Overview: The fire that burnt through the capital markets before the weekend, triggered by the new Covid mutation, burned itself out in the Asian Pacific equity trading earlier today. A semblance of stability, albeit fragile and tentative, has emerged. Europe's Stoxx 600 is up about 1%, led by real estate, information technology, and energy. US index futures are trading higher, with the NASDAQ leading. Benchmark 10-year yields are firmer. The US 10-year Treasury...

Read More »The ‘Growth Scare’ Keeps Growing Out Of The Macro (Money) Illusion

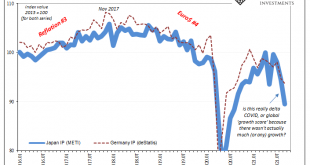

When Japan’s Ministry of Trade, Economy, and Industry (METI) reported earlier in November that Japanese Industrial Production (IP) had plunged again during the month of September 2021, it was so easy to just dismiss the decline as a product of delta COVID. According to these figures, industrial output fell an unsightly 5.4%…from August 2021, meaning month-over-month not year-over-year. Altogether, IP in Japan is down just over 10% since June, nearly 11% since...

Read More »Turkey gets a Reprieve before US Thanksgiving, but Capital Strike may not be Over

Overview: The dramatic collapse of the Turkish lira was like an accident one could not help look at, but it was not an accident, but the result of a disregard for the exchange rate and compromised institutions. The lira was off around 15% at its worst yesterday, before settling 11.2% lower. After falling for 11 sessions, it has steadied today (~2.7%) but the capital strike may not be over. On the other hand, the Reserve Bank of New Zealand delivered the 25 bp...

Read More »The Greenback Slips to Start the New Week

Overview: While the Belarus-Poland border remains an intense standoff, there have been a couple other diplomatic developments that may be exciting risk appetites today. First, Biden and Xi will talk by phone later today. Second, reports suggest the UK has toned down its rhetoric making progress on talks on the implementation of the Northern Ireland Protocol. Equities in the Asia Pacific region were mostly firmer, with China a notable exception among the large...

Read More »FX Daily, November 9: Falling Yields Give the Yen a Boost

Swiss Franc The Euro has risen by 0.09% to 1.0587 EUR/CHF and USD/CHF, November 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Reports that the Fed’s Brainard was interviewed for the Chair helped soften yields a bit, not that they needed extra pressure, on ideas she is more dovish than Powell. In turn, the lower yields saw the yen rise to its best level in nearly a month and led the major currencies higher...

Read More »Markets Await Fresh Developments

Overview: Last week's bond market rally has stalled. Benchmark 10-year yields are up 1-3 bp in Europe, and the three bp increase in the US puts the yield slightly below 1.50%. Equities were mixed in the Asia Pacific region. Japan, Hong Kong, South Korea, and Australia nursed losses after the regional benchmark (MSCI) rose 0.65% last week. The Stoxx 600 had a seven-session rally in tow, but it is little changed in the European morning. It rose 1.65% last week. ...

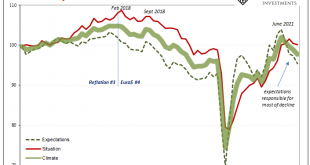

Read More »An Anti-Inflation Trio From Three Years Ago

Do the similarities outweigh the differences? We better hope not. There is a lot about 2021 that is shaping up in the same way as 2018 had (with a splash of 2013 thrown in for disgust). Guaranteed inflation, interest rates have nowhere to go but up, and a certified rocking recovery restoring worldwide potential. So said all in the media, opinions written for everyone in it by none other than central bank models. It was going to be awesome. Straight away, however,...

Read More »Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the...

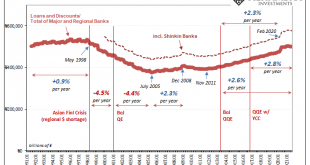

Read More »You Don’t Have To Take My Word For It About Eliminating QE

You don’t have to take my word for it. QE doesn’t work and it never has. That’s not just my assessment, pull out any chart of interest rates for wherever gets the misfortune of having been wasted with one of these LSAP’s. If none handy, then just read what officials and central bankers write about their own programs (or those of their close and affectionate counterparts). After nearly a decade of Abenomics in Japan, the latest Japanese Prime Minister Fumio Kishida...

Read More »Markets Turn Cautious

Overview: After a couple of sessions of taking on more risk, investors are taking a break today. Equities are mostly lower today after the S&P 500's six-day advance took it almost to its record high, while the NASDAQ's streak was halted at five sessions. The Nikkei's nearly 1.8% slide paced the Asia-Pacific session, where most bourses retreated. Europe's Dow Jones Stoxx 600 is off about 0.15% near midday after rising approximately 0.65% over the past two...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org