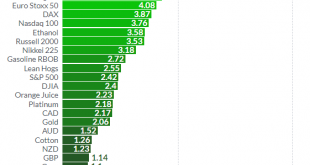

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in...

Read More »Euro area core inflation to rise again after Easter

The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy...

Read More »Healthcare costs rise further in Switzerland

Statistics published today show a further rise in Swiss healthcare costs. © Aviahuismanphotography | Dreamstime.com - Click to enlarge In 2016, spending on healthcare rose by 3.8% reaching over CHF 80 billion, 12.2% of GDP. In 2015, Swiss healthcare spending was equal to 11.9% of GDP. The challenge of rising healthcare costs is not confined to Switzerland. In the UK in 2015, healthcare costs rose 3.6% to reach 9.9% of...

Read More »Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX). COMEX is by far the largest and most...

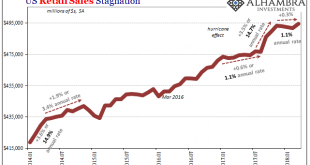

Read More »The Retail Sales Shortage

Retail sales rose (seasonally adjusted) in March 2018 for the first time in four months. Related to last year’s big hurricanes and the distortions they produced, retail sales had surged in the three months following their immediate aftermath and now appear to be mean reverting toward what looks like the same weak pre-storm baseline. Exactly how far (or fast) won’t be known until subsequent months. US Retail Sales, Jan...

Read More »The “Turn of the Month Effect” Exists in 11 of 11 Countries

A Well Known Seasonal Phenomenon in the US Market – Is There More to It? I already discussed the “turn-of-the-month effect” in a previous issues of Seasonal Insights, see e.g. this report from earlier this year. The term describes the fact that price gains in the stock market tend to cluster around the turn of the month. By contrast, the rest of the time around the middle of the month is typically less profitable for...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only...

Read More »Swiss unemployment at lowest in 3.5 years

Swiss unemployment is at its lowest for 3.5 years, according to the Swiss State Secretariat for Economic Affairs (SECO). © Gpointstudio | Dreamstime.com - Click to enlarge The last time Swiss unemployment reached March 2018’s level was in October 2014. After reaching a peak of 3.7% in January 2017, the rate had fallen to 2.9% by March 2018. Unemployment has some seasonality however the rate for last March (2.9%) is...

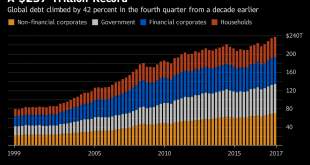

Read More »Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

– Global debt bubble hits new all time high – over $237 trillion– Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD – Increase in debt equivalent to United States’ ballooning national debt – Global debt up $50 trillion in decade & over 327% of global GDP – $750 trillion of bank derivatives means global debt over $1 quadrillion – Gold will be ‘store of value’ in coming economic...

Read More »What Do We Know About Syria? Next to Nothing

Anyone accepting “facts” or narratives from any interested party is being played. About the only “fact” the public knows with any verifiable certainty about Syria is that much of that nation is in ruins. Virtually everything else presented as “fact” is propaganda intended to serve one of the competing narratives or discredit one or more competing narratives. Consider a partial list of “interested parties” spinning their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org