The ECB decided to extend its QE programme beyond March 2017 at a slower pace of EUR60 bn, until December 2017, or beyondThe ECB made the following announcements at its 8 December meeting:• QE extension: asset purchases will be continued for an extra nine months, at a pace of EUR60 bn month from April to December 2017 (or beyond, if necessary), with an option to increase the size and/or duration of purchases if “the outlook becomes less favourable or if financial conditions become inconsistent with further progress towards a sustained adjustment of the path of inflation”;• QE parameters: purchases below the ECB’s deposit rate will be allowed “to the extent necessary” for securities with a maturity of at least one year (instead of 2 years), starting in January 2017; and• Securities lending facilities: changes to include the use of cash as collateral and new pricing reducing pressure on short-term rates.• Meanwhile the ECB staff forecasts for inflation were revised slightly downwards for 2017-2018, and the new projections show inflation averaging 1.7% (only) by the end of the forecast horizon in 2019.Although we made the fundamental case for a slower pace of asset purchases in our preview, this came as a surprise to us and our first impression is that it could prove to be a risky move.

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB decided to extend its QE programme beyond March 2017 at a slower pace of EUR60 bn, until December 2017, or beyond

The ECB made the following announcements at its 8 December meeting:

• QE extension: asset purchases will be continued for an extra nine months, at a pace of EUR60 bn month from April to December 2017 (or beyond, if necessary), with an option to increase the size and/or duration of purchases if “the outlook becomes less favourable or if financial conditions become inconsistent with further progress towards a sustained adjustment of the path of inflation”;

• QE parameters: purchases below the ECB’s deposit rate will be allowed “to the extent necessary” for securities with a maturity of at least one year (instead of 2 years), starting in January 2017; and

• Securities lending facilities: changes to include the use of cash as collateral and new pricing reducing pressure on short-term rates.

• Meanwhile the ECB staff forecasts for inflation were revised slightly downwards for 2017-2018, and the new projections show inflation averaging 1.7% (only) by the end of the forecast horizon in 2019.

Although we made the fundamental case for a slower pace of asset purchases in our preview, this came as a surprise to us and our first impression is that it could prove to be a risky move. True, the stock of additional purchases (9 months at EUR60bn, or EUR540 bn) exceeded our expectation (6 months at EUR80 bn, or EUR480 bn). Moreover, the decision to scale down asset purchases is not proper tapering in the sense that the ECB’s commitment is asymmetric, only signalling a possible increase in QE from here, while the programme could still be perceived as open-ended, or “state-contingent” according to Mario Draghi. Tapering in the sense of a reduction of asset purchases to zero was not discussed and is “no in sight”, Draghi said.

The main risk, in our view, is that the ECB is forced to buy for much longer. We believe that the ECB will eventually extend QE well into 2018, only reducing the pace of its monthly asset purchases below EUR60 bn if and when core inflation rises above 1.2-1.3% on a sustained basis. Our forecasts suggest that this is unlikely to happen before early 2018.

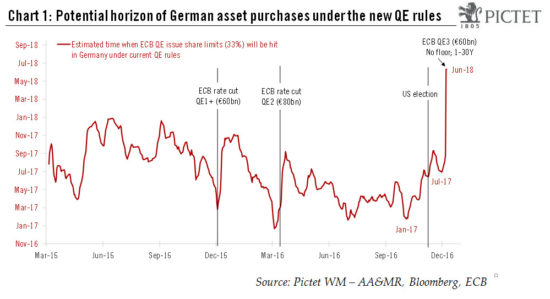

For now, we estimate that the removal of the yield floor and the extension of the eligible maturity spectrum to 1-30 years will allow the ECB to extend its asset purchases at a EUR60 bn current pace until Q2 2018, if needed, before limits on German bonds are hit. The time extension could be shorter in practice given that purchases below the deposit rate are only “an option”.

If our estimates are correct, then the ECB could be forced to ease QE’s parameters again before it extends asset purchases into 2018. If, on the contrary, core bond yields rise further, then the pressure to tweak the parameters further will be reduced.