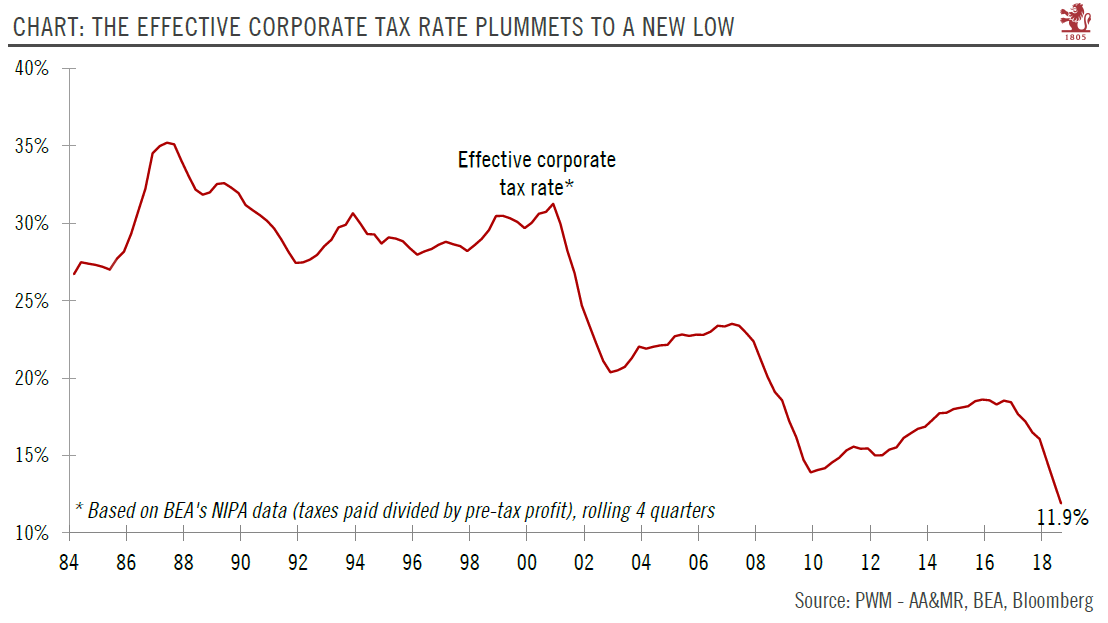

The effective corporate tax rate plummets in the wake of Trump tax cuts.US corporates are delivering strong profits and this robust profit picture is further enhanced by a sharp drop in the corporate tax burden.According to NIPA (national accounts) data, the effective tax rate for the year ending in Q3 2018 reached a new low of 11.9%.President Trump’s December 2017 tax cuts led to a lower federal statutory tax rate of 21% (from 35% prior), but firms still have several options to bring down the effective rate further, as this data shows.Not all taxes are going down. In fact the newly-introduced tariffs on Chinese imports are de facto a new tax on the US consumer.Read full report here

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The effective corporate tax rate plummets in the wake of Trump tax cuts.

US corporates are delivering strong profits and this robust profit picture is further enhanced by a sharp drop in the corporate tax burden.

According to NIPA (national accounts) data, the effective tax rate for the year ending in Q3 2018 reached a new low of 11.9%.

President Trump’s December 2017 tax cuts led to a lower federal statutory tax rate of 21% (from 35% prior), but firms still have several options to bring down the effective rate further, as this data shows.

Not all taxes are going down. In fact the newly-introduced tariffs on Chinese imports are de facto a new tax on the US consumer.