Swiss Franc EUR/CHF - Euro Swiss Franc, February 03(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Ahead of the weekend, there are two series of economic reports. The first are Europe’s service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market. It is important too to recognize the utilitarian use of data by new US Administration. President Trump had been critical of the US jobs reports during the campaign. To be fair, BLS calculates several different measures of unemployment and job creation. They all do not get reported by the media but can be found on the BLS website. It is hard to argue that there is a systemic problem with the data and simply emphasize a different BLS metric from the customary U3 measure or U6 (which measures under-employment). FX Performance, February 03 2017 Movers and Shakers Source: Dukascopy.com - Click to enlarge Moreover, during the campaign, it was in the candidate’s interest to play down the economic improvement. Going forward, it will want to see the glass as half full not half empty as its own economic record is being made. And, arguably, for this President, improvement in the labor market is critical.

Topics:

Marc Chandler considers the following as important: AUD, EUR, Featured, FX Trends, GBP, JPY, newslettersent, U.S. Average Hourly Earning, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 03(see more posts on EUR/CHF, ) |

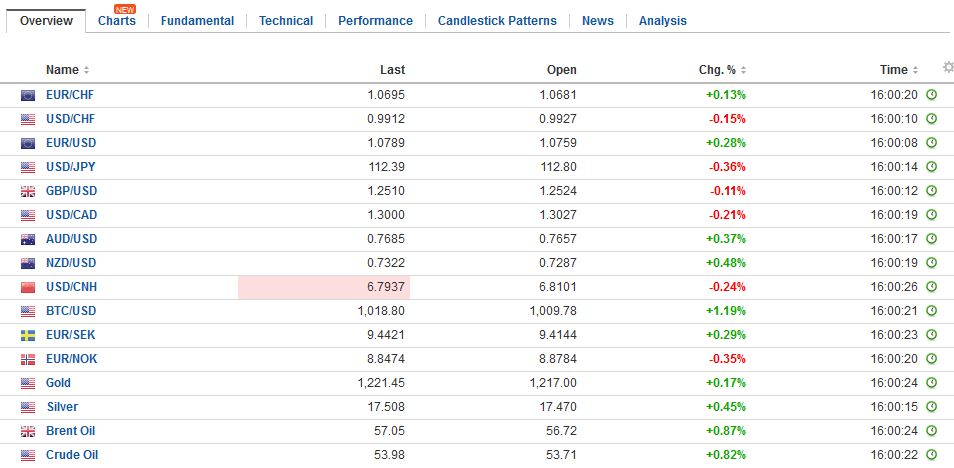

FX RatesAhead of the weekend, there are two series of economic reports. The first are Europe’s service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market. It is important too to recognize the utilitarian use of data by new US Administration. President Trump had been critical of the US jobs reports during the campaign. To be fair, BLS calculates several different measures of unemployment and job creation. They all do not get reported by the media but can be found on the BLS website. It is hard to argue that there is a systemic problem with the data and simply emphasize a different BLS metric from the customary U3 measure or U6 (which measures under-employment). |

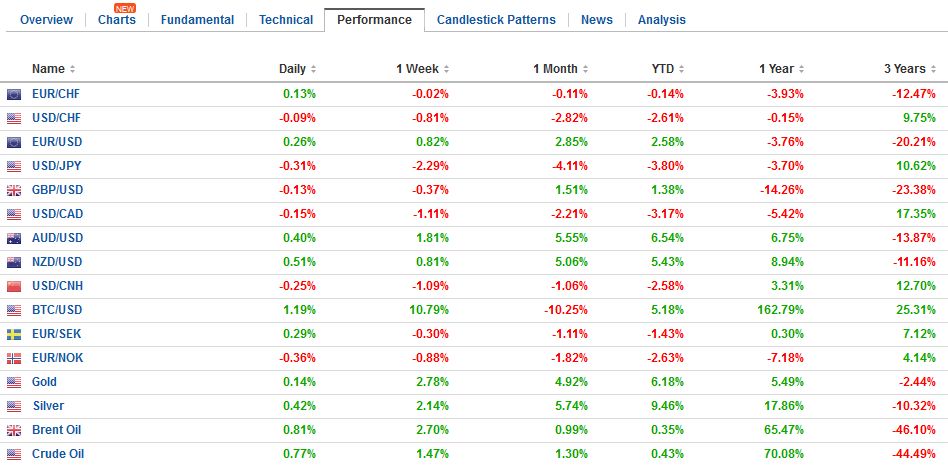

FX Performance, February 03 2017 Movers and Shakers Source: Dukascopy.com - Click to enlarge |

