Swiss Franc The Euro has risen by 0.14% at 1.1366 EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Amid light news, global equities are moving higher In Asia, the Nikkei rose to a new high since early December, while the Shanghai Composite rose 2.3% and posted its highest close since March 2018. European equities are solid, with...

Read More »FX Daily, April 05: Trade Talk and German Industrial Output Lifts Sentiment

Swiss Franc The Euro has risen by 0.03% at 1.1219 EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German...

Read More »Monthly Macro Chart Review – March

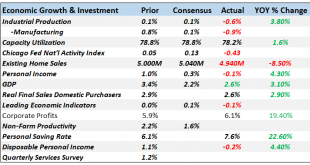

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk. We are still playing catch up on the economic data releases due to the government...

Read More »Arnold Kling’s “Specialization and Trade, A Re-Introduction to Economics”

Arnold Kling (2016), Specialization and Trade, A Re-Introduction to Economics, Washington, DC, Cato Institute. Kling’s central theme in this short book of nine main chapters is that specialization, trade, and the coordination of individual plans by means of the price system and the profit motive play fundamental roles in modern economies. Most mainstream economists would agree with this assessment. Their models of trade, growth, and innovation certainly include the four elements, with...

Read More »“Specialization and Trade, A Re-Introduction to Economics”

Arnold Kling (2016), Specialization and Trade, A Re-Introduction to Economics, Washington, DC, Cato Institute. Kling’s central theme in this short book of nine main chapters is that specialization, trade, and the coordination of individual plans by means of the price system and the profit motive play fundamental roles in modern economies. Most mainstream economists would agree with this assessment. Their models of trade, growth, and innovation certainly include the four elements, with...

Read More »FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive. United States The US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker,...

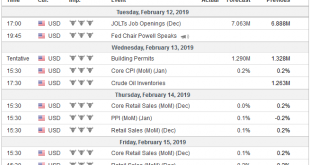

Read More »FX Weekly Preview: Little Resolution in the Week Ahead

According to legend, the person who unraveled the Gordian Knot would rule the world. No one succeeded until Alexandar the Great took his mighty sword and sliced the knot in half. A young boy saw him afterward, crying on the steps of the Temple of Apollo. “Why are you crying?” the boy asked, “you just conquered the world. “Yes'” Alexander wept, ” now there is nothing else for me to do.” Investors are not as cursed as...

Read More »Two Brinkmanship Games and a Possible Third

Some historians give Adlai Stevenson credit for inventing the word “brinkmanship” as part of his criticism of US foreign policy under Dulles, who said that “if you are scared of going to the brink, you lost.” But surely we can agree that the tactic is as old as civilization. The idea is you take the issue to the very edge, risking a significant confrontation, to force a deal, is the way it may seem. The Cuban Missile...

Read More »FX Weekly Preview: Divergence Reinvigorated

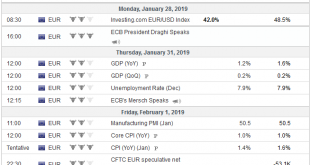

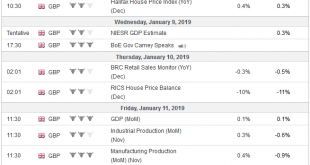

Eurozone Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling’s gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December. Speculation that the Reserve Bank of Australia would be forced to cut interest rates saw the Australian dollar punch through $0.7100. For its part, the yen was...

Read More »FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision. Yet far from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org