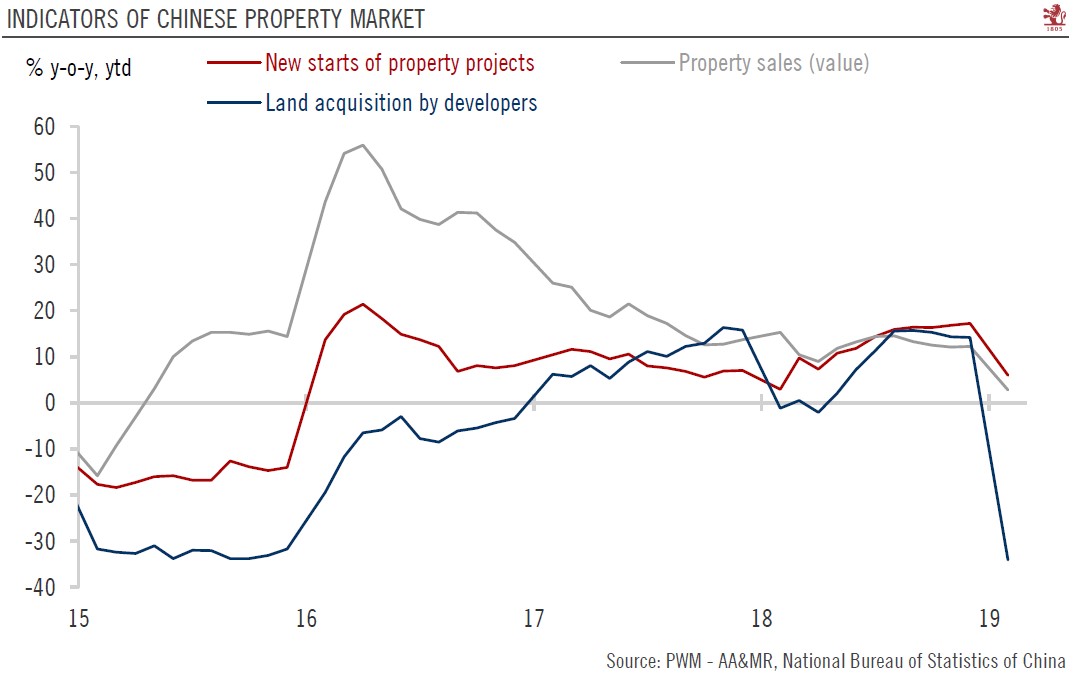

China’s growth momentum is likely to continue to decelerate before staging a modest rebound in the second half of this year.The latest economic indicators show that Chinese growth momentum remained soft in January and February, consistent with our expectations.Industrial activity was especially weak, weighed down by the mining and utility sectors. Growth in fixed asset investment improved slightly, mainly driven by the acceleration in property investment, but investment in the manufacturing sector declined. However, the strength in property investment is unlikely to be sustained. A broad range of leading indicators suggest that property construction may slow down in the coming months (see chart). At the same time, retail sales growth remains sluggish, indicating soft momentum in the

Topics:

Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

China’s growth momentum is likely to continue to decelerate before staging a modest rebound in the second half of this year.

The latest economic indicators show that Chinese growth momentum remained soft in January and February, consistent with our expectations.

Industrial activity was especially weak, weighed down by the mining and utility sectors. Growth in fixed asset investment improved slightly, mainly driven by the acceleration in property investment, but investment in the manufacturing sector declined. However, the strength in property investment is unlikely to be sustained. A broad range of leading indicators suggest that property construction may slow down in the coming months (see chart). At the same time, retail sales growth remains sluggish, indicating soft momentum in the consumer sector as well.

All in all, the latest round of macro data out of China generally point to continued slowdown in the economy. Despite the monetary easing started last year, there is no sign the economy is turning around yet. During the People’s National Congress meetings this month, the Chinese government announced a set of new measures to stimulate the economy, mainly on the fiscal front (cuts in value-added taxes and increase in issuance of local government bonds, for example). In our view, these policies are a step in the right direction.

However, given that the tax cuts will only start to be implemented in Q2 and given the usual time lag between policy and change in growth momentum, we expect China’s growth momentum to continue to decelerate before stabilising around the middle of the year and staging a modest rebound in H2.