[This piece is an excerpt from Chapter 13 of The Great Reset and the Struggle for Liberty: Unraveling the Global Agenda, to be released January 10, 2023.] This chapter derisively refers to the notorious Great Leap Forward (1958–1961) as the Great Leap Backward. But China’s Great Leap Forward is not the ultimate object of my scorn. That scorn is reserved for the contemporary project conducted by people, who, if they knew anything about history, or cared about its...

Read More »US Labor Market: Help Wanted!

As we enter the holiday season stock owners have been the big losers of 2022, but jobs are still plentiful and nominal wages are rising rapidly. The Wall Street Journal reports “Stiff Demand Drives Gains in Jobs, Wages” (December 4). Faced with a stagnant stock market, nothing bolsters confidence more than the plethora of job openings, seemingly everywhere, and for all types of jobs. The number of job openings is a statistic worth paying attention to as a gauge of...

Read More »Woodrow Wilson’s Christmas Grift of 1913

We think of thieves as conducting their work when no one is looking, such as breaking into a house while the owners are away. But the most successful thieves have done their stealing in plain sight, on a grand scale, while the owners were home and often with their tacit approval, though with sleights of hand that few are able to detect. Such a theft occurred when Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913. A central bank such as the...

Read More »The Origins of the Federal Reserve

Where did this thing called the Fed come from? Murray Rothbard has the answer here — in phenomenal detail that will make your head spin. In one extended essay, one that reads like a detective story, he has put together the most comprehensive and fascinating account based on a century's accumulation of scholarship. The conclusion is that the Fed did not originate as a policy response to national need. It wasn't erected for any of its stated purposes. It was founded by...

Read More »Reclaiming the Anti-State Roots of Christmas

While Christians the world over look to the celebration as a way to remember the incarnation of Christ, some dismiss it as a Christianized version of the ancient Rome’s Saturnalia. Whatever one’s view happens to be, I humbly suggest that it ought to be used by Christians and non-Christians alike as a reflection upon a collision of two kingdoms and two forms of rule. One that makes the way for life, and the other for misery, suffering, and death. If the celebration of...

Read More »How Christmas Became a Holiday for Children

During the 1980s, millions of American children pored over the Toys 'R' Us catalog, daydreaming about what toys we hoped to receive in a few weeks on Christmas morning. After all, by the mid twentieth century, Christmas—for countless middle-class households with children— had become more or less synonymous with an enormous number of gifts for children in the form of toys and games. Barbie playsets and a myriad of action figures were routinely advertised during...

Read More »How Marxism Abuses Ethics and Science to Deceive Its Followers

In his 1922 book on socialism, Die Gemeinwirtschaft, Ludwig von Mises attributes socialism’s attractiveness to the claim that Marx’s doctrine would be both ethical and scientific. In truth, however, Marxism represents a metaphysical dogma that promises an earthly paradise yet threatens civilization itself. Thesis of the Inevitability of Socialism Marxism explains that immoral capitalist economies will necessarily be replaced by socialist systems that meet higher...

Read More »Budget Deficit Hits Monthly Record Due to Biden’s Policies

America’s “monthly federal deficit hit a record $249 billion in November—$57 billion more than the same month last year—with federal spending also hitting new heights in consecutive months, while tax revenues dropped,” reports the London Daily Mail. The deficit is $57billion higher than it was in November of 2021—which is a record-breaking year-on-year change. Federal spending is up $28billion from last year to $501billion in November 2022, according to the Treasury...

Read More »Money Laundering: Another Noncrime Pursued by Criminal Authorities

Money laundering is illegal in the USA, but like so many other federal crimes, it is difficult to identify and define. That is the perfect recipe for government abuse of innocent people. Original Article: "Money Laundering: Another Noncrime Pursued by Criminal Authorities" This Audio Mises Wire is generously sponsored by Christopher Condon. [embedded content]...

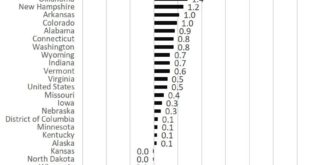

Read More »Since Covid Lockdowns, New York Lost More of Its Population than Any Other State

Florida Governor Ron DeSantis has frequently bragged that Florida is in high demand among people looking to relocate. In a new report released this week from the Census Bureau, it seems that he's been correct. According to the Bureau's report: After decades of rapid population increase, Florida now is the nation’s fastest-growing state for the first time since 1957, according to the U.S. Census Bureau’s Vintage 2022 population estimates released today. Florida's...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org