Central banks are prepared to take fresh measures to strengthen and extend the business cycle primarily because price pressures are below what their predecessors thought would be acceptable levels. Draghi, speaking for the ECB, the Federal Reserve, and the Bank of Japan ratcheted up their concerns, which, even without new initiatives, were sufficient to drive interest rates lower. Eurozone There is no real definition...

Read More »FX Daily, June 21: Markets Pause Ahead of the Weekend

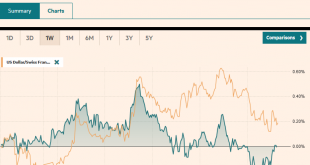

Swiss Franc The Euro has risen by 0.30% at 1.1115 EUR/CHF and USD/CHF, June 21(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are trading quietly ahead of the weekend. Equity markets are mostly narrowly mixed. Chinese shares extended their run, and the major benchmarks were up 4%+ on the week. Japan, Australia, South Korea, and...

Read More »FX Weekly Preview: FOMC, EMU PMI, and Pre-G20 Positioning: Crossroads and Crosswinds

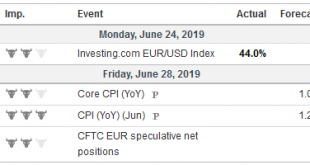

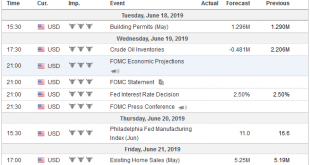

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last...

Read More »FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Swiss Franc The Euro has risen by 0.08% at 1.125 EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng’s nearly 1.9% decline was...

Read More »FX Daily, June 11: Markets Take Another Small Step Away from the Edge

Swiss Franc The Euro has risen by 0.37% at 1.1235 EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities continues today in light news day. Nearly all the bourses in the Asia Pacific region rose, led by a 2.6% gain of the Shanghai Composite. The MSCI Asia Pacific Index rose for a third session. European equity...

Read More »FX Daily, June 05: Dollar Remains on Back Foot

Swiss Franc The Euro has fallen by 0.09% at 1.115 EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve’s patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has...

Read More »FX Daily, June 04: Nervous Calm Settles Over Markets

Swiss Franc The Euro has risen by 0.13% at 1.117 EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between...

Read More »FX Daily, June 03: US Penchant for Tariffs Keeps Investors on Edge

Swiss Franc The Euro has risen by 0.04% at 1.1181 . FX Rates Overview: The weekend failed to break the grip of investor worries that is driving stocks and yields lower. The US Administration’s penchant for tariffs is not simply aimed at China, where there is some sympathy, but the move against Mexico, dropping special privileges for India, and apparently, had considered tariffs on Australia. At the same time, the...

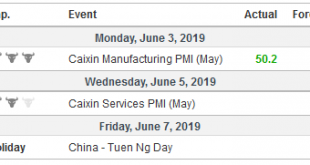

Read More »FX Weekly Preview: Curiouser and Curiouser

The first week of June features the Reserve Bank of Australia meeting, an ECB meeting, and the US employment data. The RBA is expected to deliver its first rate cut in three years. The market appears to have discounted not only a second cut in H2 but has priced nearly half of a third cut as well. A soft inflation reading after the seasonal bump in April and disappointing survey data, with Brexit and trade tensions,...

Read More »FX Daily, May 31: US Struggles to Build Physical Wall, Tries Tariff Wall on Mexico

Swiss Franc The Euro has fallen by 0.01% at 1.1214 EUR/CHF and USD/CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US announcement to lay a 5% tariff on all goods coming from Mexico (starting June 10) until it stops the flow of “illegal migrants” spurred sharp losses in the Mexican peso and general risk-off move that strengthened the yen. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org