Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign. The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this expected? All this...

Read More »FX Daily, June 5: Greenback Remains Soft Ahead of Employment Report, but Reversal Possible

Swiss Franc The Euro has risen by 0.64% to 1.0898 . FX Rates Overview: The modest loss in the S&P 500 and NASDAQ yesterday did not signal the end of the bull run. All the markets in the Asia Pacific region rallied, with the Hang Seng among the strongest with a 1.6% advance that brought the week’s gain to around 7.8%. South Korea’s Kospi was not far behind with a weekly gain of 7.5%. In the past two weeks, the MSCI Asia Pacific Index is up nearly 10%. European...

Read More »FX Daily, June 4: Risk Taking Pauses Ahead of the ECB

Swiss Franc The Euro has risen by 0.02% to 1.0798 EUR/CHF and USD/CHF, June 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After several days of aggressive risk-taking, investors are pausing ahead of the ECB meeting. Equities were mostly higher in the Asia Pacific region, though China was mixed, and Indian shares slipped. Europe’s Dow Jones Stoxx 600 is snapping a five-day advance, and US shares are trading...

Read More »FX Daily, May 8: Jobs and Negative Fed Funds Futures

Swiss Franc The Euro has fallen by 0.09% to 1.0528 EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 closed near its session lows for the third day running yesterday but failed to deter the bulls in Asia-Pacific, where most markets rose by more than 1%. Taiwan, Korea, and Australia lagged a bit though closed higher. Europe’s Dow Jones Stoxx 600 is firm, and the modest...

Read More »FX Daily, March 06: Panic Deepens, US Employment Data Means Little

Swiss Franc The Euro has fallen by 0.40% to 1.0581 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the...

Read More »FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Swiss Franc The Euro has fallen by 0.07% to 1.0692 EUR/CHF and USD/CHF, February 7(see more posts on EUR/CHF, USD/CHF, ) Source: makets.ft.com - Click to enlarge FX Rates Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the...

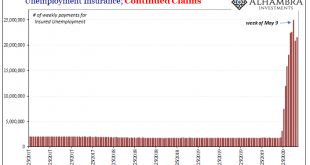

Read More »Very Rough Shape, And That’s With The Payroll Data We Have Now

The Bureau of Labor Statistics (BLS) has begun the process of updating its annual benchmarks. Actually, the process began last year and what’s happening now is that the government is releasing its findings to the public. Up first is the Household Survey, the less-watched, more volatile measure which comes at employment from the other direction. As the name implies, the BLS asks households who in them is working whereas the more closely scrutinized Establishment...

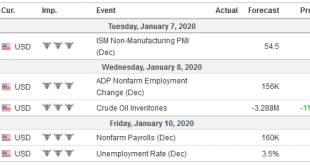

Read More »FX Daily, January 10: Jobs Friday: Asymmetrical Risks?

Swiss Franc The Euro has risen by 0.06% to 1.0813 EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The first full week of 2020 is ending on a quiet note, pending the often volatile US jobs report. New record highs US equities on the back of easing geopolitical anxiety is a reflection of greater risk appetite that is evident across the capital markets. Asia Pacific equities mostly...

Read More »FX Weekly Preview: High-Frequency Data may Underscore Four Thematic Points

Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China’s CPI. The UK reports December PMIs, November GDP, and industrial output figures. While the economic reports may pose some headline risk, the course of events suggests investors will look past the data. How the economies perform in Q1 20...

Read More »Disposable (Employment) Figures

If last month’s payroll report was declared to be strong at +128k, then what would that make this month’s +266k? Epic? Heroic? The superlatives are flying around today, as you should expect. This Payroll Friday actually fits the times. It wasn’t great, they never really are nowadays (when you adjust for population and participation), but it was a good one nonetheless. November 2019, according to the BLS, was the first month since January to register better than...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org