The US dollar lost momentum on May 24 but has regained it on May 25. The euro has been pushed through last week’s lows near $1.1180. The next immediate target is $1.1145, which corresponds to the lower Bollinger Band today, though the intraday technical readings suggest some modest upticks are likely first. The $1.1200-$1.1220 area may cap upticks. Source Dukascopy The greenback held above JPY109 and bounced to recoup 38.2% of its decline since the pre-weekend high near...

Read More »FX Daily May 23

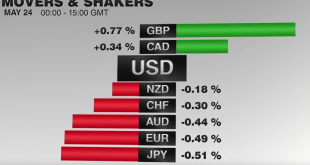

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week. FX Rates The US dollar is mixed. The yen is the strongest of the majors. The media continues to play up tension between the US and Japan at the weekend G7 meeting over the appropriateness of intervention, but Europe is not very sympathetic either. Today’s...

Read More »FX Week Ahead: Evolving Investment Climate

The US dollar’s weakness in recent months, despite negative interest rates in Europe and Japan likely had many contributing factors. These factors include shifting views of Fed policy, weaker US growth, the recovery in commodity prices, including oil, gold and iron ore, and market positioning. A new phase began in late-April/early May. The dramatic rally in iron prices reversed, and the Australian dollar, bottomed against the US dollar in mid-January, seemingly to anticipate the...

Read More »FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This means that a follow-up rate cut next month is unlikely, which is what we have argued. While short-term participants may be surprised today, the...

Read More »FX Daily, May 12: Yen Recovers After Being Thrown for 2%

The Japanese yen is recovering from two-day two percent decline. The yen is the strongest of the majors today, rising about 0.6%. The greenback initially extended its gains marginally in early Tokyo before the selling pressure emerging. The price action reinforces the importance of the JPY109.50 resistance area. The Nikkei initially moved higher and filled the gap created by the sharply lower opening on May 3, following disappointment with the BOJ lack of action at the end of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org