Unless the Fed is going to start buying millions of homes outright, prices are going to fall to what buyers can afford. There are two generalities that can be applied to all asset bubbles: 1. Bubbles inflate for longer and reach higher levels than most pre-bubble analysts expected 2. All bubbles burst, despite mantra-like claims that “this time it’s different” The bubble burst tends to follow a symmetrical reversal of...

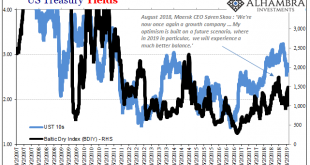

Read More »Sinking Shippers Signal Global Goods Troubles

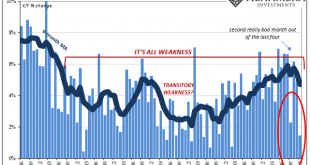

It infects every boardroom across the world. Big business requires decent forecasting, yet time and again it seems they are deprived of what they desperately need. Instead, even after this last decade, the world’s largest companies continue to be surprised by weakness that is far more prevalent than strength. It has been the one constant. Central bankers declare their policies successful, ignoring mountains of...

Read More »Homeless Encampments and Luxury Apartments: Our Long Strange Boom

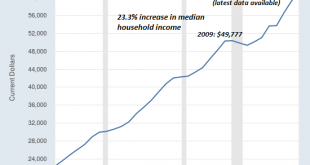

The cold truth is homelessness and soaring rents are the only possible outputs of central bank policies that inflate asset bubbles. It’s been a long, strange economic boom since the nadir of the Global Financial Meltdown in 2009. A 10-year long boom that saw the S&P 500 rise from 666 in early 2009 to 2,780 and GDP rise by 43% has been slightly more uneven for most participants. First and most importantly, household...

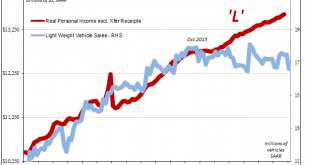

Read More »Getting Back Up To Speed On Loss Of Speed in US Economy

For much of 2018, the idea of “overseas turmoil” lived up to its name. At least in economic terms. Market-wise, there was a lot domestically to draw anyone’s honest attention. Warnings were everywhere by the end of the year. And that was what has been at issue. Some said Europe and China are on their own, the US is cocooned in a tax cut-fueled boom. Decoupling, only now the other way around. The Bureau of Economic...

Read More »Credit Exhaustion Is Global

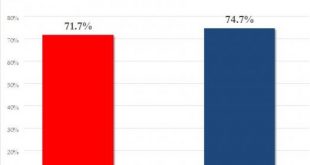

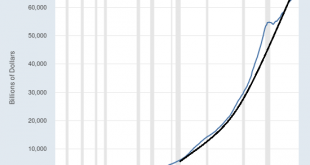

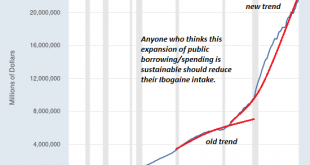

Europe is awash in credit exhaustion, and so is China. The signs are everywhere: credit exhaustion is global, and that means the global growth story is over: revenues and profits are all sliding as lending dries up and defaults pile up. What is credit exhaustion? Qualified buyers don’t want to borrow more, leaving only the unqualified or speculators seeking to save a marginal bet gone bad with one more loan (which will...

Read More »Retail Sales Landmine

Ignore Black Friday and Cyber Monday. Those are merely an appetizer, an intentional preamble to whet the appetite of hungry consumers looking to splurge. The real action comes in December. People look, some buy, after Thanksgiving, but as anyone counts down the actual twelve days of Christmas and celebrates the eight crazy nights of Hanukkah that’s when the retail industry makes its bank. In 2016, the month of December...

Read More »What Happens When More QE Fails to Reverse the Recession?

The smart money is liquidating assets, paying off debt and moving capital into collateral that isn’t impaired by debt or speculative valuations. The Federal Reserve’s sudden return to “accommodative” dovishness in response to the stock market’s swoon telegraphs its intent to fire up QE once the recession kicks into gear. QE (quantitative easing) are monetary policies designed to ease borrowing and the issuance of...

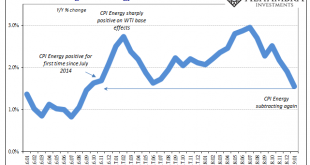

Read More »Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria. CPI Changes On Energy 2016-2019 - Click to enlarge Live by oil, now die by...

Read More »What Caused the Recession of 2019-2021?

The banquet of consequences is now being served, but the good seats have all been taken. As I discussed in We’re Overdue for a Sell-Everything/No-Fed-Rescue Recession, recessions have a proximate cause and a structural cause. The proximate cause is often a spike in energy costs (1973, 1990) or a financial crisis triggered by excesses of speculation and debt (2000 and 2008) or inflation (1980). Structural causes are...

Read More »The Corporate Lemmings Who Rushed into Mobile/Social Media Ads Are Running off the Cliff

Now the corporate lemmings have rushed into mobile advertising. Given that corporations are run by people, and people are social animals that run in herds, it shouldn’t surprise us that corporations follow the herd, too. Take the herd move to forming conglomerates in the go-go late 1960s: corporations suddenly started buying companies in completely different sectors in businesses they knew nothing about, because...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org