Swiss International Air Lines has been ranked as the most attractive employer in a survey on the 150 largest companies in Switzerland. Zurich Airport came in second, followed by watchmaker Patek Philippe. The survey, published by Dutch recruitment agency Randstadexternal link on Thursday, asked 4,800 people aged 18-65 where they would like to work. The study took 16 criteria into account, including work environment,...

Read More »FX Daily, April 27: Dollar Puts Finishing Touches on Best Week Since November 2016

Swiss Franc The Euro has fallen by 0.08% to 1.1958 CHF. EUR/CHF and USD/CHF, April 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s recent gains have been extended, and it is having one of its best weeks since November 2016. The Dollar Index is up 1.7% for the week, as US session is about to start. Though it took this week’s gains to change market’s...

Read More »Bi-Weekly Economic Review: Interest Rates Make Their Move

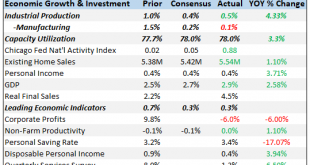

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears. The economic news over the last two weeks does not appear to...

Read More »From Fake Boom to Real Bust

Paradise in LA LA Land More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf. Normally, judgment would be passed on a Thursday, but we are making an exception. - Click to enlarge For example, here in the land of...

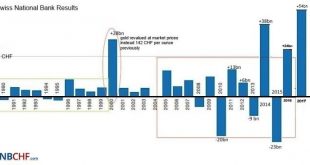

Read More »SNB reports a profit of CHF 47.6 billion for Q1 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More »Oil: Supply and Demand Drivers

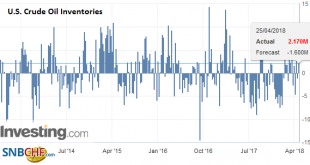

Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near $82 a barrel for Brent and $76.5 for WTI basis the continuation futures contract. The immediate consideration is that supplies have tightened. OPEC compliance to its agreement has exceeded targets, and Venezuelan output has been halved over the past two years to levels not seen in a more...

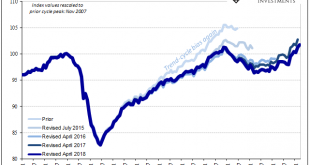

Read More »Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »Our Strange Attraction to Self-Destructive Behaviors, Choices and Incentives

Self-destruction isn’t a bug, it’s a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies. The proliferation of self-destructive behaviors, choices and incentives in our...

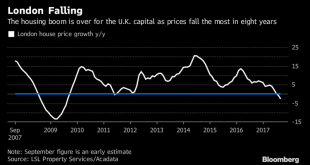

Read More »London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– London house prices fell by 3.2% in the first quarter – Halifax – Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or...

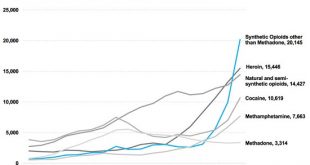

Read More »Getting High on Bubbles

Turn on, Tune in, Drop out Back in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). Dr. Albert Hoffman and his famous bicycle ride through Basel after he ingested a few drops of LSD-25 by mistake. The photograph in the middle was taken at the Woodstock...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org