The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. . In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which...

Read More »The Real Tantrum Should Be Over The Disturbing Lack of Celebration (higher yields)

Bring on the tantrum. Forget this prevaricating, we should want and expect interest rates to get on with normalizing. It’s been a long time, verging to the insanity of a decade and a half already that keeps trending more downward through time. What’s the holdup? You can’t blame COVID at the tail end for a woeful string which actually dates back farther than the last pandemic (H1N1). Emil Kalinowski has it absolutely right; what happened in 2013 in the Treasury...

Read More »Inching Closer To Another Warning, This One From Japan

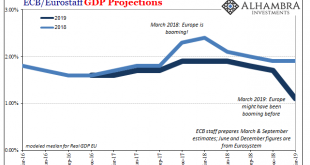

Central bankers nearly everywhere have succumbed to recovery fever. This has been a common occurrence among their cohort ever since the earliest days of the crisis; the first one. Many of them, or their predecessors, since this standard of fantasyland has gone on for so long, had caught the malady as early as 2007 and 2008 when the world was only falling apart. The disease is just that potent; delirium the chief symptom, especially among the virus’ central banker...

Read More »Bond Reversal In Japan, But Pay Attention To It In Germany

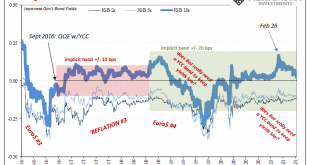

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change. Inflation had finally been achieved across multiple geographies, it was widely repeated, and this would create problems, purportedly, as these various places would have to grapple with higher interest rates. The idea behind...

Read More »A Clear Balance of Global Inflation Factors

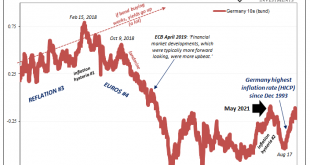

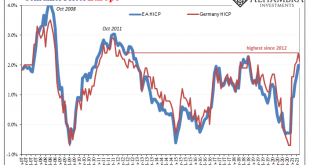

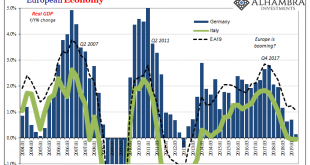

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years. Even using the European “harmonized” methodology (Harmonized Index of Consumer Prices, or HICP), inflation had reached 2.4% year-over-year which was the highest since 2012. Europe HICP and...

Read More »Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates? Not for nothing, every couple years when we do those (record low yields) that’s what “they” always say and yet...

Read More »Big Trouble In QE Paradise

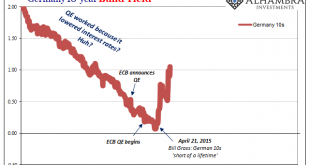

Maybe it was a sign of things to come, a warning how it wasn’t going to go as planned. Then again, when it comes to something like quantitative easing there really is no plan. Other than to make it sound like there is one, that’s really the whole idea. Not what it really is and what it actually does, to make it appear like there’s substance to it. After experimenting with NIRP for the first time and then adding a bunch of sterilized asset purchases in 2014, Europe’s...

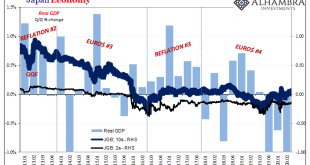

Read More »Germany’s Superstimulus; Or, The Familiar (Dollar) Disorder of Bumbling Failure

The Economics textbook says that when faced with a downturn, the central bank turns to easing and the central government starts borrowing and spending. This combined “stimulus” approach will fill in the troughs without shaving off the peaks; at least according to neo-Keynesian doctrine. The point is to raise what these Economists call aggregate demand. If everyday folks don’t want to spend – because a lot of them can’t – then the government will spend on their...

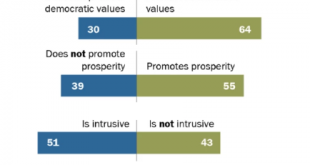

Read More »Europe Comes Apart, And That’s Before #4

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

Read More »Not Buying The New Stimulus

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates. The reaction to this new round was immediately negative: The euro and euro zone government bond yields fell sharply...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org