[unable to retrieve full-text content]Overview: After an ugly week, market participants have returned with strong risk appetites. Equities are rebounding, and the greenback is paring recent gains. Bond yields are firm, as are commodities. Asia Pacific equities got the ball rolling with more than 1% gains in several large markets, including Japan, China, Hong Kong, and Taiwan.

Read More »Consolidative Mood Grips Markets

Overview: The dollar is consolidating yesterday's advance and is confined to fairly narrow ranges in quiet turnover. Most of the major currencies are within 0.1% of yesterday's close near midday in Europe. The $1.1700-level held in the euro. Most emerging market currencies have edged a little higher. Despite the largest fall in the US NASDAQ in three weeks and the largest fall in the S&P 500 in a month, the MSCI Asia Pacific Index rose for the first time in...

Read More »Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some...

Read More »Markets Look for Direction, Currencies in Narrow Ranges

Overview: The global capital markets are subdued today as investors wrestle with the rising virus, the shifting stance of several central banks, and a more tense geopolitical backdrop. Equity markets are struggling today. Most of the large bourses in the Asia Pacific region, including Japan, China, Hong Kong, and Taiwan, moved lower, and Europe's Dow Jones Stoxx 600 threatens to snap an eight-session advance. US futures are narrowly mixed. The US 10-year yield...

Read More »US Employment Data is Important but for the Millionth Time, Don’t Exaggerate It

Overview: Record high closes yesterday for the S&P 500 and NASDAQ have done little to help global equities today. Most of the Asia Pacific region markets, but Japan and Australia slipped ahead of the weekend while still holding on to gains for the week. Europe's Dow Jones Stoxx 600 is threatening to snap a four-day advance, and US futures are trading a little lower. The US 10-year yield reached 1.125% in the middle of the week and is extending yesterday's...

Read More »FX Daily, July 21: Did Japan Deliver a Fait Accompli to the US?

Swiss Franc The Euro has fallen by 0.18% to 1.0837 EUR/CHF and USD/CHF, July 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The biggest rally in US equities in four months has helped stabilize global shares today. In the Asia Pacific region, Japan, China, and Australian markets advanced. Led by information technology and consumer discretionary sectors, Europe’s Dow Jones Stoxx 600 is up around 1.35% near the...

Read More »Inching Closer To Another Warning, This One From Japan

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart. The disease is just that potent; delirium the chief symptom, especially among the virus’ central banker...

Read More »FX Daily, July 16: BOJ Tweaks Forecasts

Swiss Franc The Euro has risen by 0.10% to 1.085 EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets head into the weekend with little fanfare. Most large equity markets in the Asia Pacific region slipped earlier today. Hong Kong, which will be exempt from the need to secure mainland’s cybersecurity approval for foreign IPOs, and Australia were notable exceptions. European...

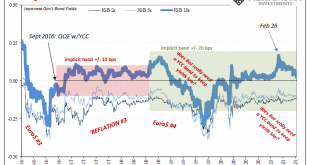

Read More »Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change. Inflation had finally been achieved across multiple geographies, it was widely repeated, and this would create problems, purportedly, as these various places would have to grapple with higher interest rates. The idea behind...

Read More »FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

Swiss Franc The Euro has fallen by 0.03% to 1.0922 EUR/CHF and USD/CHF, July 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has steadied after surging yesterday and has so far retained the lion’s share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming. The freely accessible...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org