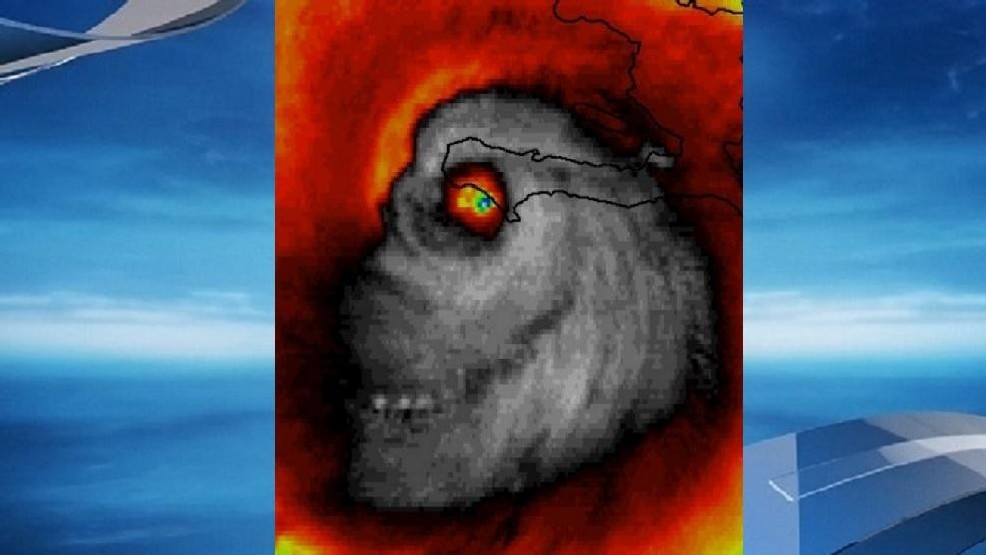

Escaping the Hurricane BALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash. A satellite image of hurricane Matthew taken on October 4. He didn’t look very friendly. Image via twitter.com - Click to enlarge “Evacuate or die,” we were told. Not wanting to do either, we rented a car and drove to Maryland. “We’ll just stay where we are,” we had proposed to the building manager. “You can’t do that. We’re going to shut down the building. You have to leave.” Hurricane Matthew makes landfall in Daytona Beach, Fla. Photo credit: Luis Rodriguez / weather.com - Click to enlarge We dreaded the idea of driving anywhere. The roads would be packed. It would be a nightmare. As it turned out, route 95 was clear all the way from Palm Beach to Richmond, where we spent the night. Matthew says hello to Rocky Mount, NC. Photo credit: Thomas Babb / The News & Observer via AP - Click to enlarge We drove north in light traffic on Thursday, as convoys of electric utility trucks made their way in the opposite direction. But skirting the coast in northern Florida, Georgia, and South Carolina, we saw the disaster beneath us. A drowned church in Nichols, SC.

Topics:

Bill Bonner considers the following as important: Debt and the Fallacies of Paper Money, Featured, Janet Yellen, Miscellaneous, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Escaping the HurricaneBALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash. |

A satellite image of hurricane Matthew taken on October 4. He didn’t look very friendly. Image via twitter.com - Click to enlarge |

| “Evacuate or die,” we were told. Not wanting to do either, we rented a car and drove to Maryland.

“We’ll just stay where we are,” we had proposed to the building manager. “You can’t do that. We’re going to shut down the building. You have to leave.” |

Hurricane Matthew makes landfall in Daytona Beach, Fla. Photo credit: Luis Rodriguez / weather.com - Click to enlarge |

| We dreaded the idea of driving anywhere. The roads would be packed. It would be a nightmare. As it turned out, route 95 was clear all the way from Palm Beach to Richmond, where we spent the night. |

Matthew says hello to Rocky Mount, NC. Photo credit: Thomas Babb / The News & Observer via AP - Click to enlarge |

| We drove north in light traffic on Thursday, as convoys of electric utility trucks made their way in the opposite direction. But skirting the coast in northern Florida, Georgia, and South Carolina, we saw the disaster beneath us. |

A drowned church in Nichols, SC. Photo credit: Rainier Ehrhardt / AP Photo - Click to enlarge |

| The roads into Savannah, Beaufort, and Charleston were closed. Traffic on the highways leading out of the cities, underneath I-95, was at a standstill. People must have spent whole days just going a few miles to higher ground. Or they were trapped down in the low country wondering how high the water might rise.

