Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

Read More »US CPI: Inflation Still Isn’t About Inflation

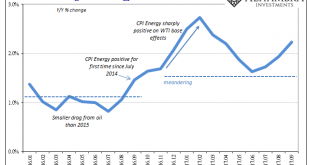

The US Consumer Price Index (CPI) rose back above 2% in September 2017 for the first time since April. Boosted yet again by energy prices, consumer prices overall still aren’t where the Fed needs them to be (by its own policies, not consumer reality). In fact, despite a 10.2% gain in the energy price index last month, the overall CPI just barely crossed the 2% mark (though for the Fed it really needs to be closer to 3%...

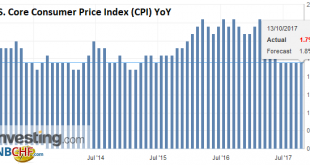

Read More »Dollar Dropped like Hot Potato After Core CPI Disappointed

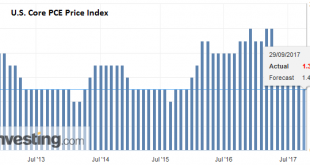

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower. Retail sales were largely in line with expectations. The 1.6% headline increased missed expectations by 0.1%, which is exactly what the August series was...

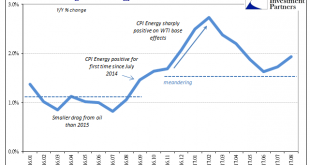

Read More »Non-Transitory Meandering

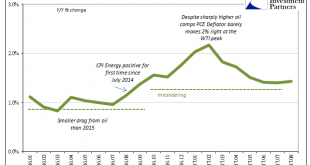

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of...

Read More »Dollar Surge Continues Ahead Of Jobs Report; Europe Dips As Catalan Fears Return

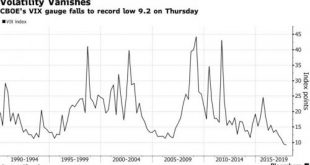

World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red – as they have been every day this week before levitating to record highs – ahead of hurricane-distorted nonfarm payrolls data (full preview here)....

Read More »Hard Assets In An Age Of Negative Interest Rates

Time is the soul of money, the long-view – its immortality. Hard assets are forever, even when destroyed by the cataclysms of history. It is the outlook that perpetuated the most competent and powerful aristocracies in continental Europe, well up through World War I and, in certain prominent cases, beyond; it is the mindset that has sustained the most fiscally serious democratic republic in the Western world, that of...

Read More »Evolving Thoughts on Inflation

In early 2005, Greenspan said that the fact that long-term rates were lower despite the Fed’s campaign to raise short-term rates was a “conundrum.” Many rushed to offer the Fed Chair an explanation of the conundrum, which given past cycles may not have been such an enigma in the first place. Be it as it may, at last week’s press conference, Yellen admitted that the decline in inflation was a “mystery.” She said, “I...

Read More »The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal...

Read More »Nullzinsen trotz Boom

Trotz Wirtschaftsaufschwung keine Zinserhöhung: Bank für Internationalen Zahlungsausgleich in Basel. (Foto: Keystone/Martin Ruetschi) Vor einem Jahr waren die Erwartungen klar: 2017 werden die Zinsen auf breiter Front steigen. Die neuste Publikation der Bank für Internationalen Zahlungsausgleich (BIZ) stellt klar, dass diese Erwartungen falsch waren (Quelle). Der Grund für den Irrtum ist, dass der Inflationsdruck trotz Wirtschaftsaufschwung kaum zugenommen hat. Die BIZ stellt fest, dass...

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org