Negative for 10 Years Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

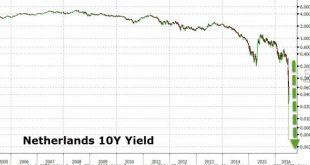

Read More »Going Dutch? Netherlands Joins The 10Y NIRP Club

Netherlands 10Y Yield For the first time in Dutch history, 10Y government bond yields have turned negative (-0.001% intraday) closing at 0.00%… Click to enlarge. Joining Switzerland, Japan, Germany, and Denmark… Pushing Global NIRP bonds over the $13 trillion! Click to enlarge. Chart: Bloomberg

Read More »Next Up for Central Banks: Infrastructure Investments?

In the years following the global financial crisis, the world’s leading economies have found relief through aggressive monetary policy. But with interest rates slashed to historic lows and central bank balance sheets significantly larger as a percent of GDP than they were before the financial crisis, policymakers will need alternatives to interest rate cuts and conventional quantitative easing when the next recession comes along. U.S. central bankers have cut real interest rates between...

Read More »Is Globalization Finished?

The shock of Great Britain’s vote to leave the European Union has already thrown global financial markets into disarray and cost Prime Minister David Cameron his job, but it will take years before the geopolitical impact of the Brexit referendum fully materializes. The political uncertainty generated by the “Leave” vote will reach far beyond 10 Downing Street, potentially into Scotland, Northern Ireland, Eurozone capitals, and beyond. It may even mark the beginning of the end of...

Read More »10 Ways The UK Could Leave The EU

Authored by Alastair Macdonald, originally posted at Reuters.com, Stalemate between Britain and the European Union over what happens next following Britons’ referendum vote to leave has opened up a host of possible scenarios. Here are some that are (in some cases, barely) conceivable: 1. BY THE BOOK Prime Minister David Cameron, who said he will resign after losing his gamble to end British ambivalence about...

Read More »Another Sexual Assault Gets Refugees Banned From Pools In Austria

Authorities in the Austrian town of Mistelbach issued a temporary pool ban for refugees following a sexual assault by a “dark-skinned’ man on a 13-year-old girl. German and Swiss are issuing leaflets how to behave in pools. Earlier this year we reported that a town in Germany had banned adult male asylum seekers from the public pool after receiving complaints that some women were sexually harassed. As a result,...

Read More »British Discontent About The EU: Only A Precursor To Unrest On The Continent

Authored by Peter Cleppe, originally posted at Euro Insight, If Brexit marks the beginning of the end for the European project, Brussels will take its share of the blame If Britain leaves the EU and if the reaction to Brexit causes years of uncertainty, the EU will reap what it has sowed. British discontent is only a precursor to unrest on the Continent, where populists from across the political spectrum feel they...

Read More »OMT Does Not Manifestly Exceed ECB Competences

The German Federal Constitutional Court has decided that the policy decision on the OMT program does not “manifestly” exceed the competences attributed to the European Central Bank: If the conditions formulated by the Court of Justice of the European Union in its judgment of 16 June 2015 (C-62/14) and intended to limit the scope of the OMT programme are met, the complainants’ rights under Art. 38 sec. 1 sentence 1, Art. 20 secs. 1 and 2 in conjunction with Art. 79 sec. 3 of the Basic Law...

Read More »FX Weekly Preview: It is All about Europe

Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org