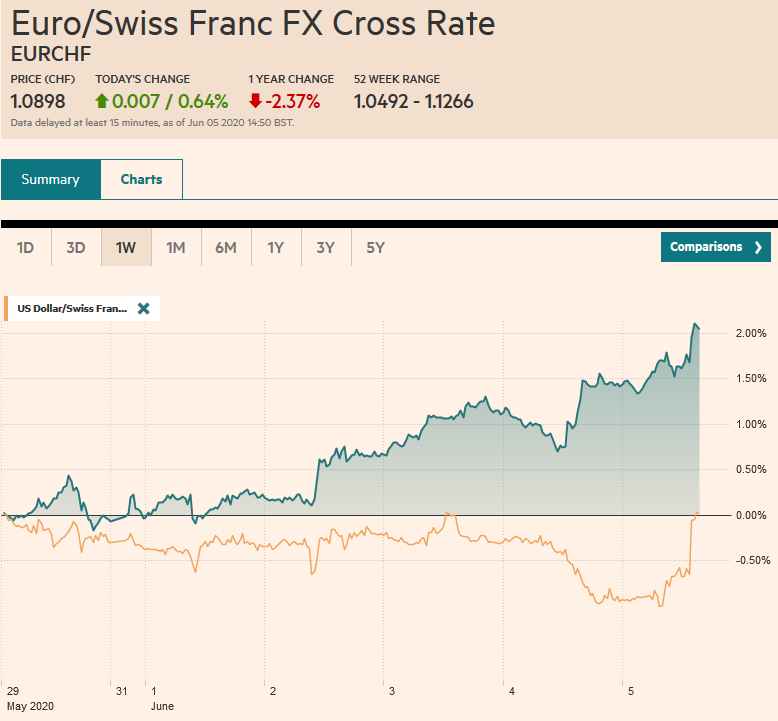

Swiss Franc The Euro has risen by 0.64% to 1.0898 . FX Rates Overview: The modest loss in the S&P 500 and NASDAQ yesterday did not signal the end of the bull run. All the markets in the Asia Pacific region rallied, with the Hang Seng among the strongest with a 1.6% advance that brought the week’s gain to around 7.8%. South Korea’s Kospi was not far behind with a weekly gain of 7.5%. In the past two weeks, the MSCI Asia Pacific Index is up nearly 10%. European shares are higher by more than 1% in the morning turnover. The Dow Jones Stoxx 600 has gained almost 9% in the past two weeks, which the S&P 500 matches coming into today, where it is poised for additional gains. While stocks are rallying, benchmark 10-year yields have backed up. Interest rates are a bit

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Currency Movement, ECB, EUR/CHF, Featured, FX Daily, jobs, newsletter, U.S. participation rate, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.64% to 1.0898 |

|

FX RatesOverview: The modest loss in the S&P 500 and NASDAQ yesterday did not signal the end of the bull run. All the markets in the Asia Pacific region rallied, with the Hang Seng among the strongest with a 1.6% advance that brought the week’s gain to around 7.8%. South Korea’s Kospi was not far behind with a weekly gain of 7.5%. In the past two weeks, the MSCI Asia Pacific Index is up nearly 10%. European shares are higher by more than 1% in the morning turnover. The Dow Jones Stoxx 600 has gained almost 9% in the past two weeks, which the S&P 500 matches coming into today, where it is poised for additional gains. While stocks are rallying, benchmark 10-year yields have backed up. Interest rates are a bit firmer today. The US 10-year is up 17 bp this week to 85 bp, ahead of the employment report. Germany’s 10-year Bund yields are a little higher today and up nine basis points on the week at minus 31 bp. Peripheral yields are little changed today, but Italy’s 10-year yield is off six basis points this week, and Greece’s benchmark yield is down 14 bp. The Antipodeans remain the standouts among the major currencies, and with today’s gains (~0.5%) are up about 4.7% on the week. The yen is little changed but is the only major currency to have lost ground to the dollar this week (~1.3%). Emerging market currencies continue to recover. The JP Morgan Emerging Market Currency Index is extending its advance to the seventh consecutive session today. In fact, since May 15, it has been down only twice. Note that Moody’s reviews Turkey and Russia’s credit rating today. Gold’s shine has dulled a bit, and its loss today (~-0.2%) brings week’s loss to more than 1%, and it is the third consecutive weekly loss. A deal among OPEC+ is helping underpin oil prices, and July WTI is higher for the fourth straight session and is extending its recovery for the sixth consecutive week. |

FX Performance, June 5 |

Asia Pacific

The Hong Kong Monetary Authority intervened to prevent the Hong Kong dollar from breaking higher out of its band against the dollar. The HKMA appears to have bought about $125 mln. The three-month forward points have slipped back below 100 and into the previous range. The 12-month forward points have eased eight of the past 10 sessions, and around 370 are still elevated compared with the 200 points on May 15. Separately, the PBOC set the dollar’s reference rate at CNY7.0965, which was a bit firmer than the models suggested. Still, the dollar fell to its lowest level against the yuan (~CNY7.0825) since May 12. The greenback’s four-week climb against the yuan is ending this week with about a 0.6% decline.