| Moreover, during the campaign, it was in the candidate’s interest to play down the economic improvement. Going forward, it will want to see the glass as half full not half empty as its own economic record is being made. And, arguably, for this President, improvement in the labor market is critical. Also, at the end of the day, it is important how policy responds to the evolving economy. In this regard, the central bank’s mandate means that its understanding of the job market (note Yellen’s expertise is as a labor economist) is more important than the White House views in setting monetary policy. |

FX Daily Rates, February 03 |

| There were two developments in Asia to note. First, the BOJ appears to be playing a little cat-and-mouse with the markets. It initially disappointed by its small bond purchases and this fanned ideas that Kuroda may be backing off efforts to anchor the 10-year bond yield near zero. The disappointment says the 10-year yield rise to 15 bp. However, then the BOJ came in and offered to buy an unlimited about of bonds and this sent yields back down below 10 bp and seemed to pull the yen lower.

Lastly, we note some large option expiries today at the NY cut (10:00 am ET). These include a yard (one billion) euros with $1.0750-$1.0760 strikes. There are $1.3 bln on a JPY113.50 expiry. There are also GBP1.4 bln expiries at $1.25 strike. In the Australian dollar, there are nearly A$900 mln expiries between $0.7650 and $0.7675 today. There are also $1.3 bln options struck at CAD1.3050 that expiry today. |

FX Performance, February 03 |

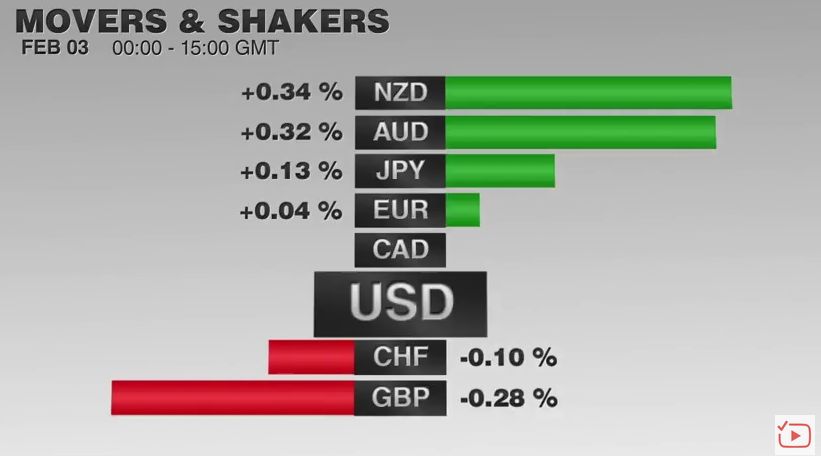

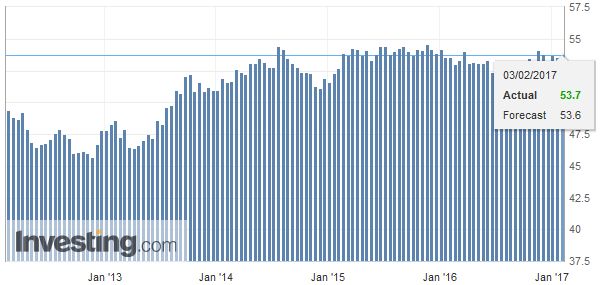

EurozoneThe eurozone economy appears to be expanding at a stable rate, somewhat above what is regarded as trend growth. It grew 0.5% in Q4 and 1.8% year-over-year (2.0% in 2015). The composite flash was 54.3 (54.4 in December). The challenge for monetary policy is not so much focused on growth as prices. Headline inflation has picked up, and the deflation risks appear to have passed. However, the increases in prices do not yet appear sustainable. They, by and large, reflect energy prices and the past depreciation of the euro. Specifically, the core rate, which bottomed at 0.6% has only been lifted to 0.9%, whereas the headline is near 2%. Moreover, later this year, as the base effect wanes, even headline inflation may ease. |

