Swiss Franc The Euro has fallen by 0.27% to 1.0881 EUR/CHF and USD/CHF, October 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe’s Dow Jones Stoxx 600 turned...

Read More »FX Daily, October 3: Shades of Q4 18?

Swiss Franc The Euro has risen by 0.34% to 1.0959 EUR/CHF and USD/CHF, October 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Disappointing economic data again drove US equities lower, which in turn carried into Asia Pacific activity. Losses were recorded throughout the region, with the notable exception of Hong Kong. The Nikkei and Australia’s ASX were off by 2%. After its largest losing session of the year...

Read More »FX Daily, September 26: Greenback Remains Firm

Swiss Franc The Euro has risen by 0.15% to 1.0866 EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A compelling narrative for yesterday’s disparate price action is lacking. A flight to safety, which is a leading interpretation, does not explain the weakness in the yen, gold, or US Treasuries. Month- and quarter-end portfolio and hedge adjustments may be at work, but the risk is...

Read More »FX Daily, September 25: Risk Appetite Stymied: Dollar Recovers while Stocks Slide

Swiss Franc The Euro has fallen by 0.13% to 1.0842 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities and fixed income reacted to the large moves yesterday in the US when the 10-year note yield fell eight basis points, and the S&P 500 fell by 0.85%. Investors have focused on three separate developments and two of which came from President Trump’s speech at the...

Read More »Waiting on the Calvary

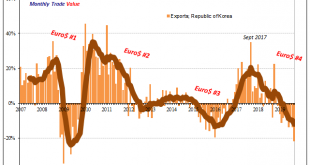

Engaged in one of those protectionist trade spats people have been talking about, the flow of goods between South Korea and Japan has been choked off. The specific national reasons for the dispute are immaterial. As trade falls off everywhere, countries are increasingly looking to protect their own. Nothing new, this is a feature of when prolonged stagnation turns to outright contraction. While the dispute with Japan hasn’t helped, it isn’t responsible for the level...

Read More »FX Daily, September 24: UK Supreme Court Deals another Defeat to Johnson

Swiss Franc The Euro has fallen by 0.03% to 1.0874 EUR/CHF and USD/CHF, September 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A fragile calm hangs over the capital markets today. Equities in Asia Pacific were narrowly mixed. Japan, China, and HK advanced. India saw some profit-taking after a two-day surge in response to the unexpected corporate tax cuts but recovered in late dealings. European shares are...

Read More »FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.19% to 1.0932 EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are digesting ECB’s actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July...

Read More »FX Weekly Preview: Talking and Fighting in the Week Ahead

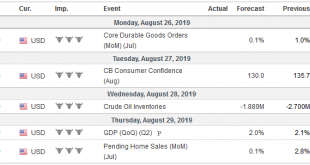

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

Read More »FX Daily, August 26: Trump’s “Call from China” helps Markets Recover

Swiss Franc The Euro has risen by 0.11% to 1.0873 EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The anticipated growth implications of the heightened tensions between the world’s two largest economies is dominating activity at the start of the new week. These considerations that drove the 2.6% drop in the S&P 500 before the weekend is carrying over into today’s...

Read More »FX Weekly Preview: The Week Ahead is not about the Week Ahead

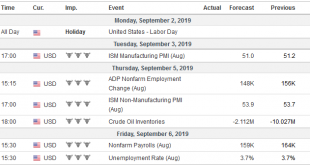

It’s the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China’s PMI, and the eurozone’s preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast. They are looking further afield. The next US tax increase on Chinese imports goes into effect on September 1, and Beijing has threatened to retaliate. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org