One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia. In...

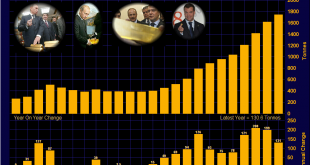

Read More »Neck and Neck: Russian and Chinese Official Gold Reserves

Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those...

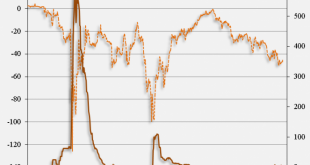

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

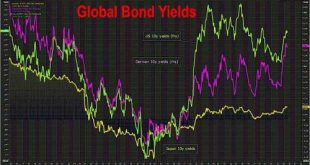

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

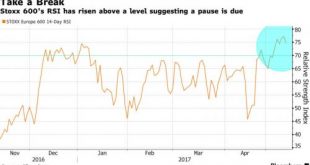

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency. There are, of course, various economic areas where estimates are going to...

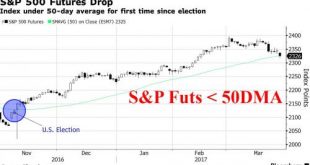

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

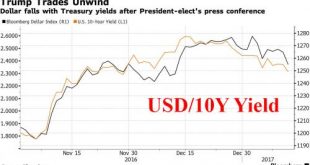

Read More »Dollar, Futures Slump; Gold Spikes Over $1,200 After Trump Disappoints Markets

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org