People do not just disagree on what should and will happen, but they disagree on what has happened. As William Faulkner instructed: “The past is not dead. Actually, it’s not even past. This is clear in the narratives about the sharp drop in equity markets. It seems that the most common explanation places the onus on the Federal Reserve. Fed Chair Powell’s was seemingly hawkishness in early October (during a time when...

Read More »FX Weekly Preview: FOMC Dominates Week Ahead Calendar

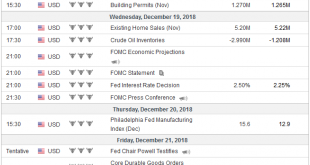

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise. The famous dot plot of the Summary of Economic Projections has long shown that...

Read More »Cool Video: Santa Claus Rally and Trade

I was on Fox Business today. Stuart Varney introduced me by asking me about my forecast for a Santa Claus rally–a year-end recovery in equities. From a technical perspective, I liked the fact that the S&P 500 successfully retested last month’s lows last week. I liked that the price action made last Friday’s price action into an island bottom, with a gap lower opening followed by Monday’s gap higher opening. In terms...

Read More »FX Weekly Preview: Unfinished Business

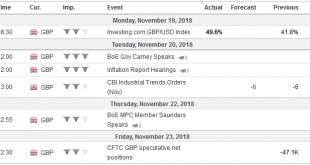

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but “what we know that just ain’t so.” Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC’s efforts to enforce the agreed-upon...

Read More »FX Weekly Preview: Stocks, Trade, and the Fed in the Week Ahead

Last month’s downdraft in equities spooked investors. The fear that is often expressed is that the end of the business cycle may coincide with the end of a credit cycle and a return to 2008-2009 crisis. It seems like an increasing number of economists agree with the sentiment expressed by President Trump that the Fed is too aggressive. Of course, they do not think the president should comment on Fed policy, but they...

Read More »FX Daily, October 05: US Jobs Data will Test Dollar Bulls and Bond Bears

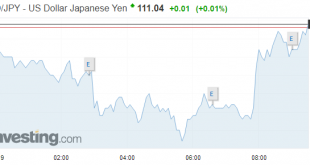

Swiss Franc The Euro has risen by 0.11% at 1.1429 EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firmer against most of the major and emerging market currencies. The yen and sterling are resisting the pressure, while the South African rand and Russian rouble are paring some of this week’s declines. US equity losses...

Read More »Three Things that may Disappoint Investors

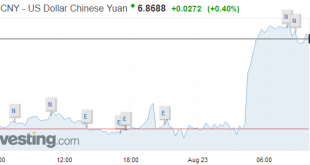

There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday. With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada. It is not clear what a “handshake agreement” really...

Read More »Monthly Macro Monitor – August 2018

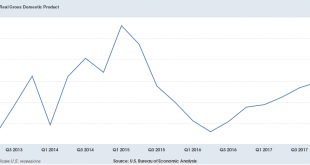

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%). The US economy is definitely accelerating out of the 2016 slowdown. The...

Read More »US-Japan Trade Talks

The withdrawal of the US from the Trans-Pacific Partnership trade agreement lift it exposed on two fronts. First, the TPP was going to modernize the NAFTA. Without, the US remains locked in protracted negotiations. A breakthrough in talks with Mexico has been reportedly imminent for weeks. Talks with Canada have apparently not progressed very far in recently, and the US insistence on a sunset clause remains a...

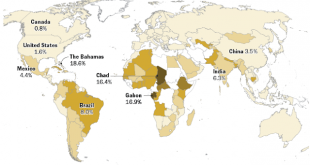

Read More »Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought. It has become fashionable to talk about reciprocity and intuitively has much...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org