Eurozone Markit Composite PMI, January 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| The flash service sector reading was 53.6 (53.7 in December). |

Eurozone Services PMI, January 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

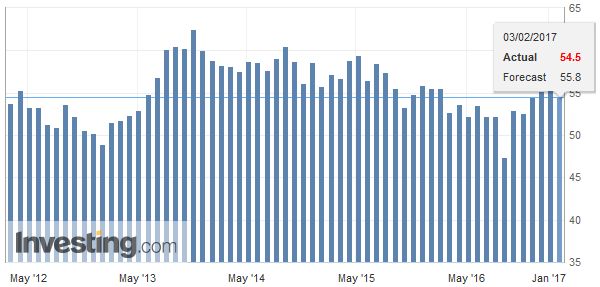

United KingdomThe Bank of England may have stolen any thunder from the today’s service and composite PMI. The BOE raised its growth forecasts and still seemed to want to look through the near-term inflation overshoot. It still sees Brexit being a drag on growth but less than previously. The January service PMI is expected to ease to 55.8 from 56.2, and the composite is anticipated to have slipped to 56.0 from 56.1. The composite would still be above the three, six, and 12-month averages (55.6, 53.6 and 53.5 respectively. Such a report is unlikely to provide new incentives for traders or shift the focus from Brexit. |

U.K. Services PMI, January 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

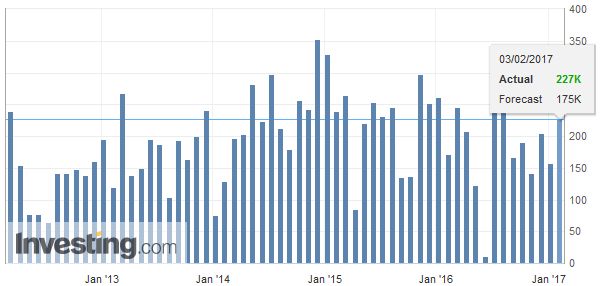

United StatesAlthough there is not always a good month-to-month match between the ADP estimate and the BLS private sector non-farm payroll report, the large upside surprise in the former appears to reduce the risk of a downside surprise in the latter. |

U.S. Nonfarm Payrolls, January 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

| The median forecast in the Bloomberg survey is for a 175k increase in private sector employment (180k overall) up from 144k in December (156k overall). Our bias is toward a slightly greater job growth than the median. |

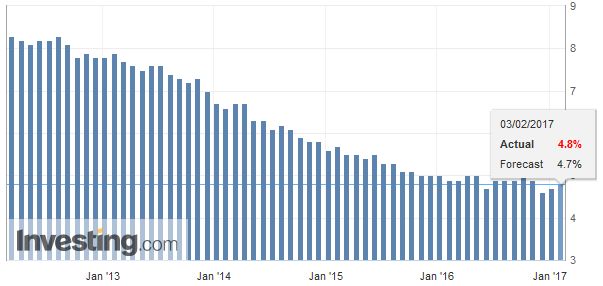

U.S. Unemployment Rate, January 2017(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

| The revisions to back months may attract more attention than usual as benchmark revisions are announced with the January figures. |

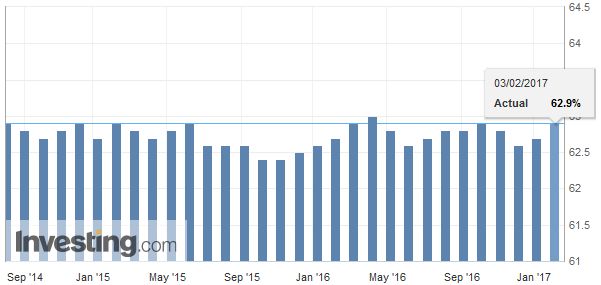

U.S. Participation Rate, January 2017(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

