Earlier this week we observed that in what may be Europe’s latest mistake, the European Union is about to grant visa-gree travel to 80 million Turks: a key concession that Erdogan obtained as a result of the ongoing negotiations over Europe’s refugee crisis which has pushed Turkey into the key player spotlight. And then, overnight, the European Commission officially granted its support to a visa-free travel deal with Turkey after Ankara threatened to back out of a landmark migration deal....

Read More »Great Graphic: CAD Takes out Trendline

CAD BGN Curncy It has been painful trying to pick a bottom of the US dollar against the Canadian dollar. But now a 4-5 point downtrend from the secondary high in late-January is being violated today. It is found near CAD1.2785 today. Intraday penetration is one thing, but some models may take the signal on a closing basis only. CAD BGN Curncy The US dollar recorded the multi-year high against the Canadian dollar on January 20 a little below CAD1.47. Since then the Canadian...

Read More »Great Graphic: Odds of President Trump Rise (Predictit)

TRUMP . USPREZ16 This Great Graphic is a 90-day history of the “betting” at PredictIt that Trump becomes the new US President. With Cruz suspending his campaign, the odds of Trump have risen just above 40%. TRUMP.USPREZ16 The US national interests and challenges to those interests do not change much from year-to-year, and this may help explain the continuity in US foreign policy (including foreign economic policy). Trump’s campaign style emphasized a break from the conventional...

Read More »Commodities – Will the Rally Continue?

Pros and Cons The original Bethlehem Steel Works in Bethlehem, Pennsylvania. Photo via leggendaurbana.it The recent rally in commodity prices has surprised many market participants and has greatly supported the stock market’s rebound. It has also made bulls out of a number of former stock market bears, as one of its side effects was to cause an improvement in market internals. But does the rally actually make sense? As always, there are arguments both for and against the idea. We...

Read More »Financial Revolution: ECB Blames You For Negative Interest Rates

Just after sunrise on April 19, 1775, a large contingent of British military troops arrived to the town of Lexington, Massachusetts. They were under orders to search for and confiscate all weapons and munitions from the colonials– something the British army had done countless times before. In many ways it was a routine operation. And yet, that morning, roughly 80 local militiamen stood blocking their path. Paul Revere had ridden through Lexington only hours before to warn residents of the...

Read More »Two Decisions from Europe

It might not be on investors’ calendars, but European officials will take steps toward addressing two issues tomorrow. First, the EC will make a preliminary recommendation of visa-free travel in the Schengen area for Turkish passport holders. Second, the ECB governing council will hold a non-monetary policy meeting. It is expected to discuss the future of the 500-euro note. In exchange for implementing previously agreed upon measures to address the refugees going from Turkey to...

Read More »Dollar Continues to Push Lower

The US dollar’s downtrend is extending. The euro traded above $1.16 for the first time since last August. With Japanese markets closed for the second half of the Golden Week holidays, perhaps participants felt less hampered by the risk of intervention and pushed the dollar to almost JPY105.50. Despite an unexpectedly large fall in the UK’s manufacturing PMI (49.2 from 50.7), sterling has pushed to its highest level in four months (~$1.4770). The Australian dollar is the main exception. ...

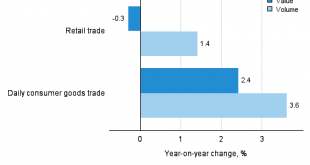

Read More »Swiss retail sales Nominal -2.4%, Real -1.3% against last year

02.05.2016 09:15 – FSO, Economic Surveys (0353-1604-60) Retail trade turnover in March 2016 Swiss retail trade turnover falls by 2.4% Neuchâtel, 02.05.2016 (FSO) – Turnover in the retail sector fell by 2.4% in nominal terms in March 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real...

Read More »Retail trade turnover in March 2016: Swiss retail trade turnover falls by 2.4%

02.05.2016 09:15 – FSO, Economic Surveys (0353-1604-60) Retail trade turnover in March 2016 Swiss retail trade turnover falls by 2.4% Neuchâtel, 02.05.2016 (FSO) – Turnover in the retail sector fell by 2.4% in nominal terms in March 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real...

Read More »Carly Fiorina: Running Mate Turns Into Fall Girl

Odd Couple While checking on the US primaries a few days ago, we came across a piece of news informing us that pretend candle-swallower Ted Cruz had picked Carly Fiorina as his “vice-presidential running mate”. Our first thought upon hearing this was “WTF”? The match made in heaven… two loooosers find each other. Photo credit: AP It’s not so much that he’s picking another “loooooser” as The Donald would put it…the real absurdity of it is that even if Cruz were to win every single one of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org