China has ordered American soy and crude oil (2 mln barrels on the way). Given the price decline of oil, to meet the dollar targets, China will have to import much more than it may have thought in January. The US seems to be in a win-win situation in terms of the trade agreement. China fulfills the terms, and US exports rise. China does not, and the US can lord it over China, and it fits well into the US political cycle. The latest polls show Trump has begun to trail in two key swing states, Ohio and Wisconsin. To the extent the Democrats offer a substantive criticism of Trump’s China policy, it is that it is not tough enough.

Japan reported April household spending fell 11.1% year-over-year, almost twice the 6% decline in March. It cannot all be attributed to the virus. In fact, the April decline was the seventh consecutive monthly fall that began with the sales tax increase last October. Separately, the BOJ boosted its purchases of 5-10 year JGBs to JPY400 bln from JPY370 bln.

The dollar is higher against the yen for the fourth consecutive session today, and near JPY109.40, it is at its best level since March 27. The JPY109.50 area corresponds to the (61.8%) retracement objective of the drop that began a few days earlier (March 24) from around JPY111.70. There is much talk of a test on JPY110.00. The Australian dollar poked above $0.7000 for the first time today since January 2. It is stretching its advance into the seventh consecutive session. It has fallen in only one week since April 3. Note that its upper Bollinger Band is found near $0.6980 today.

Europe

The ECB did not disappoint. It opted to boost the Pandemic Emergency Purchase by 600 bln euros and extended the program until at least the end of June next year from the end of this year. Most had expected a 500 bln euro expansion. It also indicated that it would reinvest the maturing principle from PEPP assets until at least the end of 2022. This is probably best understood within the context of forward guidance the commitment to keep rates low for the foreseeable future. The average maturity of bunds is considerably shorter than the average maturity of Italian bonds. Still, by pre-announcing the recycling, it assures investors that discrepancy will not be translated to a premature unwind. It was quickly calculated that at the current pace, the PEPP facility would be exhausted around the middle of Q1 21. Depending on conditions, it suggests the issue of PEPP resources will be addressed again at the end of the year.

The ECB’s staff forecasts saw a cut in both growth and inflation projections. The eurozone economy is expected to contract by 8.7% this year and grow by 5.2% in 2021 and 3.3% in 2022. The IMF’s April forecasts anticipated a 7.5% contraction this year and a 4.7% expansion next. The ECB’s CPI forecast was slashed to 0.3% this year and 0.8% next year. In March, the staff projected 1.1% inflation this year, followed by 1.4% next. Next week, the Federal Reserve will update its forecasts, and the median forecast will likely be for a shallower contraction this year and a stronger recovery in 2021. The economic estimates assumed a $36 barrel of oil this year and $37.20 next year, and $40.7 in 2022. The euro was assumed to be $1.09 this year and $1.08 in 2021 and 2022. These are not forecasts and appear consistent with the forward curve a couple weeks ago.

German factory orders for April collapsed by almost 26% in April. Spanish industrial output tanked by nearly 22%. Both reports were weaker than expected. Italy’s 10.5% drop in April retail sales was roughly half the decline the median forecast in the Bloomberg survey anticipated. It follows a 21.3% decline in March. Still, the news was regarded as old, and the euro extended its gains to almost $1.1385, the highest since March 10. It is consolidating ahead of the US jobs data and found support in the European morning near $1.1320. There is an option for 600 mln euros at $1.13 that could come into play later, though the intraday technical indicators do not favor that. Sterling surpassed the April highs (~$1.2640-$1.2650) and rose to almost $1.2700 before the buying enthusiasm eased. It traded above its 200-day moving average (~$1.2680) for the first time since March 12. Support is seen near $1.2580. Sterling is trying to snap a three-week slide against the euro. The euro finished last week near GBP0.8995 and is near GBP0.8975 now.

