Sometimes the news drives the markets and but now it seems that the markets are driving the news. The dramatic swing in market sentiment from fearing a repeat of Q4 18 and the pessimism of World Bank/IMF forecasts have been cast aside for a few data points and a tease from the world’s two largest economies that an agreement to begin a de-escalation process not just extending the third tariff truce. The Federal Reserve, the European Central Bank, the People’s Bank of...

Read More »FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

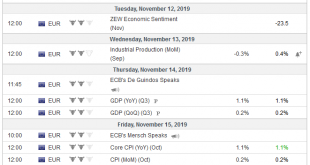

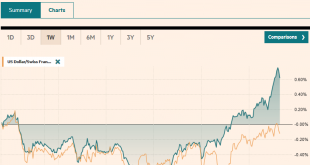

Swiss Franc The Euro has fallen by 0.06% to 1.0987 EUR/CHF and USD/CHF, November 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week’s gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index...

Read More »FX Daily, November 7: Trade Optimism Boosts Sentiment but Weighs on the Dollar

Swiss Franc The Euro has risen by 0.08% to 1.0992 EUR/CHF and USD/CHF, November 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Indications that a phase one agreement between the US and China would include rolling back some existing tariffs is boosting risking appetites, sending stocks higher, and pushing up yields. However, this appears to be simply a restating of China’s views rather than a new breakthrough....

Read More »FX Daily, October 16: Fickle Market Tempers Enthusiasm

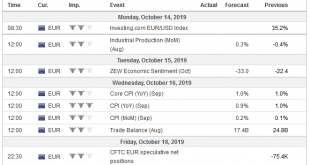

Swiss Franc The Euro has fallen by 0.06% to 1.1006 EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Fading hopes that a Brexit agreement can be struck is seeing sterling trade broadly lower, while China’s demand that US tariffs be rescinded in exchange for a commitment to buy $40-$50 bln of US agriculture goods over two years, makes the handshake agreement less secure. At the same...

Read More »FX Daily, October 14: Optimism Took the Weekend Off

Swiss Franc The Euro has fallen by 0.16% to 1.0979 EUR/CHF and USD/CHF, October 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Japanese and Canadian markets are on holiday today. While the US bond market is closed, equities maintain their regular hours today. Asia Pacific equities rallied, led by 1% of more gains in China, Taiwan, South Korea, and Thailand. The buying did not continue in Europe, and after a...

Read More »FX Weekly Preview: Same Three Drivers in the Week Ahead but Changing Tones

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little. It begins with the most substantive progress on Brexit in months, but also entails a possible new tariff truce between the US and China. Indeed, we irreverently...

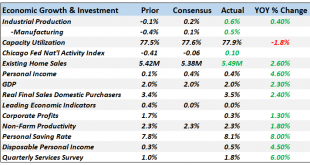

Read More »Monthly Macro Monitor: Doom & Gloom, Good Grief

When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time. That has proven to be valuable advice over the years and I think still relevant today. We continue to hear, on an...

Read More »FX Daily, October 11: Nothing Like Approaching the Edge to Focus the Minds

Swiss Franc The Euro has risen by 0.56% to 1.1031 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the edge of the abyss is approached in three distinct areas, there is hope that victory can be snatched from the jaws of defeat. US-China trade talks continue today, and there is hope of a small deal that could lead to the US not hiking tariffs next week. A shift in the UK toward a...

Read More »FX Daily, October 10: Setback for the Greenback

Swiss Franc The Euro has risen by 0.37% to 1.0962 EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China’s indices, and HK gaining, while most of the...

Read More »FX Daily, October 9: Hope is Trying to Supplant Pessimism Today

Swiss Franc The Euro has risen by 0.35% to 1.0912 EUR/CHF and USD/CHF, October 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 1.5% drop in the S&P 500 and the deterioration of US-China relations and the prospects of a no-deal Brexit failed did not carry over much into today’s activity. Asia Pacific equities were mostly a little lower, though China and India bucked the regional trend, while Korea was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org