At that point, the only way to enable debt-serfs to service their debts is too give them free money, i.e. Universal Basic Income (UBI). Scrape away the churn and distraction and the problem is simple: the pie of prosperity is shrinking, and the “fixes” are failing. The status quo arrangement is based on the endless expansion of “growth” and debt, which is the monetary fuel of more, more, more of everything: money,...

Read More »The Source of Killer Inflation: Services

The soaring cost of services is driven by a number of factors. What will the future bring: fire (inflation) or ice (deflation)? The short answer: both, but in very different doses. Goods that are tradeable and exposed to technologically driven commodification will decline in price (deflation) while untradeable services that are difficult to commoditize will increase in price (inflation), generating a self-reinforcing...

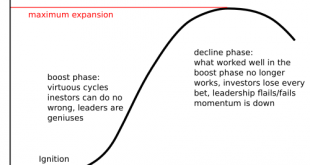

Read More »What If Politics Can’t Fix What’s Broken?

This is the politics of decline and collapse. The unspoken assumption of the modern era is that politics can fix whatever is broken: whatever is broken in society or the economy can be fixed by some political policy or political process– becoming more inclusionary, seeking non-partisan middle ground, etc. What if this assumption is flat-out wrong? What is politics is incapable of fixing what’s broken? What if politics...

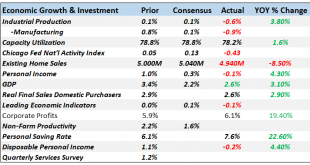

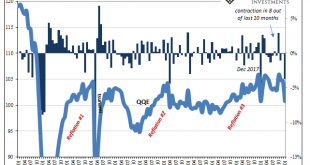

Read More »Monthly Macro Chart Review – March

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk. We are still playing catch up on the economic data releases due to the government...

Read More »Labor Shortage America has been Canceled

The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage. It was so ubiquitous, this economic boom idea, the media created several spinoffs. The...

Read More »The Fed’s “Wealth Effect” Has Enriched the Haves at the Expense of the Young

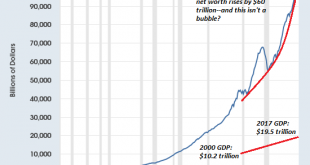

The Fed is the mortal enemy of the young generations, and thus of the nation itself. “The wealth effect” generated by rising stock and housing prices has long been a core goal of the Federal Reserve and other central banks. As Lance Roberts noted in his recent commentary So, The Fed Doesn’t Target The Market, Eh?(Zero Hedge), Ben Bernanke added a “third mandate” to the Fed – the creation of the “wealth effect”–in 2010,...

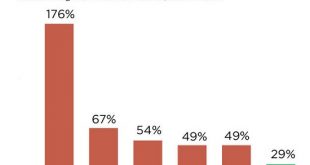

Read More »What Killed the Middle Class?

Rounding up the usual suspects won’t restore a vibrant middle class. What killed the middle class? The answer may well echo an Agatha Christie mystery: rather than there being one guilty party, it may be that each of the suspects participated in the demise of the middle class. If you doubt the middle class has expired, please consider the evidence: The Middle Class Is Shrinking Everywhere — In Chicago It’s Almost Gone...

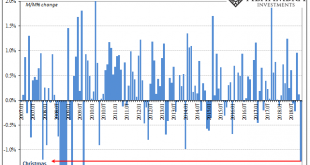

Read More »Meanwhile, Over In Asia

While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something. Therefore, Q4 US GDP wasn’t as bad as feared, cushioning...

Read More »The Doomsday Scenario for the Stock and Housing Bubbles

It was always folly to believe that inflating asset bubbles could solve the structural problems of a post-industrial economy. The Doomsday Scenario for the stock and housing bubbles is simple: the Fed’s magic fails. When dropping interest rates to zero and flooding the financial sector with loose money fail to ignite the economy and reflate the deflating bubbles, punters will realize the Fed’s magic only worked the...

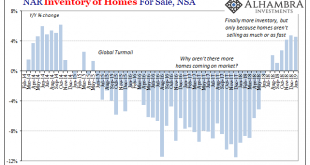

Read More »The Fate of Real Estate

For years, realtors have been waiting for more housing inventory. It had become an article of faith, what was restraining a full-blown recovery was the lack of units available. The level of resales like construction was up, but still way, way less than it was now fourteen years past the prior peak despite sufficient population growth to have absorbed the previous bubble’s overbuilding. All the way back in March 2017,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org