When things go wrong, they go much wronger than you expect. Hurricanes come up the coast all the time. They are routine. Fairly predictable. We know what to expect. People should be prepared. And yet, when push comes to shove, their best-laid plans get shoved into a ditch. How do you escape a hurricane? You go visit your sister for a few days. Easy-peasy. With the hurricane still 36 hours away, you’d think you’d have plenty of time. But already, your neighbors are panicking. |

Highway 58 disappears (Nashville, NC) Photo credit: Chris Seward / AP - Click to enlarge |

| When you go to the bank to get cash, you find that they’ve already cleaned it out. Your flight is canceled. You can’t find gasoline where you normally buy it. You can’t even get a good meal – restaurants closed in Delray Beach two days before the storm hit!

You try to remain calm. You aren’t worried. As long as you stay put, you are high and dry. The worst that could happen is that you’d have to live on short rations without air-conditioning for a few days (we had a few bottles of wine and some cheese and crackers; what else did we need?). |

In Lumberton, NC, you needed a boat. Photo credit: Mike Spencer / AP - Click to enlarge |

| And yet, you can be caught up in a situation you can’t control – forced to evacuate with thousands of others. Or worse: caught on the highway in a torrential downpour… or swept away by the flood waters. |

Savannah, Ga.; hurricane meets tree, tree meets house. Photo credit: Drew Angerer / Getty Images - Click to enlarge |

| In the hurricane, the panic was limited and easily controlled. There were only a few areas where there was any real danger. People knew what to expect. And they knew that when the storm left, life would soon return to normal. It’s not “the end of the world.”

But imagine a financial panic. Almost no one understands what causes it. Almost no one is prepared for it. No one knows how long it will last. No one knows what the world will be like when it is over. And it is worldwide. There’s no escape. |

Guess what this is… come one, you can do it. Right, it’s a Walmart parking lot! In Augustine, Fla. Photo credit: Jabin Botsford / The Washington Post via Getty Images - Click to enlarge |

A Real PanicThe next major panic in the financial markets is likely to be the end of the world, in the sense that the world we take for granted will quickly disappear. Most likely, it will begin with a major bank failure – followed by a sharp sell-off on Wall Street. |

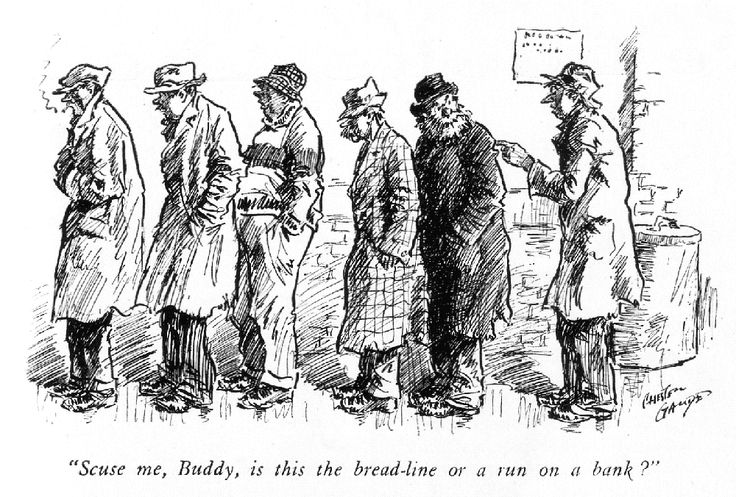

A belated attempt to convert fiduciary media into standard money. Image via Library Of Congress - Click to enlarge |

| Janet Yellen will tell us that the situation is under control. Central bankers will promise more “stimulus measures.” But the panic will intensify. Neither the Fed nor the Department of the Treasury will understand what is going on.

They will propose claptrap remedies, but the crisis will move too fast for them. It will move too fast for investors, too. Bondholders keep their eyes on inflation. The Fed is watching its data. It’s ready to take action fast. And investors still in the stock market tell themselves that they will get out when the bear market begins. But when a real panic begins, it’s too late. World stock and bond markets represent about $150 trillion dollars. A rerun of the panic of 2008 could erase $30 trillion in just a few weeks. Or, if the panic is caused by rising inflation, the bond market would be walloped, too. |

Signs and portents… Cartoon by Bill Day - Click to enlarge |

| Losses could rise to $75 trillion, or even more. The feds could offer a few hundred billion in bailouts, but it would be nothing, not compared to a market that is losing $10 trillion every week!

Our advice: Panic now. Before everyone else. Evacuate over-priced and dangerous investments. |

Awkward questions asked by those who panicked too late… Cartoon by Chester Garde - Click to enlarge |

Image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.