Swiss Consumer Price Index in April 2016 For the second time in a row prices in Switzerland increased by 0.3% against the previous month. Inflation was -0.4% against last year. Still in 2015 inflation was mostly around -1.5% y/y. Will this rising price tendency continue? It will be surely a problem for the SNB. They might need a stronger franc to keep inflation in check. The Swiss asset price bubble has not found yet its way into higher rents. Switzerland has pretty strict...

Read More »SNB Increased Equities Share from 18 to 20% with Purchases

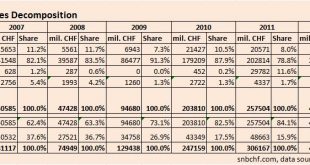

The SNB increased the equities share from 18% to 20% in Q1/2016. Purchases focused on US equities.It raised holdings in U.S. Equities 32 percent in the first Q1 2016, from $41.3 billion at the end of last year. The S&P 500 rose 0.8 percent over that period. This makes obvious that the central bank goes higher risk. The first risk is the risk on equities, the second one is the dollar that is currently quite expensive. Main Positions: Swiss National Bank, 2007-2013 Still in 2009, the...

Read More »Dollar Drivers in the Week Ahead

The key issue facing the foreign exchange market is whether the modicum of strength the US dollar demonstrated last week is the beginning of a sustainable move. It is possible that the market is again at a juncture in which the price action will drive the narrative rather than the other way around. A move above JPY108 and a decline in the euro below $1.1350 signal a start to a broader dollar recovery that may have begun last week with impressive gains against the dollar-bloc. The RBA’s...

Read More »Mind Control as a method to support the US Dollar

There is a paradox of capitalism, we’ve reached a point where those at the top, have an unlimited budget to maintain the status quo, increase their wealth, and develop an ever increasing sophisticated toolbox to manage empire and maintain their dominance. As we explain in Splitting Pennies – this is no where more obvious than Forex. The last 100 years we’ve seen capitalism evolve brightly. Industries that shouldn’t be industries, now employ millions of workers. Paradigm shift,...

Read More »Weekly Speculative Positions: Cutting Longs in Yen and Swiss Franc

Speculators in the futures market continued to pare short foreign currency positions but were cautious about expanding long positions in the CFTC reporting week ending May 3. In fact, two of the three largest adjustments were the cutting of gross long Japanese yen and Australian dollar positions. Yen Speculators took profits on 11.8k contracts of gross long yen positions, leaving 85.6k contracts still long. It was the second consecutive week that gross long yen positions were...

Read More »FX Daily, May 06: Bottoming against the Dollar-Bloc

The US dollar rose against all the major currencies last week. The importance of the price action does not lie with the magnitude or the breadth of the advance. Instead, the two takeaway technical observations are 1) the seemingly one-way market for euro and yen ended and 2) the dollar-bloc currencies appear to have put in at least a medium-term top. We hasten to note that the fundamental developments have not shifted a more dollar-friendly near-term direction. Investors, judging from...

Read More »Ron Paul and Claudio Grass Speak on Switzerland

What Do The Swiss Know That We Don’t? Claudio Grass, Managing Director of Global Gold in Switzerland, was recently invited to speak with Dr. Ron Paul at the Liberty Report. The discussion revolved around the decentralized Swiss political system, libertarianism, the European Union and cultural Marxism. Readers may recall that Claudio has recently done some research on the origins of “political correctness” as a method of thought control (see “Cultural Marxism and the Birth of Modern...

Read More »Share buybacks and dividends with borrowed money: Cure Worse than the Disease

A Week to Remember Today we look back to the recent past with singleness of purpose. Context and edification for the present economy is what we’re after. We have questions… How come the recovery has been so weak? Why is it that, nearly seven years after the official end of the Great Recession, the economy’s still mired in a soft muddy quagmire? Squinting, focusing, and refocusing, there’s one particular week that rises above all others. Photo credit: Talks at Google Hank the...

Read More »Treasury Introduces New Rules To Stop Tax Evasion, Kind Of

In the wake of the Panama Papers being released, the U.S.Treasury announced that it will use existing powers in order to make two rule changes that are intended to stop tax evasion. First, in a rule which amends the US Bank Secrecy Act, the Treasury said it will require financial institutions to verify the identity of the real people, or “beneficial owners”, who control companies opening accounts with them. The aim is to prevent true owners of the account from being masked by the names...

Read More »Trump and Clinton: Neither is Fit to Tell the Rest of Us What to Do

Misinformation and Delusions PARIS – Too bad about Ted Cruz. His tax plan was pretty good. A flat tax of 10% on anything over $36,000. And a 16% “business transfer tax” to replace the corporate income tax and all payroll taxes. Photo credit: David J. Phillip / AP Ted Cruz bows out… allegedly he did so because of losing the Indiana primary. But we know better of course. He read this article, and that was the straw that broke the camel’s back. Sorry ’bout that. Not perfect. But a step...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org