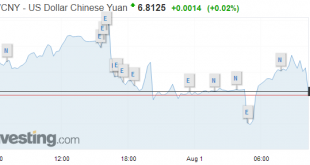

Swiss Franc The Euro has fallen by 0.19% to 1.1503 CHF. EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading at the upper end of its recent ranges against the euro and sterling. The euro finished below $1.16 yesterday for the first time since the end of June and has not been able to resurface that level so far today. We...

Read More »Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China’s practices are a source of frustration and animosity broadly and widely. Chinese officials do not seem to understand why Europe, for example, does not...

Read More »FX Weekly Preview: For the Millionth Time: Investors Exaggerate Trade Tensions at Their Own Peril

You would never have guessed it reading many of the op-eds and pundits pronouncing the end to globalization or the West, or liberalism. Global equities have rallied. Of course, stock prices are not the end all and be all, but it stands in stark contrast to the cries that the sky is falling. The MSCI World Index of developed markets advanced for the second consecutive week adding 2.2%. The US S&P 500 moved above...

Read More »FX Daily, July 11: Escalating Trade Tensions Set Tone for Capital Markets

Swiss Franc The Euro has fallen by 0.06% to 1.1639 CHF. EUR/CHF and USD/CHF, July 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US took the first step in making good its threat to put a 10% tariff on $200 bln of Chinese goods in response to the PRC retaliating for the 25% tariff on $34 bln of its exports. The US provided a list of products that will get the new...

Read More »FX Weekly Preview: Trade and Data Driving Markets

US President Trump is intent on disrupting the post-WWII arrangement that prioritized and ideological conflict over economic rivalries. Last week, it was reported that Trump told his counterparts at the G7 summit that NATO was as bad as NAFTA. NATO’s annual meeting is July 12. Trump seeks a realignment of alliances and appears to prefer the illiberal forces that arisen in recent years. The US Ambassador to Germany was...

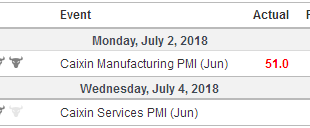

Read More »Bi-Weekly Economic Review:

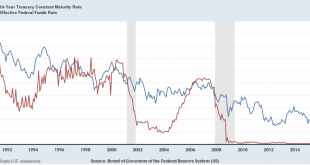

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility. There has been for some time now a large short position held by speculators in the futures market for Treasuries. Speculators have been making large and consistent bets that Treasury prices would fall....

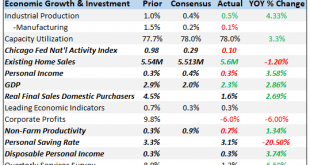

Read More »Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

Read More »FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

Swiss Franc The Euro rise by 0.38% to 1.1479 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday’s lows. While the...

Read More »Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy. As I said last month, despite the recent run up in rates, the...

Read More »FX Daily, April 06: Trade Trumps Jobs

Swiss Franc The Euro has fallen by 0.08% to 1.1779 CHF. EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Trade and equity market volatility, which are not completely separate, continue to dominate investors’ interest. Many had come around to accept that while trade tensions were running high, it was likely to be mostly posturing. This...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org