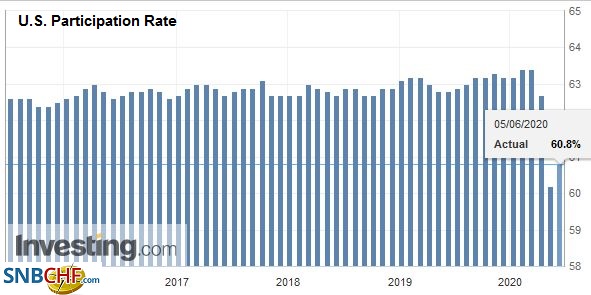

AmericaThe US employment data remains dismal but is unlikely to have much impact on the market provided that the pace of layoffs slows. Indeed, the US forecast to have lost only 7.5 mln jobs after a loss of 20.5 mln in May. |

U.S. Participation Rate, May 2020(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

| Methodological differences, such as the treatment of furloughed worker means that the government’s estimate is not likely to show the same improvement as the ADP report. Employment measures of the surveys ticked up, but not by much. |

U.S. Nonfarm Payrolls, May 2020(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

| The weekly jobless claims have gotten less bad but remain horrific. Even in the best of times, the monthly jobs report is among the hardest high-frequency data point to forecast. |

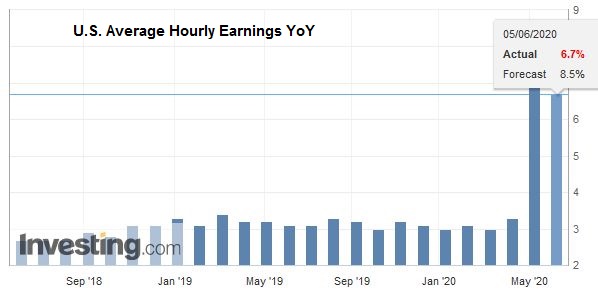

U.S. Average Hourly Earnings YoY, May 2020(see more posts on U.S. Average Hourly Earnings, ) Source: investing.com - Click to enlarge |

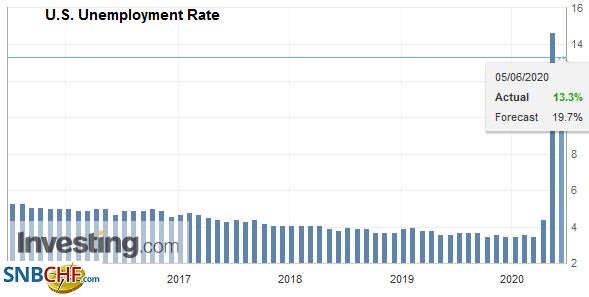

| The unemployment rate is expected to rise to 19%-20% from 14.7% in April. The underemployment rate that was 6.7% at the end of last year and 22.8% in April, may rise to 30%. The emergency payment of an extra $600 a week unemployment insurance is set to expire at the end of next month. This is just one of the fiscal cliffs that need to be extended. |

U.S. Unemployment Rate, May 2020(see more posts on U.S. Unemployment Rate=, ) Source: investing.com - Click to enlarge |

Canada is expected to report that it lost 400k jobs last month, after shedding nearly 2 mln jobs in April, according to an MNI poll. The unemployment rate was 5.5% in January and rose to 13% in April. It is expected to increase to 15% in May. Bank of Canada Deputy Governor Gravelle delivered a rather upbeat economic update, that cited an uptick in house and auto sales. Gravelle reiterated that the intention to respect the zero-bound and that the current overnight target of 25 bp was the lowest it could go without risking problems in the financial system.

The US dollar made a marginal new low against the Canadian dollar today near CAD1.3460, just below the 200-day moving average and above the bottom of an old gap from March that extends to CAD1.3440. The momentum is stalling, and a close above CAD1.3520 today could signal a correction next week. The greenback recorded the low for the week against the Mexican peso on Wednesday, just below MXN21.51. It tested the MXN22.00-level yesterday, and a move above there would be important technically. Still, this the third weekly decline for the greenback and the fifth in the past six weeks, leaving the technical indicators stretched. Lastly, the Dollar Index recorded a big outside down day yesterday by rising above the previous session’s high and then closing below the previous session’s low. There was some follow-through selling, and DXY fell to its lowest level since March 12 (~96.45). However, caution is advised, and a reversal pattern is possible today, such as a hammer candlestick.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Currency Movement,ECB,EUR/CHF,Featured,FX Daily,jobs,newsletter,U.S. Participation Rate,USD/CHF