Sterling is hovering around seven cents above last week’s lows as many short-term participants better position themselves for the UK to vote to say in the EU, even though many opinion polls show a statistical dead heat. The German Constitutional Court dismissed claims that the ECB’s Outright Market Transactions does not violate the German Constitution. Italy’s run-off for local elections was held over the past...

Read More »Great Graphic: Age and Brexit

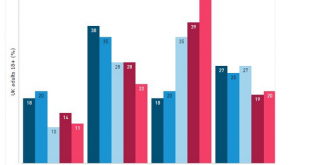

The betting and events markets have shifted more decisively than the polls in favor of the UK to remain in the EU. Sterling extended its rally from $1.4010 last Thursday to nearly $1.4785 today, as the market participants adjust positions. What is particular striking is that the asymmetrical perceptions of the personal impact of a vote to leave the EU. The Great Graphic here was posted on Business Insider,...

Read More »US Election Infographic

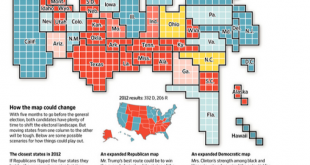

This infographic was in the Wall Street Journal on the US election. It is important to remember that the US does not elect the President by direct popular vote. This makes the national polls a bit misleading. There are 538 electoral college votes. To be elected a candidate must secure a majority or 270 electoral college votes. Obama received 332 elector votes and Romney 206. The WSJ cites four major...

Read More »Science and the Senate

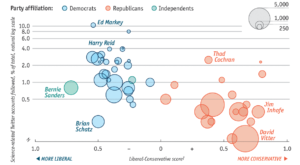

The Economist’s Graphic Detail reports about research documenting that While the Senate’s interest in science is generally quite low, Senate Democrats are three times more likely than Republicans to follow science-related Twitter accounts like NASA or the National Oceanic and Atmospheric Administration. Interest in science, the authors conclude, “may now primarily be a ‘Democrat’ value”.

Read More »Politics and Economics

Many people understand politics and economics to be two different disciplines. I remember in graduate school more than two decades ago, many colleagues and professors operationally defined political economy as how politics, by which they meant the state, screws up economics. I spoke at the Fixed Income Leaders Summit earlier this week and teased that many seemed to think that politics comes from the ancient Greek “poly”...

Read More »Three Political Events before the UK Referendum

“Every thinking person in America is going to vote for you Governor Stevenson,” said an enthusiastic voter.“I am afraid that won’t do. I need a majority,” reportedly quipped Stevenson (1952 or 1956). The UK referendum on June 23 is the most important political event of the first half of the year. A decision to leave could be a significant disruptive force. No one knows for sure. It is precisely that uncertainty that is fueling the demand for insurance in the options market that...

Read More »OPEC’s Game within a Game

The fact OPEC just agreed to agree on nothing in Vienna isn’t particularly surprising given Doha wounds are still festering from the last attempt at ‘petro-diplomacy’. But the engagement ultimately has to been knocked up as a partial success for Saudi Arabia, where it’s managed to put itself back at the centre of cartel politics by thawing the ‘freeze discussion’ on Riyadh’s terms. Confused? Don’t be. As we flagged in OPEC Politics, Doha’s failure left a very dangerous door open for...

Read More »Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has been driving the mainstream macroeconomic debate ever since. The question raised in this debate is how policy-makers can credible commit to promises made today when future events may cause short-term pain if restricted by stringent rules...

Read More »Circulus in probando

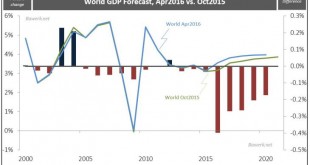

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that...

Read More »OPEC’s Doha Dilemma: 3mb/d US lock in?

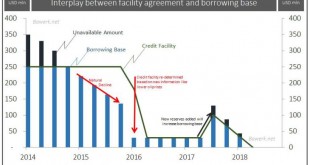

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs. Another month, another flight to Hamad international airport for 17th April after initial agreement to hold ‘upstream horses’ in February 2016. While it’s no doubt great fun getting back...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org