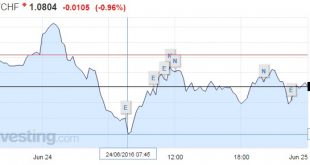

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

Read More »FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December. The market continues to put anticipate...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »FX Daily, June 20: Brexit not the main Swiss Franc Driver

On the Swiss Franc Recently I enumerated the different drivers for the continuing strength of the franc. Most commentators mentioned Brexit fears, but I insisted on the low rate and yield environment in the United States after the last Non-Farm Payroll report and the FOMC. Today’s jump in sterling after changed Brexit bets confirmed my view. This anticipation of an Anti-Brexit vote was not followed by a franc decline...

Read More »FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal and political tragedy. Her needless death provided an inflection point. The suspension of the referendum campaigns and a steady stream of reports and speeches has the emotionalism of contest freeze. Investors quickly understood that the Cox’s death injected a new unknown into the forces that seemed to build toward a decision to leave the EU....

Read More »FX Daily, June 15: Key Data and FOMC

Swiss Franc The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar. Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again. FOMC The FOMC meeting later today,...

Read More »FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

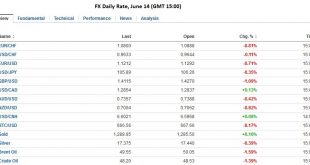

“The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%”. A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain. Core bond yields are 4-5 bp lower, which...

Read More »FX Daily, June 13: Brexit Dominates

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. See the Dukascopy Video FX Rates The risk that the UK votes to leave the EU next week is the dominant force in the capital markets. It is a continuation of what was seen at...

Read More »FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

Read More »FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

Swiss Franc The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD. The ECB bond buying program has finally started. For us the main reason of the weaker Euro was, however, the bad US jobs report, that will delay also a normalization of rates in the euro zone. via Dukascopy FX Rates The US dollar is posting...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org