastered across the front page of USA Today.

And it’s not

Articles by Kevin Muir

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

June 16, 2017Authored by Kevin Muir via The Macro Tourist blog,

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side, and then abandon the trade right before it goes parabolic.

– Click to enlarge

But when I examine the current environment, I worry the credit expansion wave that has been dragging stocks higher is about to crest. Before I go into my reasons for switching sides, let’s take a