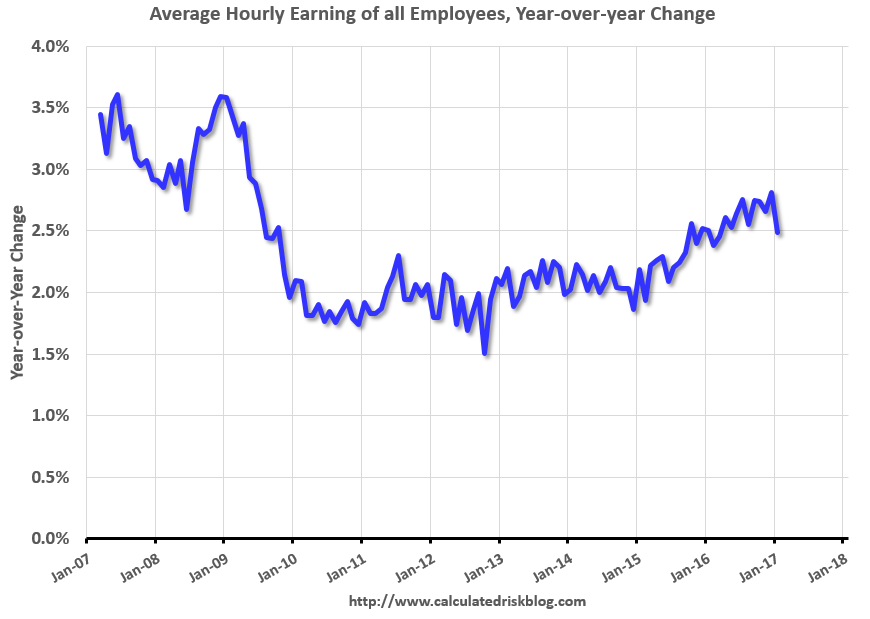

| Given the current context, average hourly earnings may be of greater interest than the headline figures. Nearly 40% of the states and several cities increased the minimum wage at the start of the year. This gives a little upside risk to the 0.3% increase in average hourly wages that the median forecasts. In December, a 0.4% increase was reported for a 2.9% year-over-year rate. In the last two years, minimum wages were also lifted at the start of the year in many states. In January 2015, average hourly earnings rose 0.6%, and in January 2016, they rose by 0.5%. |

U.S. Average Hourly Earning, January 2017(see more posts on U.S. Average Hourly Earning, ) Source: macro.ecoblogs.org - Click to enlarge |

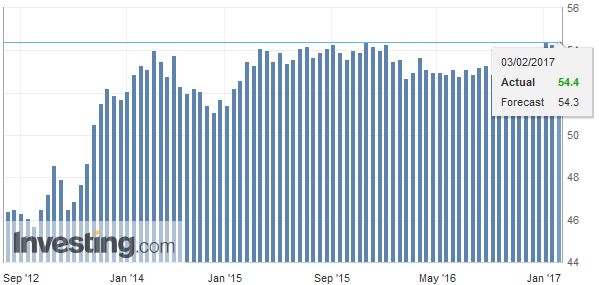

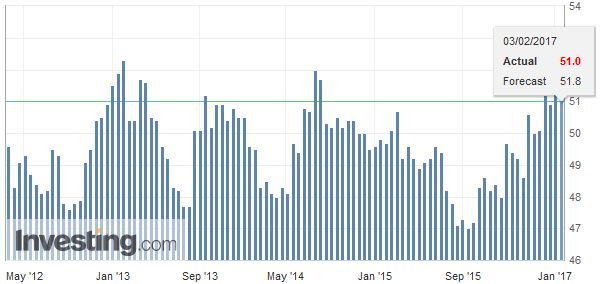

ChinaChinese markets re-opened from the Lunar New Year holiday. The PBOC drained liquidity and one-year swap rates first to the highest this year (+ 12 bp to 3.43%). The Caixin manufacturing PMI disappointed by slipping to 5.10 from 51.9 but blunting this was news that the export component rose to a two-year high. Prices also continued to rise. Given the Lunar New Year, it is often difficult to tease out the signal from Chinese January and February data. However, on balance, it appears that China’s economy has stabilized sufficiently, and the rise of producer prices is such, that officials appear poised to shift focuses to curbing credit expansion and snug monetary conditions. |

China Caixin Manufacturing PMI, January 2017(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,Featured,newslettersent,U.S. Average Hourly Earning