On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk...

Read More »FX Daily, June7: Another Breakdown of EUR/CHF

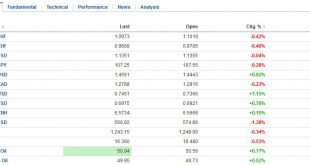

Swiss Franc Once again both EUR and USD broke down against the franc. The adverse effect of the Friday US jobs reports is visible again.Moreover, CHF appreciated with the Asian block, with AUD and NZD and with the oil price. Swiss sales are pretty high to Asian countries. We also know that rising oil prices usually lead to a stronger CHF. Japan The Japanese yen is the major currency not to be gaining against...

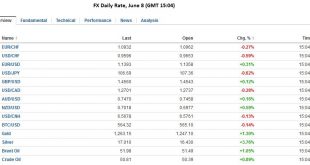

Read More »FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the shellacking it took after the shockingly poor jobs data, the US dollar has only managed a shallow recovery...

Read More »FX Daily, June 3: FX Market Shocked by Non-Farm Payrolls

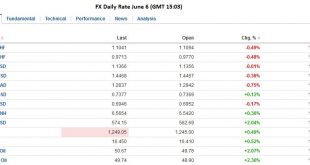

Surprise NFP visible in FX rates The massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank.Consequently the biggest short speculative position is in the euro, while traders are long CHF against USD. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc. Click to enlarge. Longer term...

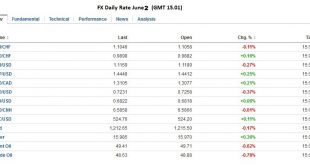

Read More »FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would have given back 50% of its rally off the May 3 low near JPY105.50. Below there, the JPY107.80 is the 61.8% retracement. The euro is north of $1.12 after having briefly...

Read More »FX Daily, June 1: Swiss SVME PMI strongest PMI

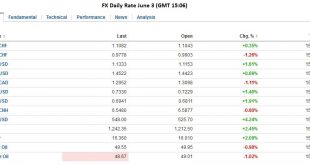

The US dollar is trading with a heavier bias to start the month of June. Weaker stocks and firmer bonds has seen the yen rise the most, while sterling’s losses have been extended after an ICM telephone survey showed a small lead for those favoring Brexit. The Swiss Franc was one of the strongest performers. Click to enlarge. The Nikkei fell 1.6%, the largest loss since May 2 and snaps a five-day advance. The delay in the sales tax was confirmed. This second delay now puts...

Read More »FX Daily, May 31: Sterling Slips and Aussie Pops as Investors Await Fresh Insight into Fed Trajectory

The US dollar is broadly mixed. The main narrative of increased prospects for a Fed hike in June or July has been pushed off center stage as the market reacts to local developments as investors await from US economic data. Ostensibly the data will determine whether the Fed raises rates in June or July. The Swiss Franc lost both against the dollar and versus the euro. Click to enlarge. On the other hand, despite the Fed’s data dependency, we argue that the determining factor is...

Read More »FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday’s ranges while sterling and the Canadian dollar pushing through yesterday’s lows. Source Dukascopy Asian shares were mostly higher, though Chinese markets closed with slight losses. The MSCI Asia-Pacific Index rose (~0.7%) for a third session and secured a 2% gain for the week. European bourses are seeing some profit-taking...

Read More »FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the US economy is rebounding strongly in Q2 and that the prospects of a Fed hike have increased, but a June/July hike is still not a done deal. The next important step...

Read More »FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds after an agreement was struck that will free up a tranche of aid. Source Dukascopy The relative stable capital markets are itself...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org