Swiss Franc The Euro has risen by 0.11% at 1.1429 EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firmer against most of the major and emerging market currencies. The yen and sterling are resisting the pressure, while the South African rand and Russian rouble are paring some of this week’s declines. US equity losses...

Read More »Jump in Hourly Earnings is Key to US Jobs, while Canada adds 40k Full-Time Positions

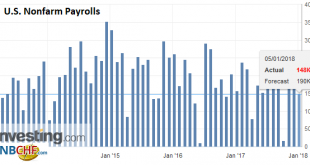

United States The 201k rise in US non-farm payrolls edged above the median forecasts, but the 50k downward revision to the past two-months removes the gloss. It is the first August report in seven years that the initial estimate was above the Bloomberg median. U.S. Nonfarm Payrolls, Sep 2013 - Sep 2018(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge The most important part of the...

Read More »FX Daily, August 03: Greenback Remains Firm Ahead of Jobs, JGBs Stabilize, Italian Debt Moves into Spotlight

Swiss Franc The Euro has fallen by 0.19% to 1.1503 CHF. EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading at the upper end of its recent ranges against the euro and sterling. The euro finished below $1.16 yesterday for the first time since the end of June and has not been able to resurface that level so far today. We...

Read More »FX Weekly Preview: Three Central Bank Meetings and US Jobs data

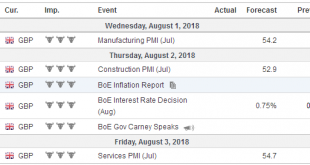

The week ahead sees three major central bank meetings and the US employment report. It will likely be the most important work before a hiatus that runs through the end of August. Of course, and perhaps more than ever, market participants are well aware that the US President’s communication and penchant for disruption is a bit of a wild card. That said, the equity market has learned to take individual company references...

Read More »Look Past Disappointing Jobs Data, Luke

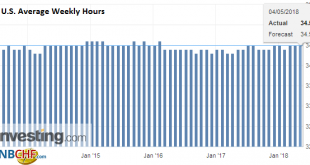

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario. The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations. The source of disappointment hourly earnings. March’s 2.7% year-over-year pace was revised to 2.6%, and there it remained...

Read More »FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously. The monthly net job creation is a...

Read More »US Jobs Data Optics Disappoint, but Signal Unchanged

The US jobs growth slowed in March more than expected, but the details of the report suggest investors and policymakers will look through it. The poor weather seemed to have played a role. Construction jobs fell (15k) for the first time since last July, and the hours worked by production employees and non-supervisory worker slipped. United States The 103k net new jobs were the least since last September when storms...

Read More »FX Daily, April 06: Trade Trumps Jobs

Swiss Franc The Euro has fallen by 0.08% to 1.1779 CHF. EUR/CHF and USD/CHF, April 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Trade and equity market volatility, which are not completely separate, continue to dominate investors’ interest. Many had come around to accept that while trade tensions were running high, it was likely to be mostly posturing. This...

Read More »FX Weekly Preview: Thumbnail Sketch Four Central Bank Meetings and US Jobs Data

The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September’s election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD...

Read More »Headline US Jobs Disappoint, but Earnings as Expected

United States The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story. The headline miss is not really made up for by the upward revision in the November series from 228k to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org