Swiss Franc The Euro has risen by 0.26% to 1.0977 EUR/CHF and USD/CHF, December 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asia Pacific equities closed higher today, with India being a notable exception. Hong Kong and South Korea led with 1% rallies. For the week, the MSCI index for the region advanced to snap a three-week decline. European and US bourses have not fared as well. The Dow Jones Stoxx 600...

Read More »FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Swiss Franc The Euro has risen by 0.24% to 1.1023 EUR/CHF and USD/CHF, November 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: An unexpected increase in China’s Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of...

Read More »FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

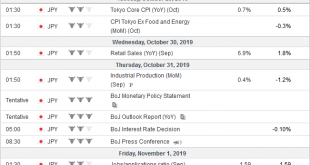

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU. A few hours before the FOMC meeting concludes on October 30,...

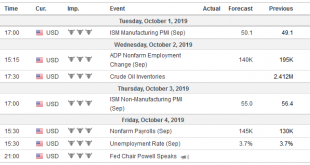

Read More »FX Daily, October 4: The US Jobs Data to Close a Sobering Week

Swiss Franc The Euro has fallen by 0.37% to 1.0913 EUR/CHF and USD/CHF, October 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery of US shares yesterday signaled today’s fragile stability. Gains in Japan, Australia, and Taiwan blunted the losses elsewhere in the region, including a 1% slide in Hong Kong. The MSCI Asia Pacific Index fell for the third week. China’s markets have been closed since...

Read More »FX Weekly Preview: Forces of Movement at the Start of Q4 19

United States The world’s largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead. The strength of the recent housing data (starts and sales)...

Read More »FX Daily, June 7: Jobs Data and Tariffs Dominate

Swiss Franc The Euro has risen by 0.11% at 1.1186 EUR/CHF and USD/CHF, June 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities continue to recover from the recent slide. Chinese and Hong Kong markets were on holiday today, but the MSCI Asia Pacific Index eked out a minor gain and ensured that its four-week slide ended. Europe’s Dow Jones Stoxx 600...

Read More »FX Daily, April 05: Trade Talk and German Industrial Output Lifts Sentiment

Swiss Franc The Euro has risen by 0.03% at 1.1219 EUR/CHF and USD/CHF, April 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German...

Read More »Short Note on Jobs Report

The January employment report was mixed. It is unlikely to have a material impact on expectations for Fed policy. However, it does suggest the downside risks may not materialize. The US economy grew 304k jobs, well above expectation. It is marred by a 70k net downward revision of the past two months, and notably a 90k cut in December’s estimate, which brings it to 222k (from 312k). The participation rate edged...

Read More »Great Graphic: Weekly Jobless Claims and the S&P 500

The softer than expected PCE deflator today plays into the dovish market mood. There may be little that can resist it until next Friday’s employment data, which should be another robust report with hourly earnings holding above 3% year-over-year. Last November, average hourly earnings rose by 0.3%. As this drops out of the year-over-year comparison, even a healthy bounce back from the 0.2% drop skewed by the hurricane...

Read More »Two-thirds of Swiss see artificial intelligence as job threat

People are in favour of taxing robots if unemployment increases as a result of technological advances. Only 34% of Swiss people believe their jobs are not at risk from automation and machine learning, according to a survey commissioned by the Swiss Broadcasting Corporation (SBC). Almost half of the 2,092 people surveyed by the Link Institute for SBC felt that some of their daily tasks could be done by machines and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org