Overview: The markets lack a clear direction today and await fresh incentives. After gaining almost 1% yesterday, the MSCI Asia Pacific Index slipped. Japan, Hong Kong, and Australia are among the few equity markets that rose. The Dow Jones Stoxx 600 is posting minor gains, while US futures are largely steady. The S&P 500 and NASDAQ have a five-day advancing streak in tow. The US 10-year yield reached a five-month high near 1.64% yesterday and extended to...

Read More »Dollar Slumps

Overview: While equities and bonds are firmer, it is the dollar's sell-off that stands out today. The greenback has retreated broadly. The euro is trading above the previous week's high for the first time in over a month, and the dollar was pushed back below JPY114.00 in early European turnover. The Chinese yuan is at four-month highs. The Antipodean and Scandi currencies are leading the move against the dollar among the major currencies. The JP Morgan Emerging...

Read More »The Euro Remains Within Last Wednesday’s Range

Overview: A weak close in US equity trading yesterday and the widening of China's "cultural revolution" for a two-month investigation of the financial sector stopped a three-day advance in the MSCI Asia Pacific Index. China, South Korea, and Taiwan saw more than a 1% decline in their major indices. All the major indices weakened. South Korea's Kospi fell to a new marginal low for the year and took the won with it. The Dow Jones Stoxx 600 in Europe is off around...

Read More »FX Daily, October 11: Rate Expectation Adjustment Continues

Swiss Franc The Euro has fallen by 0.07% to 1.0717 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are softer and yields higher to start the new week. The dollar is mixed. Oil and industrial metals are higher. There are several developments over the weekend, but the focus seems to be on central bank action, inflation reports by the US and China, and the start of the Q3...

Read More »Weekly Market Pulse: Zooming Out

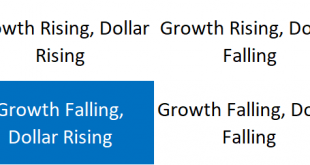

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Hard to Be Sterling

Overview: Energy prices pulled back late yesterday, but it offered little reprieve to the bond market where the 10-year benchmark yields in the US, UK, Sweden, and Switzerland reached new three-month highs. November WTI traded to almost $76.70 before reversing lower and leaving a potentially bearish shooting star candlestick in its wake. The US S&P 500 and NASDAQ gapped lower and did not recover, setting the stage for today’s drop in Asia. All the major...

Read More »FX Daily, September 15: China Disappoints, but the Yuan Remains Strong

Swiss Franc The Euro has fallen by 0.10% to 1.0849 EUR/CHF and USD/CHF, September 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sixth decline of the S&P 500 in the past seven sessions set a negative tone for equity trading in the Asia Pacific region, and the poor Chinese data did not help matters. News that China’s troubled Evergrande would miss next week’s interest payment weighed on sentiment too....

Read More »FX Daily, September 15: China Disappoints, but the Yuan Remains Strong

Swiss Franc The Euro has fallen by 0.10% to 1.0849 EUR/CHF and USD/CHF, September 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sixth decline of the S&P 500 in the past seven sessions set a negative tone for equity trading in the Asia Pacific region, and the poor Chinese data did not help matters. News that China’s troubled Evergrande would miss next week’s interest payment weighed on sentiment too....

Read More »Is it Really all about US CPI?

Overview: The markets are in a wait-and-see mode, it appears, ahead of the US CPI figures, as it absorbs bond supply from Europe and monitors the potential restructuring of China’s Evergrande. A new storm may hit US oil and gas in the Gulf before recovering from the past storm and helping to underpin prices. China and Hong Kong led the decliners in the mixed Asia Pacific session that saw the Nikkei post its highest close since 1990. South Korea, Taiwan, and Indian...

Read More »The Greenback Continues to Claw Back Recent Losses

Overview: The US dollar continues to pare its recent losses and is firm against most major currencies in what has the feel of a risk-off day. The other funding currencies, yen and Swiss franc, are steady, while the euro is heavy but holding up better than the Scandis and dollar-bloc currencies. Emerging market currencies are also lower, and the JP Morgan EM FX index is off for the third consecutive session. The Chinese yuan’s insignificant gain of less than...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org